Free Data

Except for the 30-day free trial, free end-of-day data will be

delayed by 18 hours from next week.

This means that the updates will occur at 10.00 a.m. - suitable

for training purposes but not active trading.

Premium subscribers are unaffected by these changes.

To find out more about premium subscriptions - see Incredible Offer.

Also, early US subscribers enjoy an extended free trial until

June 30 and will not be affected by the changes.

If your free trial expiry date is not correctly reflected (see

Help >> About), please contact members

support.

Trading Diary

April 3, 2004

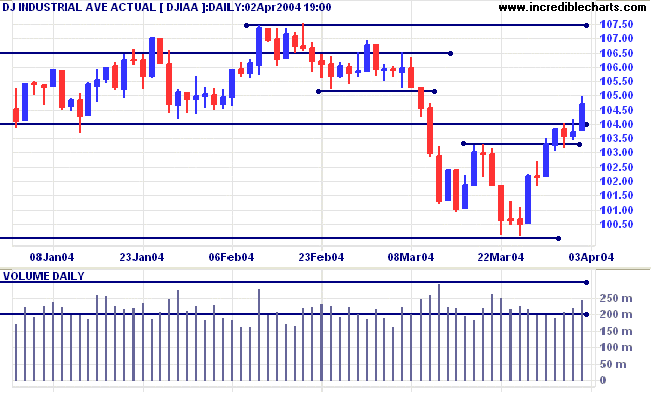

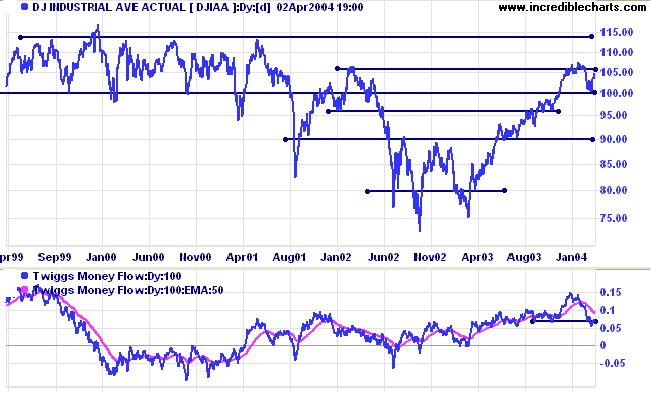

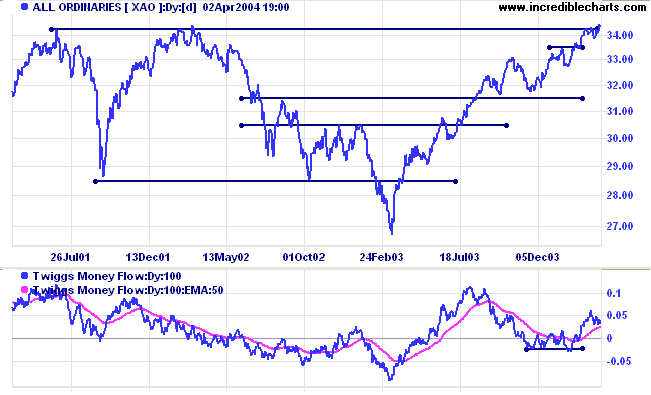

Twiggs Money Flow has rallied off the recent low but is still bearish..

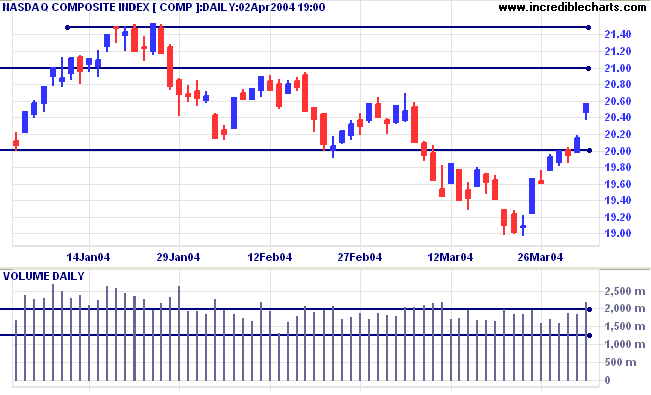

The intermediate trend is up. The gap may exhaust short-term momentum but should herald a re-test of resistance at 2100. A rise above resistance at 2150 would signal resumption of the primary up-trend. Support is at 2000 and 1900 (major). Twiggs Money Flow is still bearish.

New York: Daylight saving commences at 2:00 a.m. on April 4.

Times will shift to EDT (GMT-4) from EST (GMT-5).

For further details, see Coping with different Time Zones.

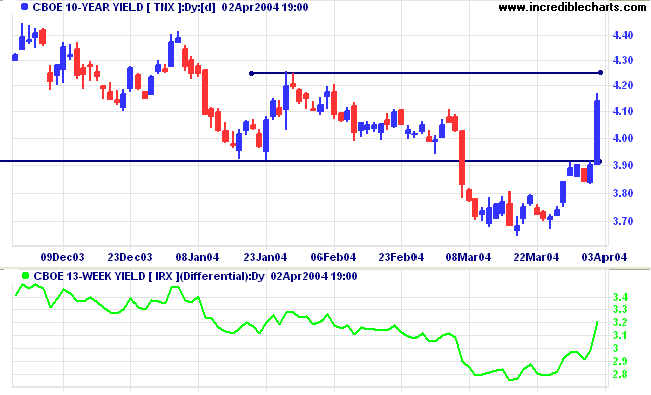

The yield on 10-year treasury notes rallied sharply to close at 4.14%.

