|

Incredible Charts 4.0.3.600 is now

available!

Your version of Incredible Charts should automatically update to the new version. Check under Help >> About on the charts menu to establish whether you have the latest version. If not, download and replace over your existing version. See What's New! (below) for a list of new features. |

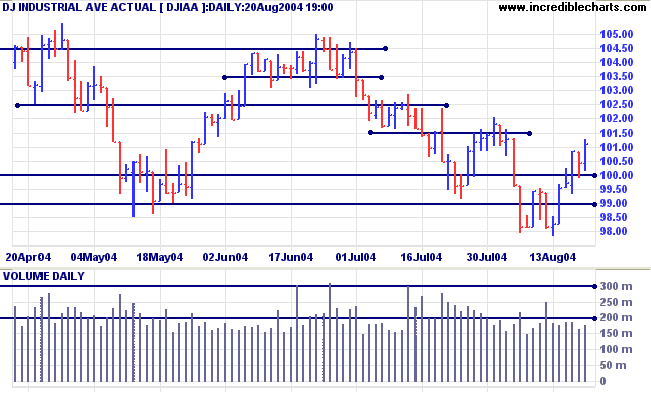

The Dow Industrial Average broke through resistance at 10000 after another pull-back. Light volume on the rally signals a lack of commitment from buyers.

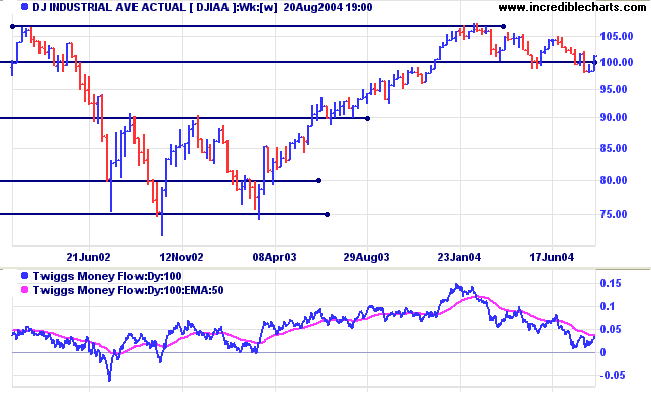

Twiggs Money Flow has formed a double bottom below the signal line but does not yet signal accumulation.

The primary trend is headed downward.

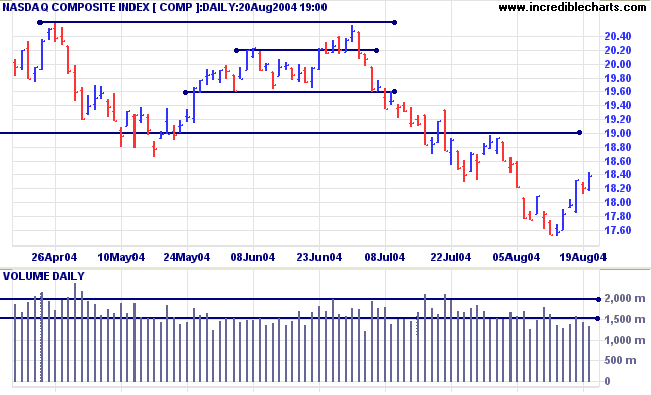

Twiggs Money Flow (not shown) continues to signal distribution.

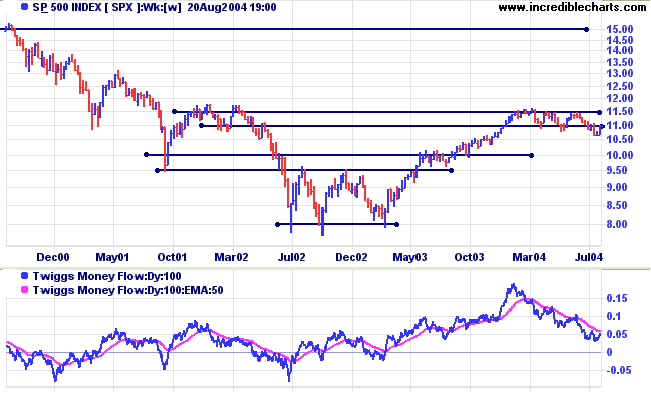

A break above 1150, followed by confirmation of the breakout, would signal that the primary trend is headed upward.

