|

Connection Problems |

|

Incredible Charts communicates via SSL

(HTTPS) with the data servers. If you experience any connection problems, please open Internet Explorer, go to Tools >> Internet Options >> Advanced >> Security and ensure that Check for server certificate revocation is not checked. You will need to restart your computer for any changes to take effect. We are investigating the cause of the problem. |

Trading Diary

June 19, 2004

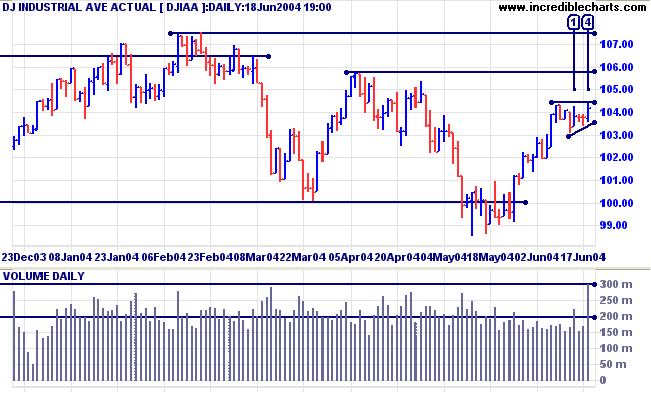

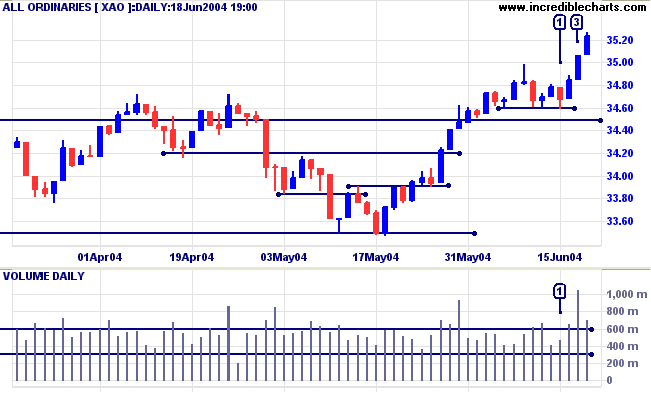

- increased volume on the two up-days at [1] and [4]; and

- equal highs with rising lows, creating an "ascending" pattern.

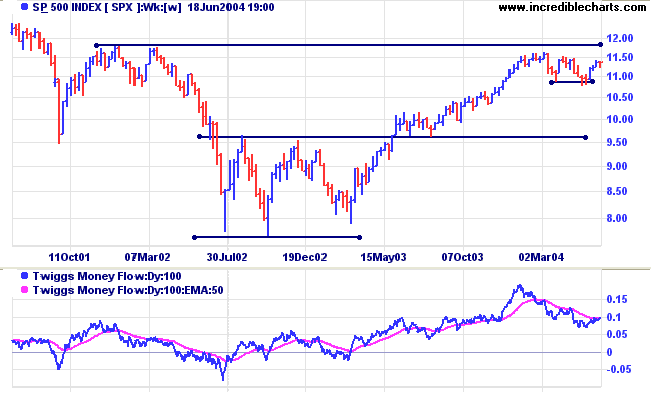

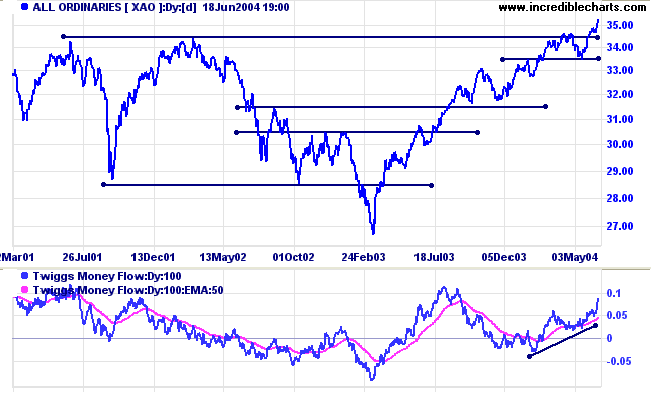

Twiggs Money Flow has crossed above its signal line but is still trending downwards.

