The NYSE Bullish Percent Index has fallen to 59.31%, giving a strong bear signal.

|

|

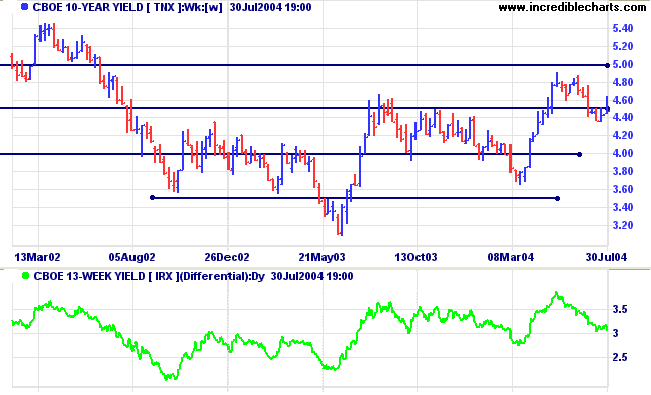

The yield on 10-year treasury notes broke through resistance before retreating back below 4.50%. The yield is consolidating in a narrow range below this level; a breakout below the pattern would signal a re-test of support at 3.50%.

The yield differential (10-year T-notes minus 13-week T-bills) is healthy at 3.0%.

New York: Spot gold has recovered to just above $390.00. The metal still appears headed for a test of support at $375.00.

|

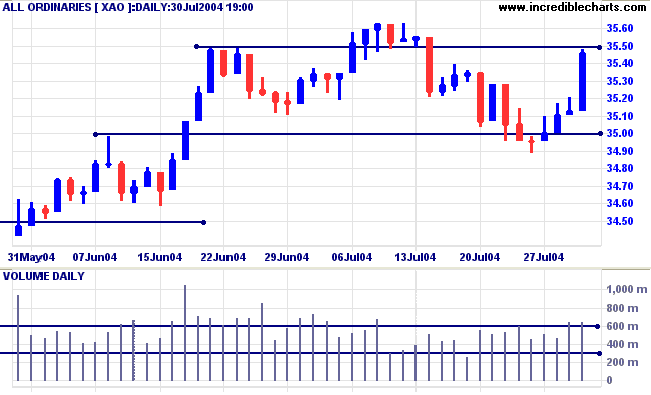

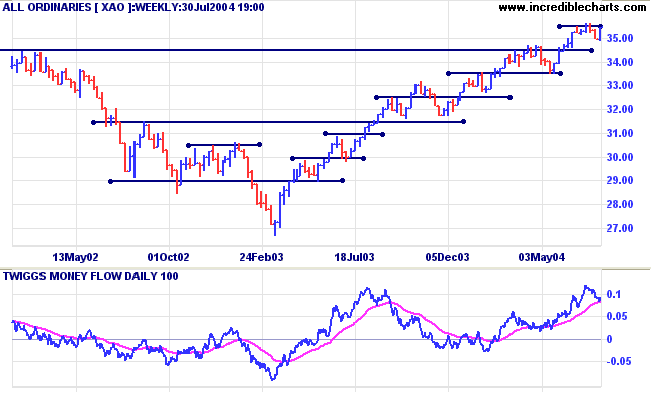

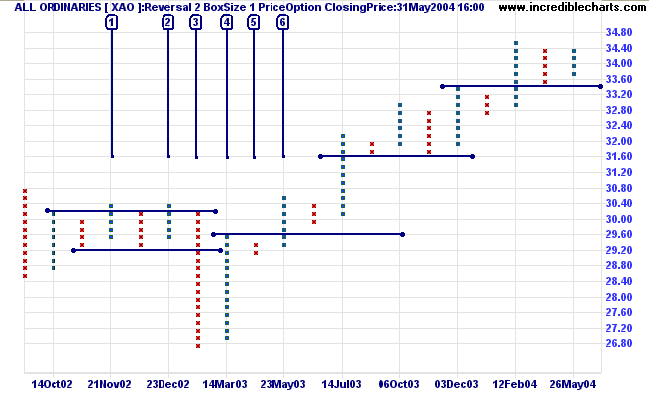

The All Ordinaries made a false break below support at 3500 before rallying on strong volume. The index is still in a consolidation pattern. An upward breakout, followed by a pull-back that respects support at 3550, would confirm the up-trend.

A fall below 3350 would be a bear signal, indicating reversal of the primary trend.

Twiggs Money Flow continues to signal accumulation.

Retracements (or corrections) during a trend tell us about the strength of that trend. They test the strength of buyers' or sellers' commitment and establish a base for further gains (or losses). There are four major categories:

- long retracement

- overlapping retracement

- short retracement

- no retracement - during an upward/downward spike.

Long Retracements

A long retracement signals trend weakness, especially when it follows a spike.

-

Higher prices after an upward spike may be

unsustainable.

Be on the alert for a short reaction followed by a change of trend. - The same applies to a long retracement following a downward spike: lower prices may be unsustainable.

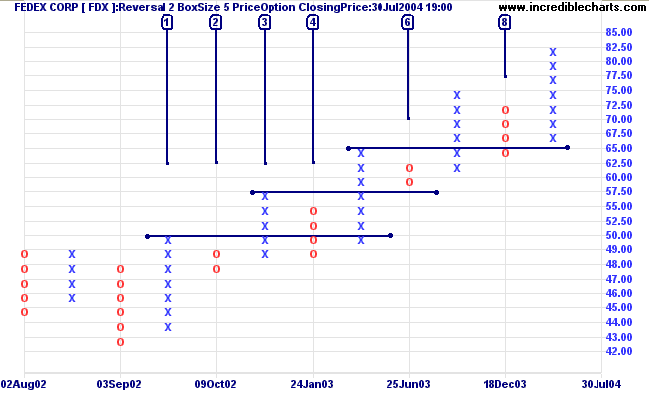

Retracements may overlap either partially or completely:

-

Partial overlaps indicate a slow but

generally stable up-trend.

On the Fedex chart below the retracement at [4] breaks through the first line of support, from the high of [1], and overlaps with column [2], indicating a slow up-trend. - Complete overlaps form equal lows in an up-trend (or equal highs in a down-trend) and generally indicate consolidation, establishing a base for further gains.

They try to have more things, or more money,

in order to do more of what they want,

so that they will be happier.

The way it actually works is the reverse.

You must first be who you really are,

then do what you need to do,

in order to have what you want.

~ Shakti Gawain: Creative Visualization

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.