|

Free trial expiry |

|

US data updates will not be delayed (on

Incredible Charts free version) until the US subscription

page is available. NYSE, NASDAQ, AMEX and indices are updated at 8.00 p.m. EST. Click Help >> About to check your membership/free trial status. |

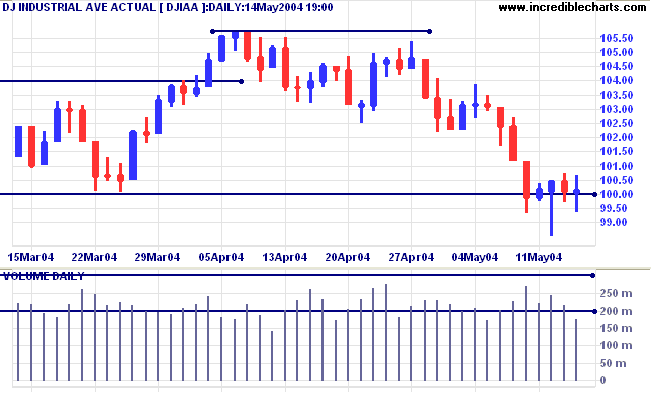

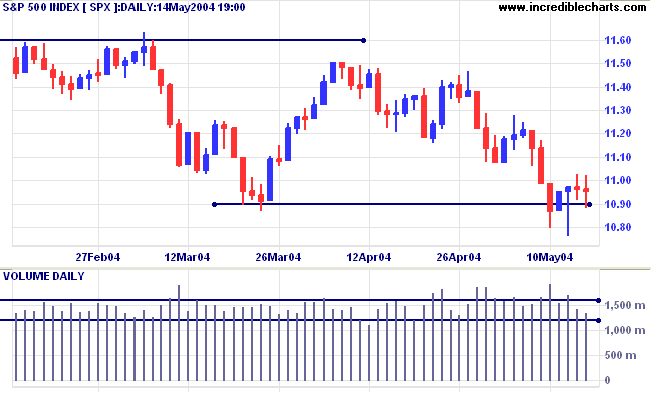

Trading Diary

May 15, 2004

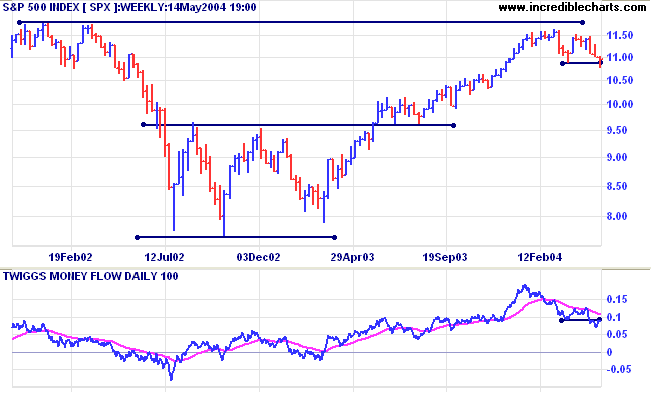

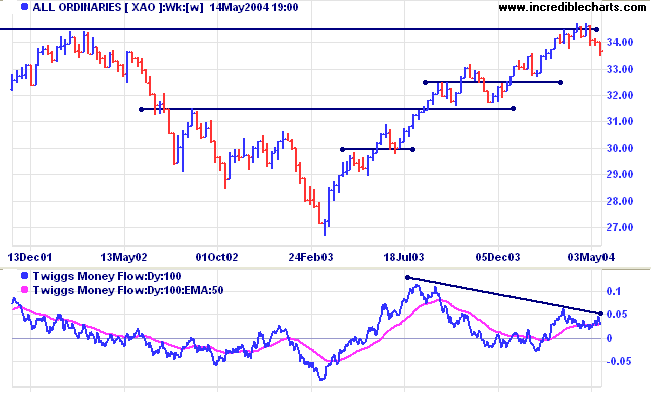

Twiggs Money Flow signals weakness.

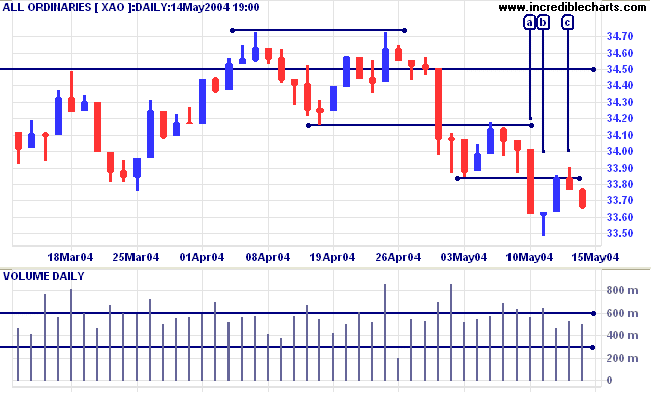

The Chartcraft Bullish Percent Index has plummeted to 59.80%, on Bear Alert status.