Twiggs Money Flow continues to signal distribution.

The NYSE Bullish Percent Index rose slightly to 54.68% but the bear signal continues.

|

|

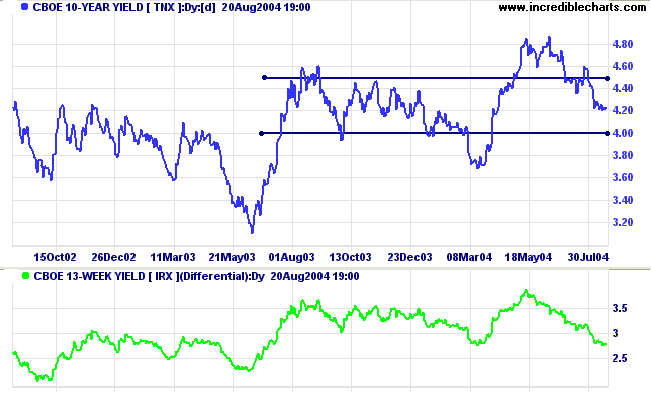

The yield on 10-year treasury notes is consolidating just above 4.20%.

Expect a re-test of support at 4.00%.

The yield differential (10-year T-notes minus 13-week T-bills) is still healthy at 2.8%.

Low differentials, of below 1.0%, are strong bear signals.

New York: Spot gold rallied to $412.90 and appears headed for a test of long-term resistance at $427.25.

|

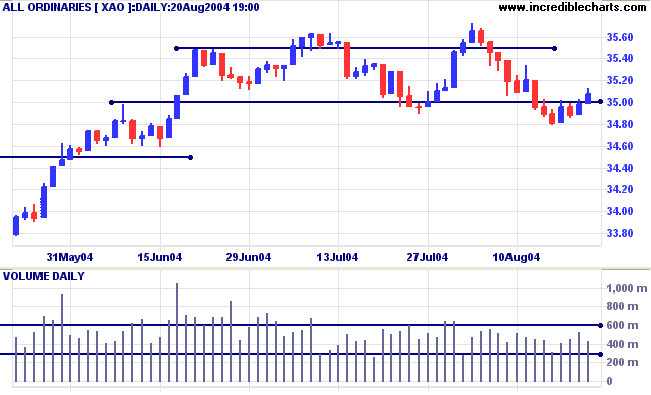

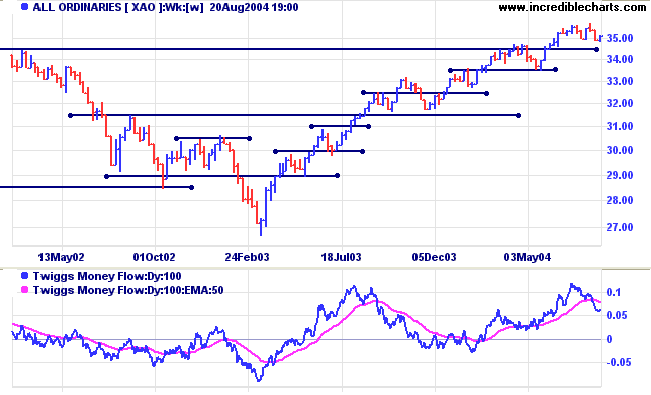

The All Ordinaries rallied back above 3500, continuing the consolidation pattern. Lower volume and a fairly weak close on Friday signal a lack of commitment from buyers. A reversal in the next day or two may still result in a test of support at 3450.

A fall below 3350 would signal reversal of the primary trend.

Twiggs Money Flow continues to signal distribution.

The latest revision is available at Incredible Charts Test version if any members want to download it ahead of the general release planned for next week. Replace over your existing version.

- The new version fixes a bug that occurs when deleting stocks from watchlists and deleting project files.

-

It also remembers (between sessions) the

last 30 stocks that you have charted.

To find the last 30 stocks, go to Securities >> Re-open from the main menu.

