|

|

E*TRADE - New Conditional Orders

help you stop losses and also seize profits. Protecting your portfolio against market dips is only half the story. There's a market full of opportunities out there, too. Which is why we've created Conditional Orders. To learn more, click here. |

Trading Diary

April 17, 2004

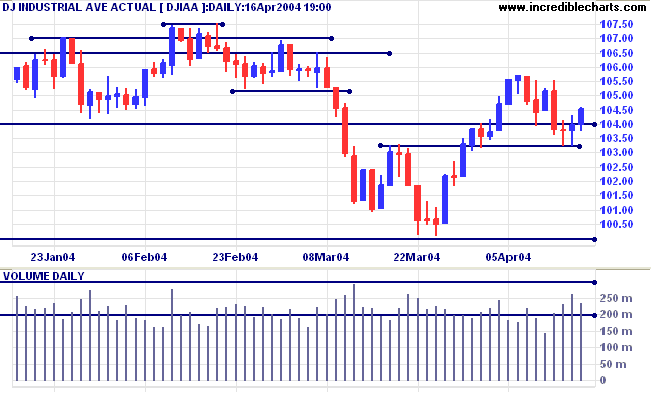

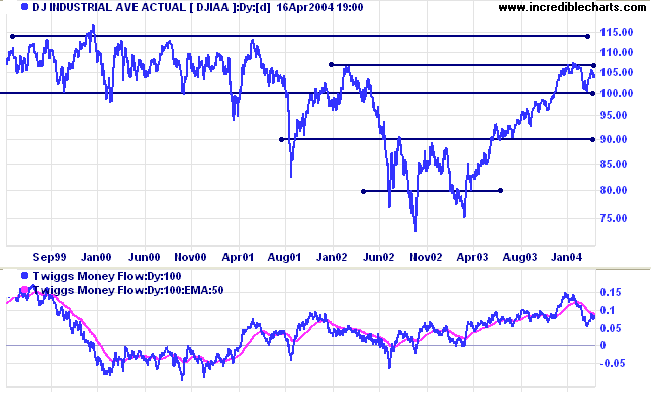

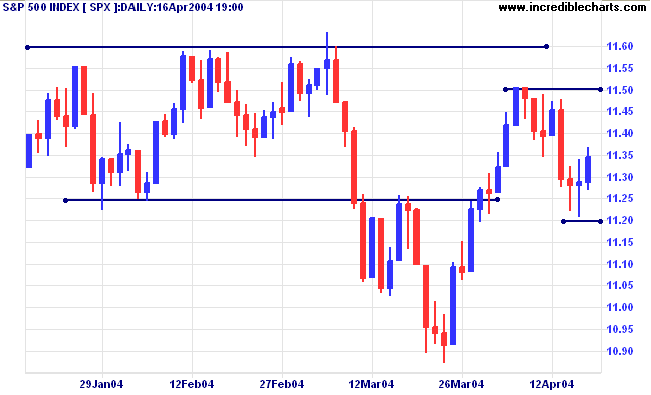

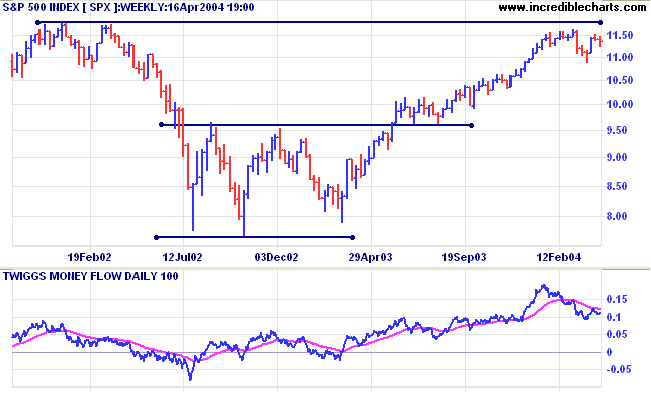

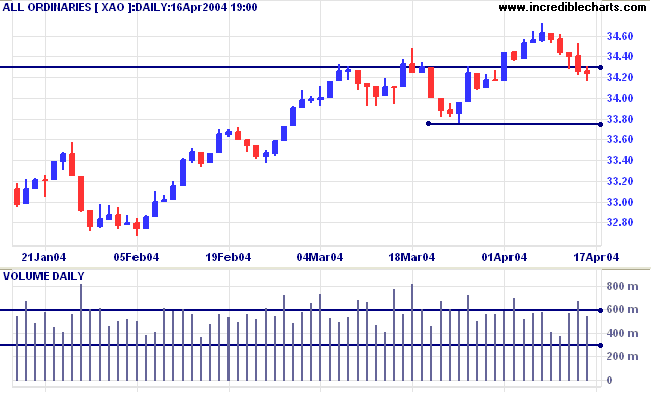

Twiggs Money Flow signals trend weakness.

