Incredible Charts Premium

version

|

Trading Diary

March 13, 2004

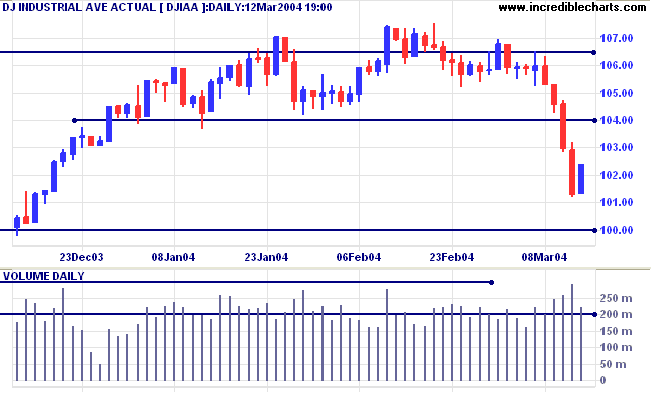

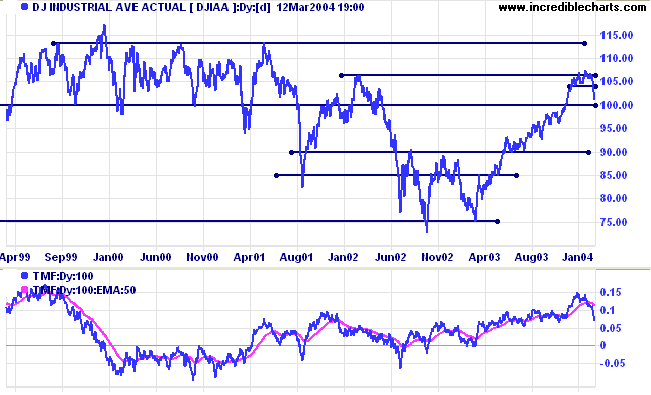

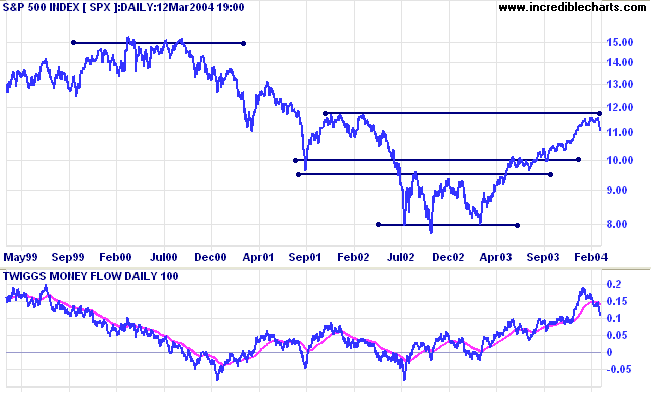

The intermediate trend is down. Expect a test of support at 10000.

Twiggs Money Flow gives a secondary signal, having broken below its signal line.

The primary trend is up. Initial support is at 1750.

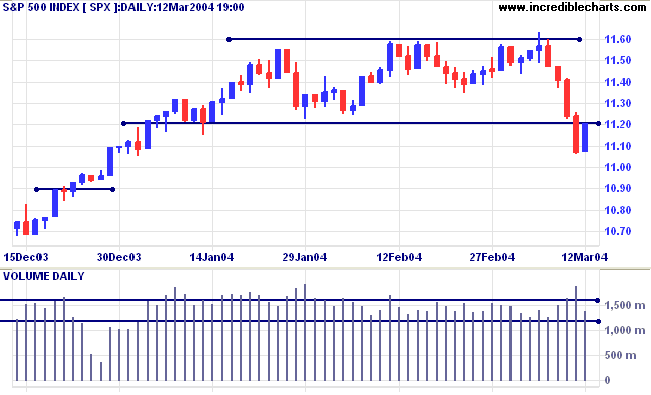

The intermediate trend has turned down. Failure to cross back above resistance at 1120 would be a bearish signal.

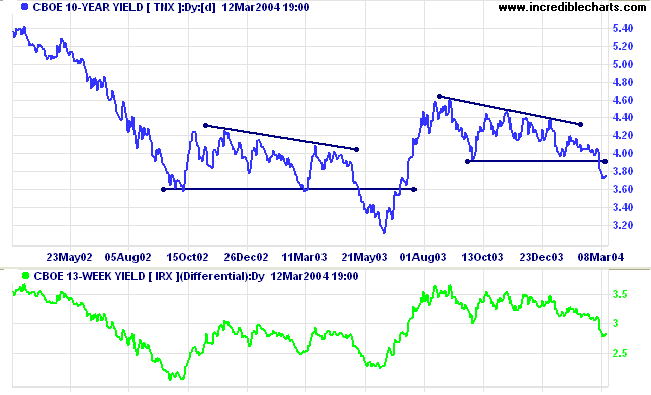

The yield on 10-year treasury notes consolidated at 3.76% after falling sharply through support at 3.93%.

