|

New Diary Format |

|

We are experimenting with a new format for

the Weekly Trading Diary in order to speed up delivery

times, improve the delivery of images (both charts and ads)

and reduce the number of bounced messages (from firewalls

and spam filters). For the next few weeks the Weekly Diary will be published on the website at https://tradingdiary.incrediblecharts.com/trading_diary.php (it may be useful to save this address to your Favorites folder in Internet Explorer). You will receive a short email notifying you when the Diary has been published. Click on the attached link and the Diary will open in your default browser. Please report any difficulties to support. |

Trading Diary

July 3, 2004

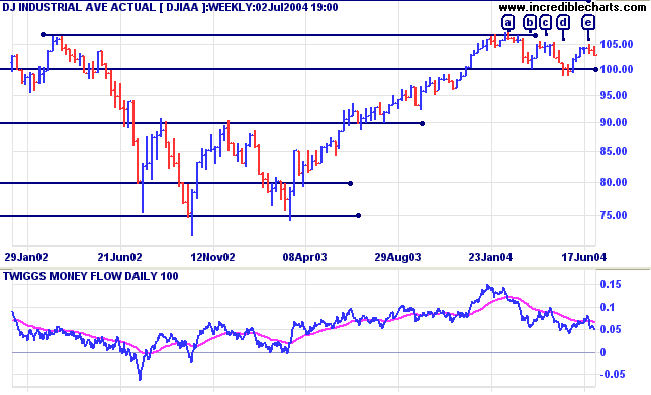

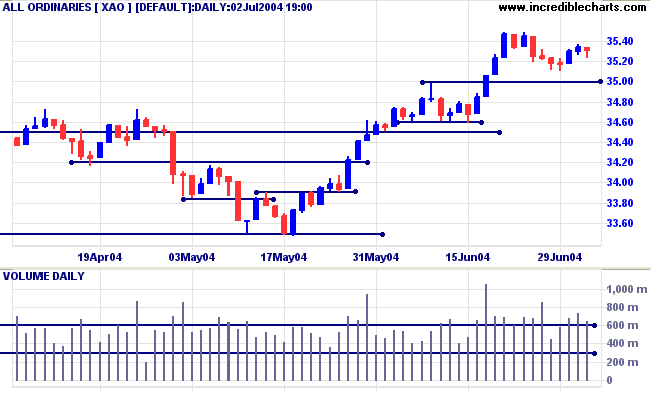

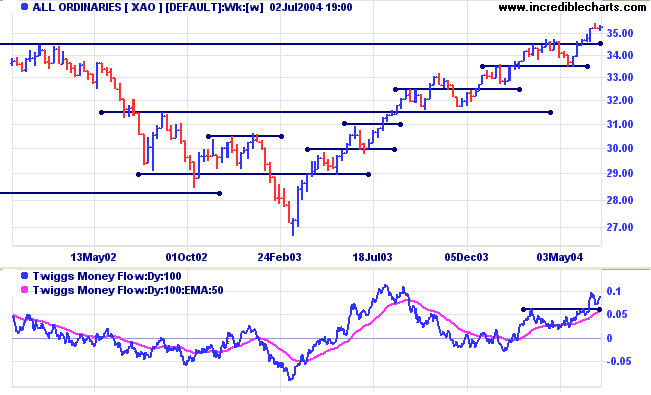

The overall pattern is one of consolidation around the 10000 support level: marginally lower highs at [c] and [e]; marginally lower low at [d]. This pattern can break out in either direction. Obviously, in an up-trend, an upward breakout is more likely but a possible reversal cannot be ignored. We may witness further marginal highs or lows and direction will only be clear when we have a breakout followed by confirmation, with a pull-back that respects the upper or lower border of the pattern.

Twiggs Money Flow is drifting lower.

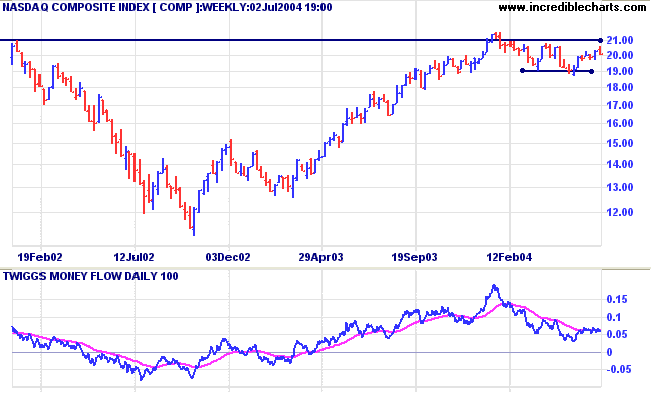

Twiggs Money Flow is drifting sideways.

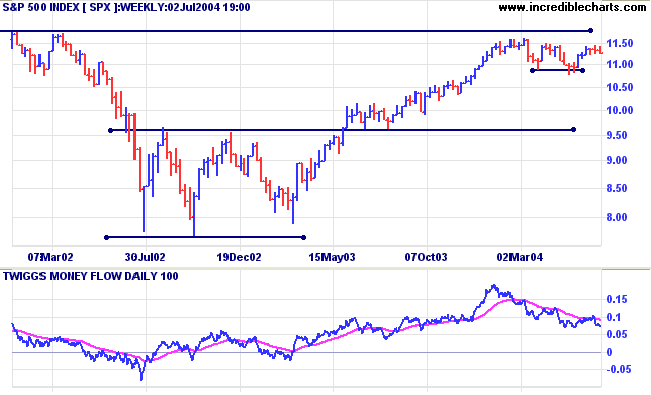

Twiggs Money Flow continues to signal distribution.