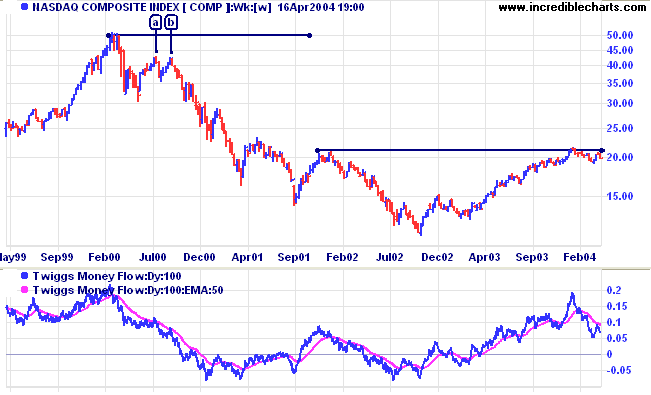

A rise above 2150 would signal resumption of the primary up-trend. Support is at 1900.

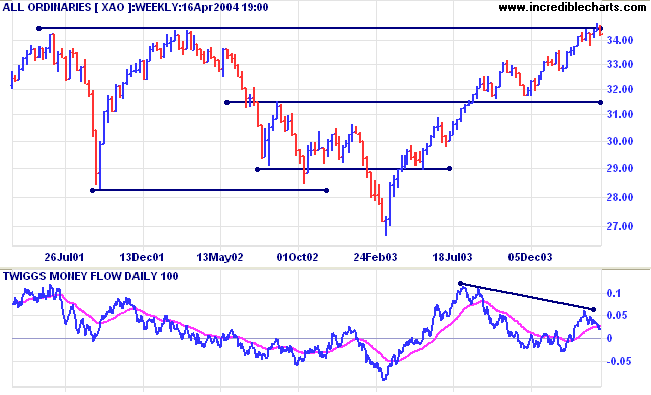

Twiggs Money Flow signals trend weakness, with recent peaks below the signal line.

Twiggs Money Flow is bearish, with recent peaks below the signal line.

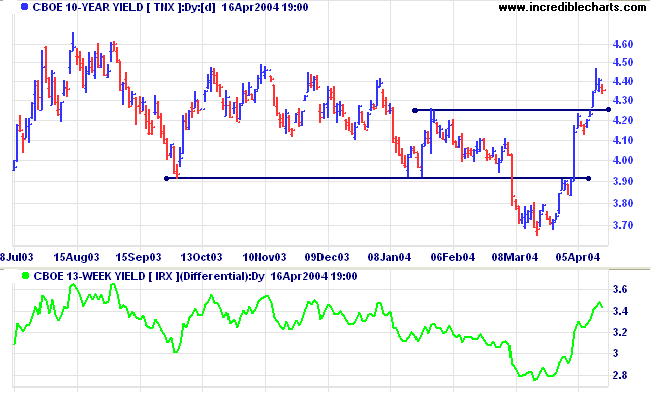

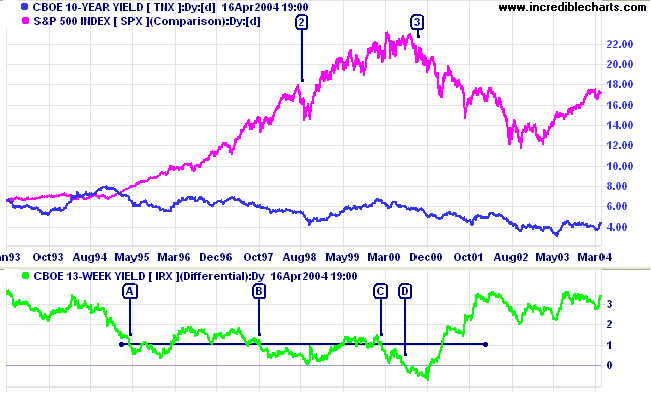

The yield on 10-year treasury notes closed up at 4.352%.

The primary trend is still uncertain.

The yield differential (10-year T-notes minus 13-week T-bills) is above 3.4%, indicating that long-term investors are demanding a healthy premium for tying up their capital.

New York: Spot gold retreated sharply to close at $400.20.

The intermediate trend is down.

A fall below $390 would signal reversal of the primary trend.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

The intermediate trend is still up.

Twiggs Money Flow appears to be forming a bearish divergence, which would signal long-term weakness.

Rising yields normally signal that the economy is recovering in the short to medium term, due to:

- increased demand for corporate debt, to finance inventories and new investment; and

- investors switching out of bonds and into equities.

The Federal Reserve drives up short-term interest rates, when it decides that the economy is overheating, and lowers short-term rates when it wants to stimulate the economy. The Fed's actions may affect the normal difference between long and short-term yields: the premium that long-term bond investors normally demand to compensate them for tying up their capital for long periods. In severe cases, when the Fed has to hit the brakes hard, short-term yields may rise to the point where they exceed long-term yields; creating a negative yield differential. This does not occur very often but, when it does, equity markets can expect a significant down-turn within the next 12 months.

- [A] was a no-show, with little change in the upward trend of the SPX apart from a consolidation in mid-1996;

- [B] was followed by a sharp correction in August/September 1998;

- [C] was the most severe, with a fall below zero at [D] and a major fall in the SPX over the next 12 months.

- Chart the CBOE 10 Year Yield (TNX) - under Indexes: CBOE on the Securities menu

-

Select the

Indicator Panel on the toolbar -

Select Price

Differential in the left column

A pop-up menu appears of all listed securities exchanges - Browse the drop-down menu and select CBOE 13 Week Yield (IRX) under Indexes: CBOE

- Select Daily and Apply to Security in the center panel

- Save the settings [ >] and close the indicator panel [X]

To think and not study is dangerous.

~ The Analects of Confucius.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.