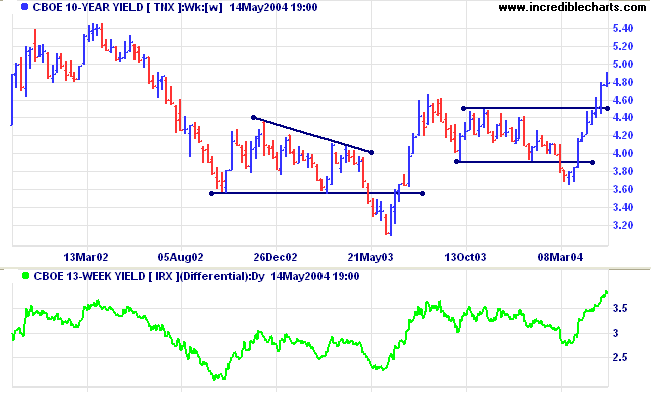

The yield on 10-year treasury notes is in a strong primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) is at its highest level in more than 10 years; reflecting expectations that rates will be increased soon.

New York: Spot gold continues in a primary down-trend, closing at $376.70.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

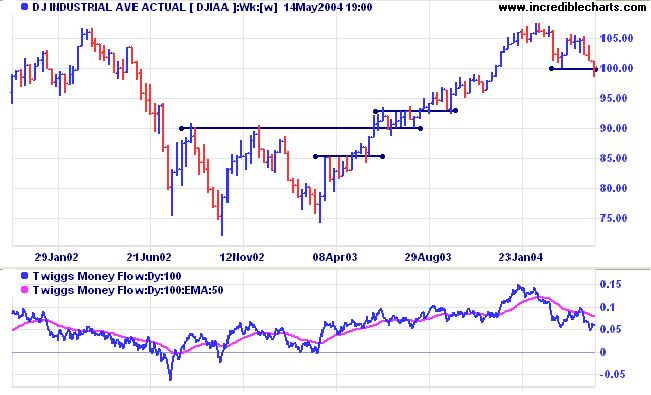

Twiggs Money Flow displays a bearish divergence, signaling long-term weakness.

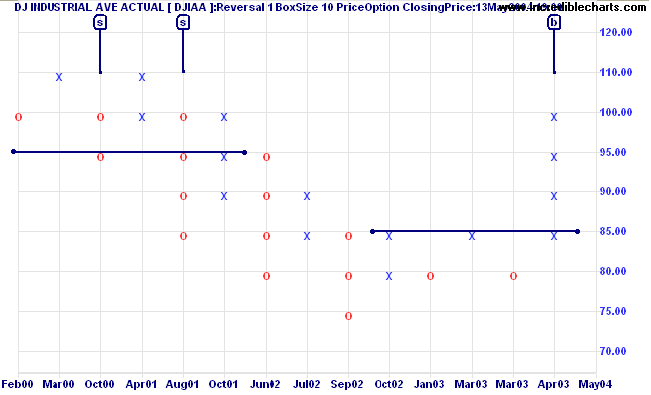

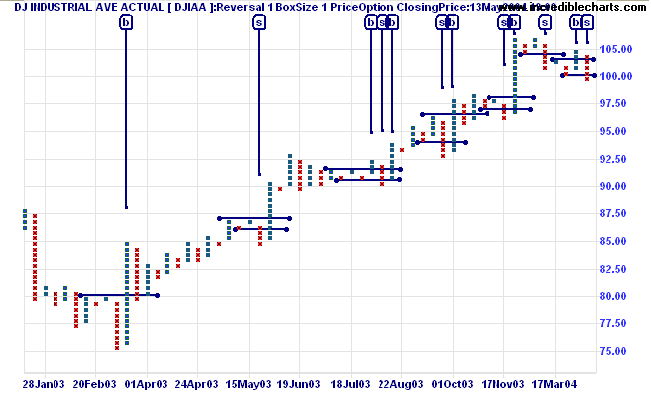

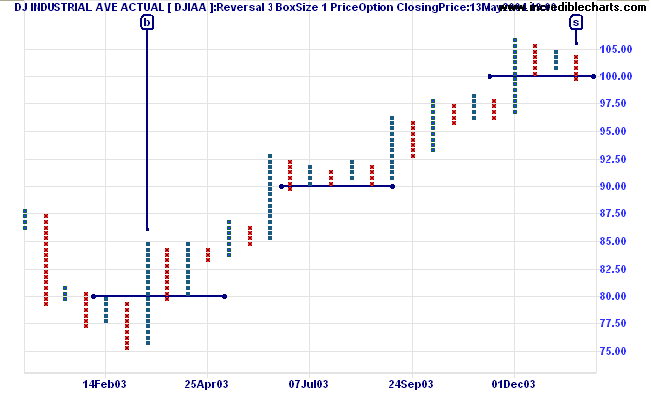

There is no single setting that is suitable for all purposes. When selecting box sizes and reversal amounts, there are two main considerations :

-

The time

frame:

When viewing longer time frames, for intermediate or primary trends, you will need to eliminate shorter-term fluctuations. Day traders or swing traders, on the other hand, will want to see short-term rallies and corrections. -

The purpose:

Are you going to trade from the signals or merely use point and figure as a trend indicator?