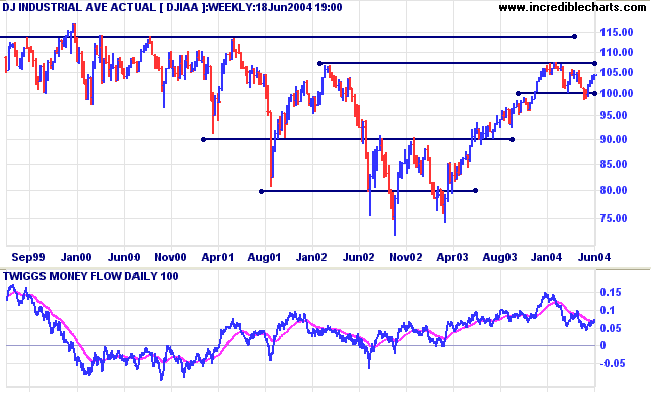

Twiggs Money Flow continues to trend downwards, signaling continued distribution.

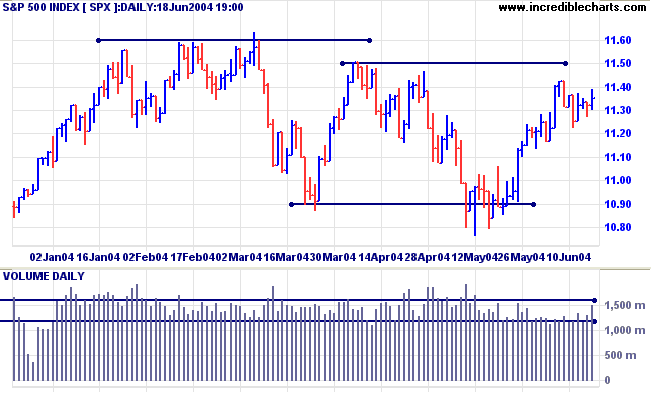

A clear break above resistance at 1150 would signal resumption of the primary up-trend; though it may be advisable to wait for confirmation. A break below 1080 would be a bear signal, indicating a possible test of support at 960.

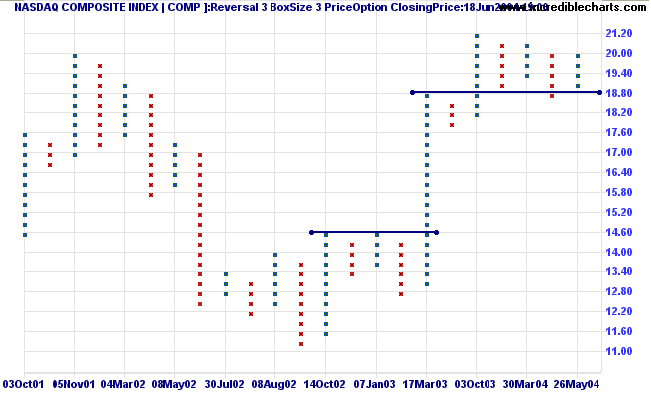

Twiggs Money Flow continues to signal distribution.

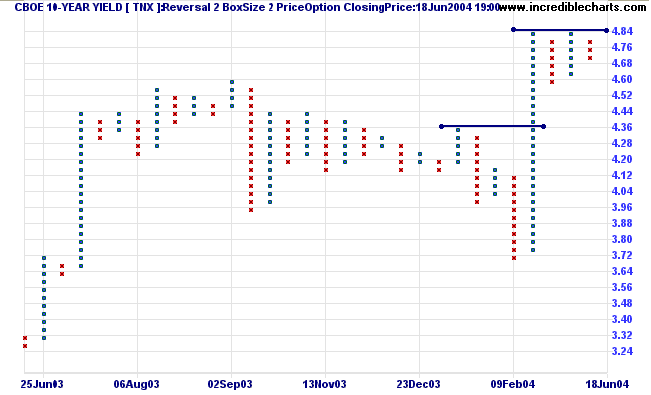

The yield on 10-year treasury notes is down slightly at 4.710%. The yield is consolidating below resistance at 4.84% after the strong breakout. A yield differential (10-year T-notes minus 13-week T-bills) of 3.5% reflects an imminent rates rise.

New York: Spot gold made a late rally to $394.90, forming a higher low. A rise above 397.20 would signal the start of an intermediate up-trend with a possible test of resistance at the April high of 427.25.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

Twiggs Money Flow is rising fast, indicating strong accumulation.