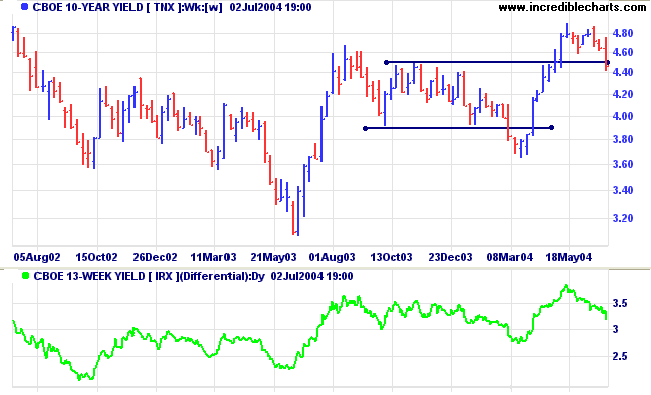

The yield on 10-year treasury notes is testing support, with a close on Friday below 4.50%. The Fed raised interest rates by a quarter percent as expected but undid the effect, to some extent, by uttering soothing words about increases at a measured pace. The yield differential (10-year T-notes minus 13-week T-bills) is still a healthy 3.2%.

New York: Spot gold closed up at $398.20. The metal has encountered resistance at the 400.00 level. The intermediate up-trend will require further confirmation, with a rise above Monday's high of 404.25.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

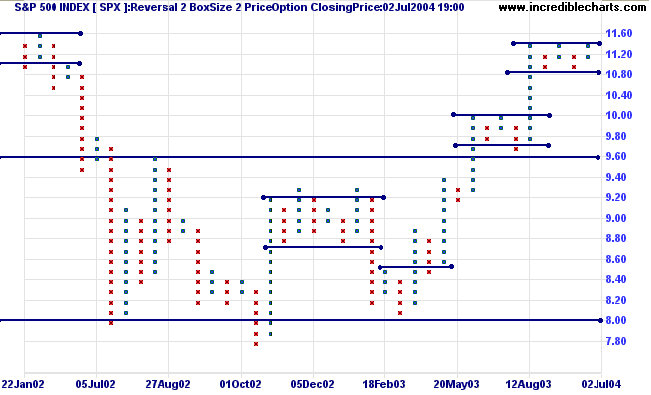

We have had a few distractions this week, so I will continue with the series on Point & Figure charts in next week's newsletter.

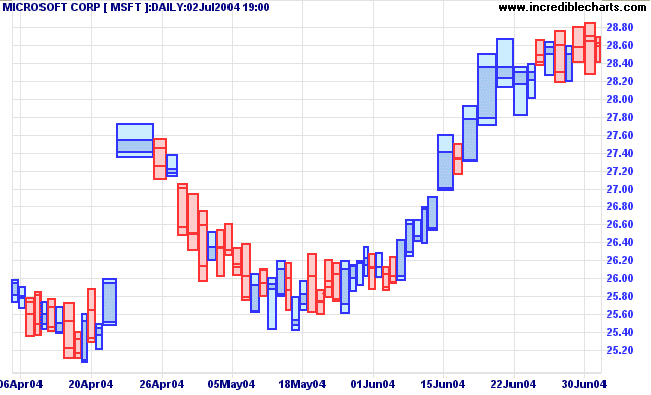

Notice anything different about the equivolume chart below?

The next update of Incredible Charts will include an improvement suggested by some members several months ago: equivolume bars presented as candlesticks.

- Both Open and Closing prices are displayed;

- The bar is colored blue if the Close is higher than the Open; and

- Red if the Close is lower than the Open.

- If the Close is equal to the open, the bar takes the same color as the previous day.

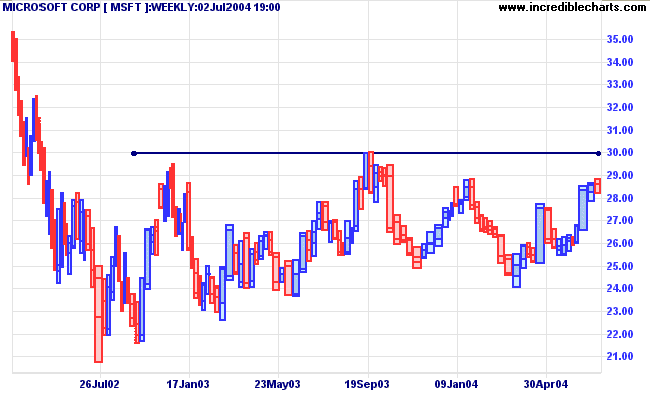

On Microsoft we can see that the recent rally is supported by strong volume. The stock then encountered resistance at 28.50 before consolidating in a narrow band between 28.00 and 29.00: a bullish sign.

A breakout, confirmed by a pull-back that respects support at these levels, would be a strong bull signal.

Failure to break through resistance at 29.00 would be bearish, while a fall below 24.00, would add further confirmation.

You are successful the moment you start moving toward a worthwhile goal

~ Chuck Carlson

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.