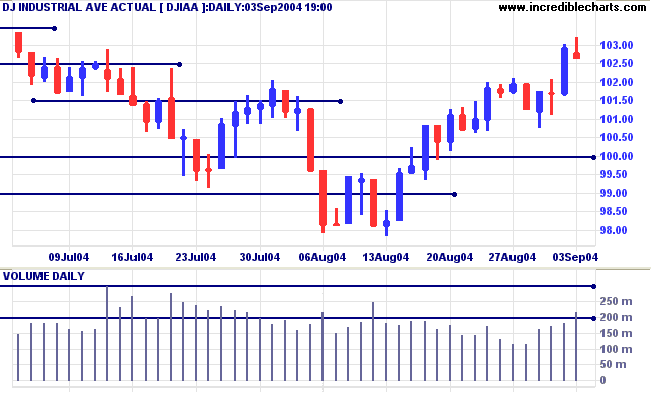

The Dow Industrial Average shows a weak close on Friday on higher volume, signaling a possible re-test of support at 10000. A successful test of support would be a bullish sign. However, low recent volume indicates a lack of commitment from buyers.

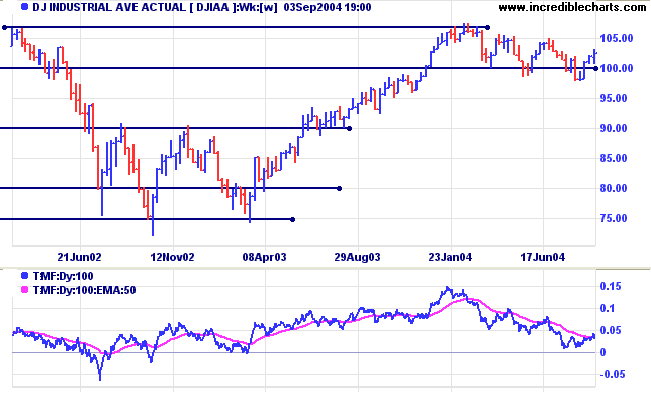

Twiggs Money Flow is strengthening.

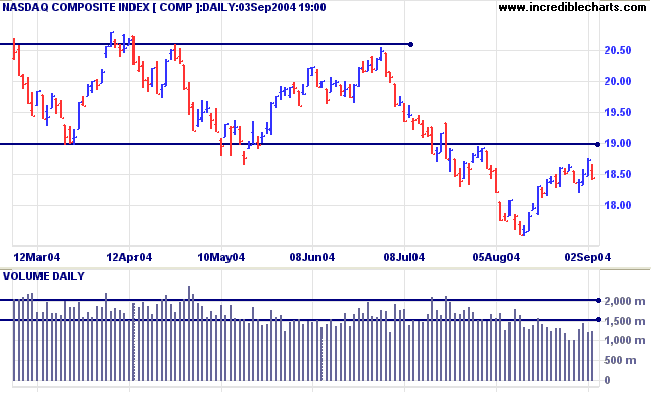

Twiggs Money Flow (not shown) is weak.

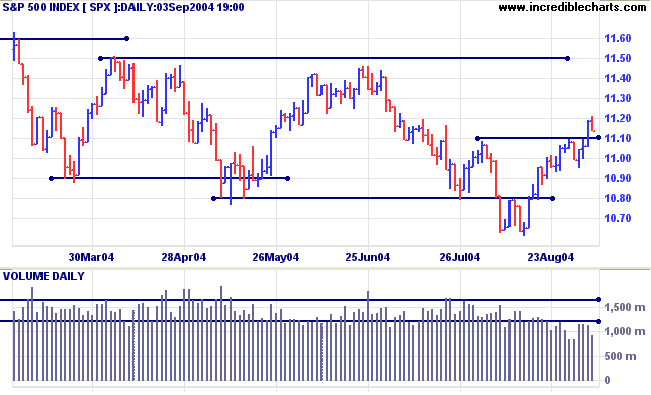

Twiggs Money Flow (not shown) has improved, crossing to above the signal line.