- Large box sizes provide very reliable signals but are often late, leaving profits on the table.

| Buy/Sell Signals | |

| Buy [b]: | When a column of Xs rises above the preceding column of Xs |

| Sell [s]: | When a column of Os falls below the preceding column of Os |

- Smaller box sizes provide earlier alerts, but also deliver more false signals:

This is where reversal settings come in, enabling us to keep smaller box sizes while at the same time eliminating minor fluctuations. With reversal amounts greater than one, new columns are not started until the trend has completed a set number of boxes (normally 2 or 3).

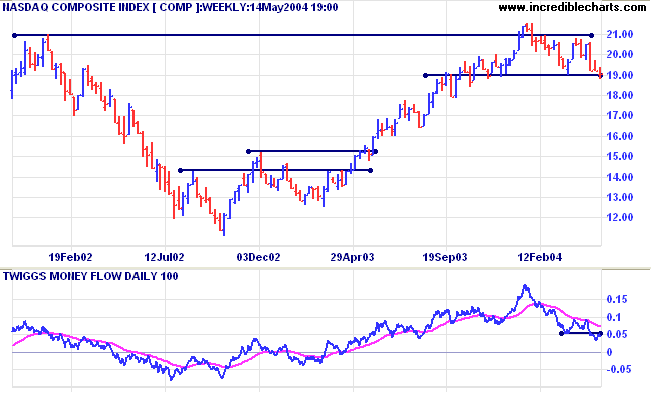

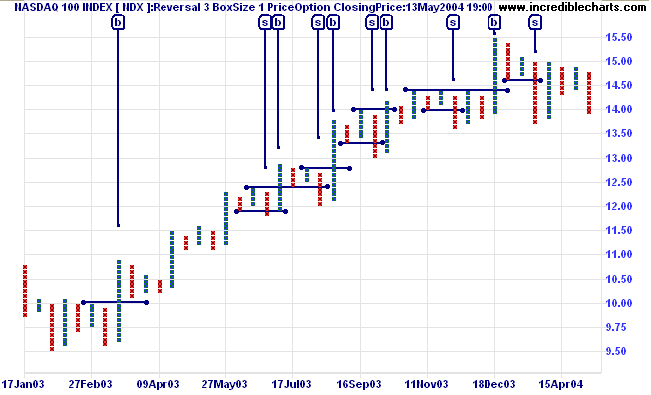

You will need to adjust box and reversal sizes for different securities (or indices): not all have the same volatility. A setting that is suitable for the Dow Jones index (above) may not be appropriate for the more volatile Nasdaq 100 [NDX]:

- Increase the reversal amount first, keeping the box size as small as possible (for increased responsiveness).

- The practical maximum reversal amount is about 5.

- Aim to minimize false signals, rather than to eliminate them altogether.

-

Choose the best visual fit, based on chart

history.

Use the P&F selector arrow

(on the toolbar) to select saved point and figure settings.

-

Adjust box/reversal sizes according to the

Volatility

index.

Example: Use the Volatility index to derive a table for long-term trends. Set up 1000-Day Volatility index with 500-day exponential smoothing.

Stock/Index Volatility index Volatility range Number of boxes Box size Reversal amount All Ordinaries [XAO] 5.5% 5 - 10% 2 1 2 Dow Jones [DJIAA] 10% 10 - 15% 3 1 3 S&P 500 [SPX] 16% 15 - 20% 4 1 4 Nasdaq 100 [NDX] 49% 40 - 50% 10 2 5 Yahoo [YHOO] 97% 90 - 100% 20 4 5

Box sizes are increased (by 1) for each 5% increment in volatility:

The table should be used only as a guideline. It is advisable to visually inspect whether the chart is a good fit.

Next week: Point & Figure - Hi/Lo, Closing Price or Typical Price options.

To chart 10 years of data history (in place of 3 years):

- select Time Period >> Chart Complete Data.

lest we be like the cat that sits down on a hot stove-lid.

She will never sit down on a hot stove-lid again, and that is well;

but also she will never sit down on a cold one anymore.

~ Samuel Clemens.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.