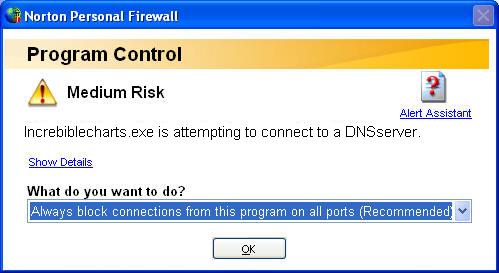

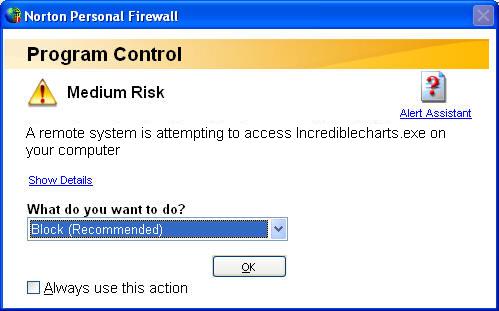

Members who use Norton Personal Firewall are likely to be prompted by their firewall whenever there is an update of Incredible Charts.

If not, you are likely to block all communication between Incredible Charts and the servers.

You may also receive an incoming communication alert:

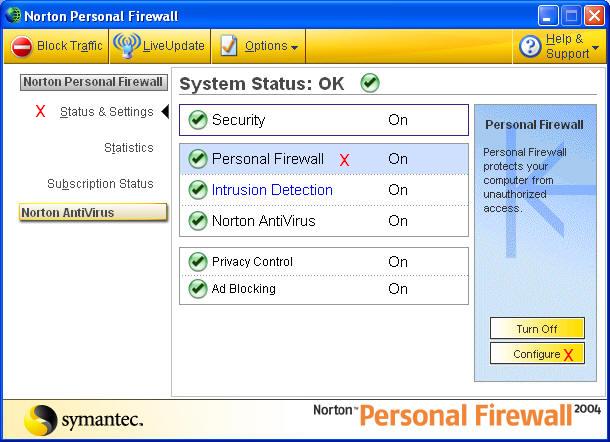

Clearing existing Norton PF block

If you have previously selected the Always block connections option, it is probably best to clear your existing settings and start again.

- Go to Norton Personal Firewall 2004, select Status & Settings on the left.

- Highlight Personal Firewall in the center panel.

- Press the Configure button.

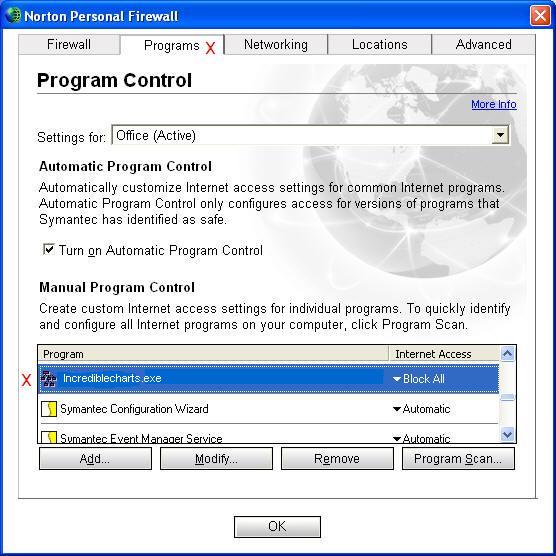

- Select the Programs tab

- Then scroll down the list until you reach Incrediblecharts.exe.

- When you have Incrediblecharts.exe selected in the list, click the Remove button.

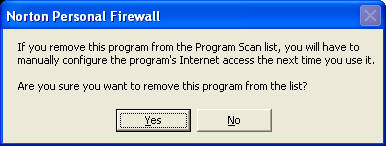

- At the prompt, select Yes.

- And Yes again.

|

It is remarkable that in so many great wars it is the

defeated who have won. The people who were left worst at

the end of the war were generally the people who were

left best at the end of the whole business. For instance,

the Crusades ended in the defeat of the Christians. But

they did not end in the decline of the Christians; they

ended in the decline of the Saracens. That huge prophetic

wave of Moslem power which had hung in the very heavens

above the towns of Christendom: that wave was broken, and

never came on again. The Crusades had saved Paris in the

act of losing Jerusalem. The same applies to that epic of

Republican war in the eighteenth century to which we

Liberals owe our political creed. The French Revolution

ended in defeat; the kings came back across a carpet of

dead at Waterloo. The Revolution had lost its last

battle, but it had gained its first object. It had cut a

chasm. The world has never been the same since.

~ G K Chesterton (1912) |

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.