The NYSE Bullish Percent Index has recovered to 57.32% but the signal is still bearish.

|

|

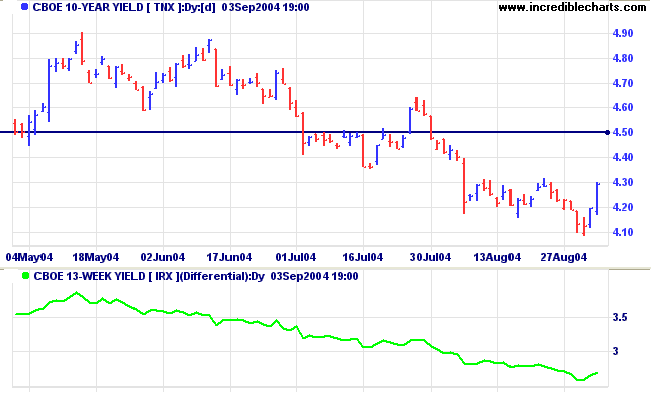

The yield on 10-year treasury notes rallied to 4.30% on the strength of a moderate rise in August payroll figures. Market expectations are for a quarter per cent rise at the Fed's September 21 meeting.

The yield differential (10-year T-notes minus 13-week T-bills) recovered to 2.7%.

Low differentials (below 1.0%) are generally bear signals.

New York: Spot gold retreated to close the week at $400.00.

Marginal new highs (May to August) indicate a lack of commitment from buyers.

|

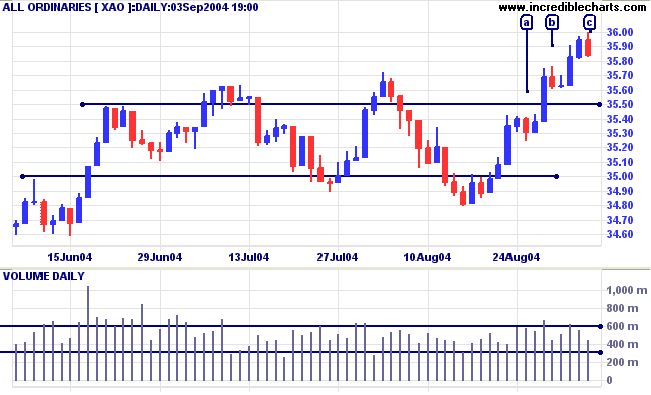

The All Ordinaries briefly tested 3600 before retreating Friday [c] on lighter volume. Short pull-backs at [a] and [b] signal buyers commitment. We cannot, however, rule out another test of support at 3550: Twiggs Money Flow (not shown) still appears weak, having so far failed to cross above the signal line.

For those who are interested in upcoming additions to the software, a new test version is available for download at https://www.incrediblecharts.com/help/download-instructions.php.

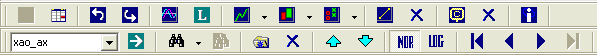

New Securities Toolbar

Incredible Charts version 4.0.3.670 incorporates a new securities toolbar. You are able to chart a security, without the exchange being loaded on the securities menu.

- Enter the security symbol

- Click the Load Security button

or hit the Enter key.

|

Use the following format to enter a

security: SYMBOL_EXCHANGECODE (e.g. bhp_ax = BHP Billiton Limited, Australia ) Where EXCHANGECODE is as follows:

|

- You can also use the drop-down list

to select recently loaded securities.

You will not need to enter an EXCHANGECODE, in the input box, for the default exchange.

For example, if Australia is set as the Default Exchange, you need not type bhp_ax to load BHP Billiton Limited:

merely type bhp and ENTER.

To set a Default Exchange, either:

- Select Securities >> Set Default Exchange from the chart menu; or

-

Right-click the new Load Security

button

The new version also corrects a watchlist scrolling error that occurred with de-listed securities: the scroll no longer reverts to the first security on the watchlist.

Live Update

The test version will be released as a live update towards the end of the month.

~ Bernard Baruch

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.