The intermediate trend is uncertain. A rise above 4.25 would signal commencement of an up-trend.

The primary trend is down.

New York: Spot gold eased to $421.40 after testing resistance at $427.

The intermediate trend is up.

The primary trend is up. A fall below $390 would signal reversal.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

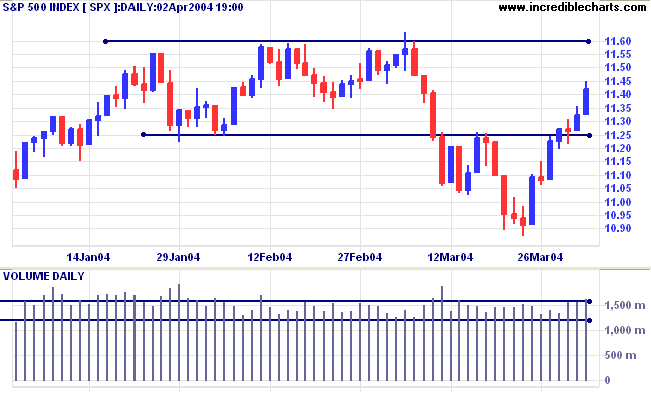

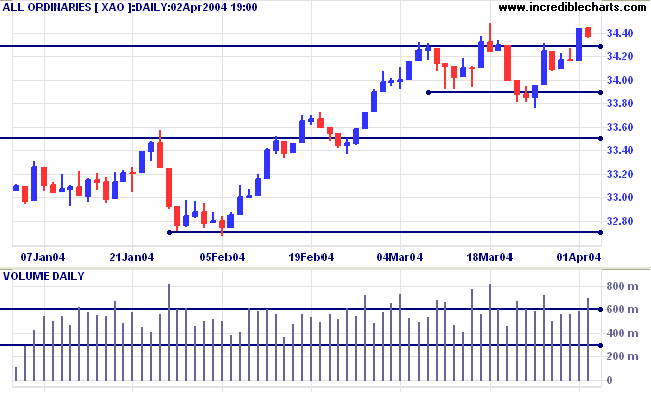

The intermediate and primary trends are up.

Twiggs Money Flow signals accumulation (intermediate time frame).

Incredible Charts Premium

version

|

FREE trial - Click Here

Welles Wilder's Directional Movement system consists of three lines:

- Positive Direction Indicator (+DI) indicates upward trend movement;

- Negative Direction Indicator (-DI) summarizes downward trend movement;

- ADX indicates the overall level of directional movement. High readings signal strong trends, while low readings indicate ranging stocks.

Short signals, when -DI crosses to above +DI while ADX (also) turns up.

There are many different ways of trading with Directional Movement. See the Trading Guide for Alexander Elder's approach.

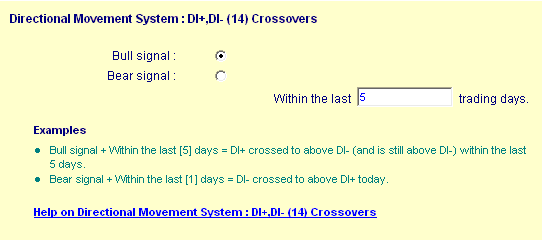

To identify potential long trades:

-

Open the Stock Screen module from the

toolbar

- Select Directional Movement System

-

Under DI+, DI- (14)

Crossovers:

- select Bull Signal and

- within the last 5 trading days

-

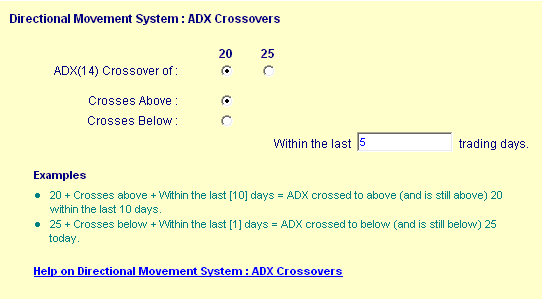

Scroll down to ADX

Crossovers:

- select ADX (14) Crossover of 20

- Crosses Above and

- within the last 5 trading days

- Submit

As an alternative to the second filter you can use the ADX Reversals filter:

- ADX (14) Reversal by 4 Points

- ADX turns up

- Within the last 5 trading days

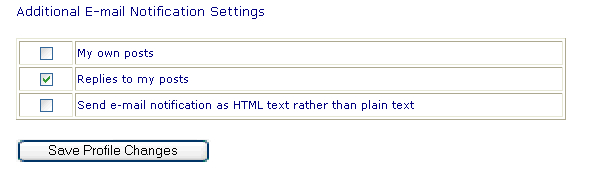

To receive images in Chart Forum notices:

- Login to your Chart Forum Profile

- Select Email Notifications

- Scroll to Additional Email Notification Settings

- Select Send e-mail notification as HTML text rather than plain text

- Save Profile Changes.

while the spirited element ought to act as its subordinate and ally.

The two will be brought into accord, by that combination of mental and bodily training

which will tune up one string of the instrument and relax the other,

nourishing the reasoning part on the study of noble literature

and allaying the other's wildness by harmony and rhythm.

~ Plato.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.