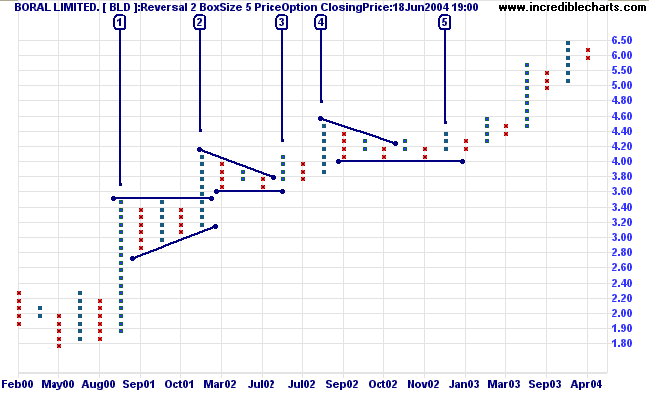

Triangles represent consolidation during an up- or down-trend: when buyers and sellers are, at least for a while, in equilibrium. Breakouts offer significant entry points, either on a continuation or on reversal of the trend.

For a valid triangle there must be at least two retracements counter to the prevailing trend:

- Two columns of Os in an up-trend; or

- Two columns of Xs in a down-trend.

Symmetrical triangles

Symmetrical triangles present a series of rising lows and falling highs. Breakouts may occur in either direction, though the pattern is more likely to resolve in a continuation unless a trend is over-extended.

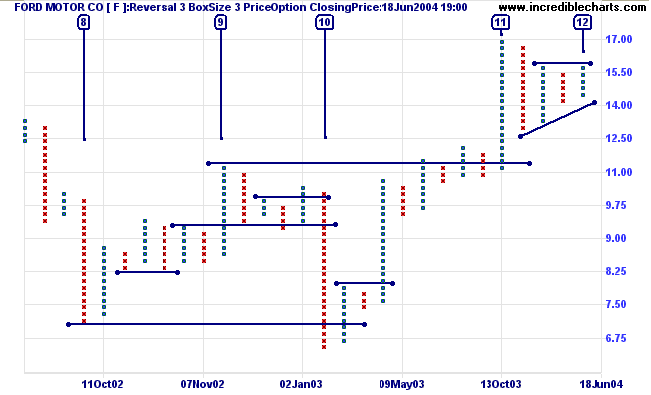

Ford Motor Co. [F] below has formed a triangle between [11] and [12] in the latest up-trend. There are two retracements (red columns) counter to the direction of the trend so this is a valid pattern.

- An upward breakout entry would be made if the column at [12] rises above the high of the previous column. Stops would be placed below 14.00: the low of the last red column.

- A downward breakout would occur if price reverses back below 14.00. On a trend reversal it is advisable to wait for confirmation: otherwise you could get suckered by a false break.

Ascending and descending triangles are treated in the same way as on a normal bar chart:

-

Ascending triangles are strong bull

signals in an up-trend that is not over-extended. Also in

an extended down-trend. In a normal down-trend, the pattern

is less certain: often resulting in a bull trap.

Breakout entries are taken when price rises above the resistance level. Stops are placed below the most recent low.

-

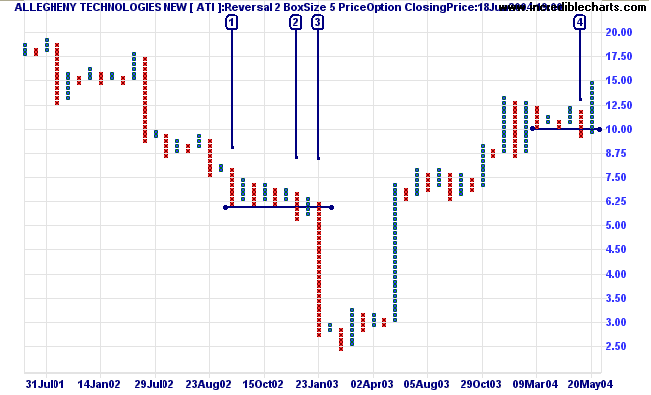

Descending triangles are strong bear

signals in a down-trend (when not over-extended). Also in

an extended up-trend. In a normal up-trend, the pattern is

less certain; watch out for bear traps.

Breakout entries are taken when price falls below the support level. Stops are placed above the most recent high.

Allegheny Technologies [ATI] below displays a descending triangle in a down-trend: at [1] to [3]. Observe how the breakout at [2] retreats back above the previous support level. Price then forms another lower high, followed by a strong downward break at [3]: a fine bearish catapult.

More on breakouts and confirmations next week.....

And in to-day already walks to-morrow.

~ Samuel Taylor Coleridge

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.