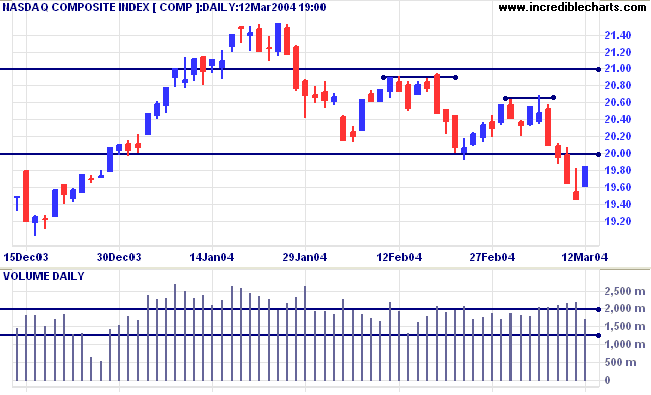

The intermediate trend is down.

The primary trend is down, after the breakout from the bearish descending triangle.

New York: Spot gold is back down at $395.00.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

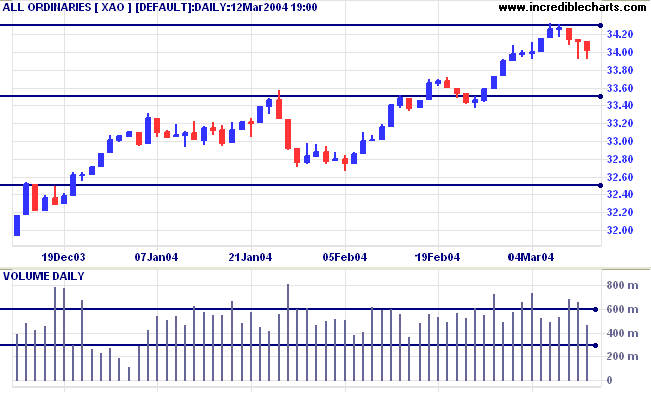

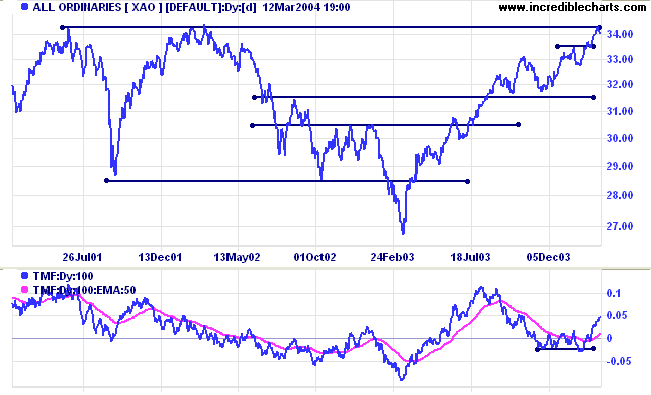

The primary trend is up. R

Trading Diary

esistance is at

3450, the high from 2002

We have had to curtail our coverage of sectors to ensure compliance with Australian Financial Services Regulations. The new weekly format will include coverage of stock screens, indicators, chart patterns, support and resistance and other items of general interest to subscribers.

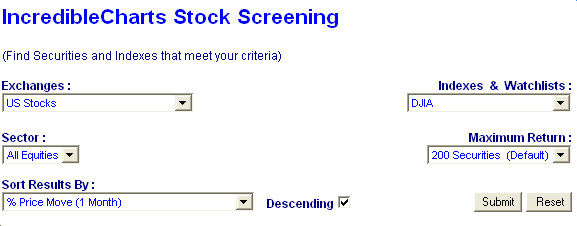

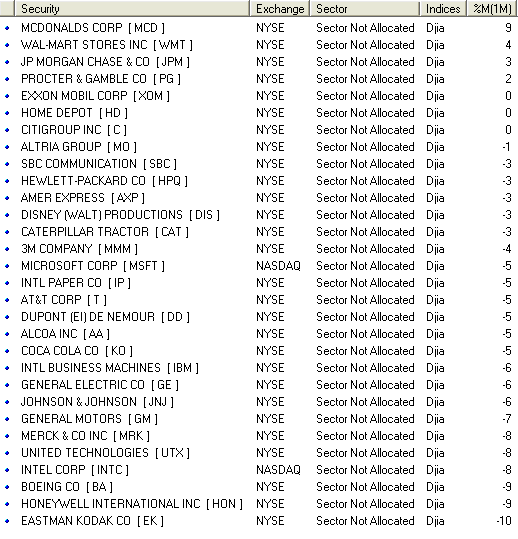

To determine the relative performance of stocks (or indices) over a set time period, sort your stock screen by %Price Move. For example, to determine the relative strength (over 1 month) of stocks in the Dow Jones Industrial Average:

- Open the Stock Screen module from the toolbar

- Select US Stocks (under Exchanges)

- Select DJIA (under Indexes & Watchlists)

- Sort Results By % Price Move (1 Month)

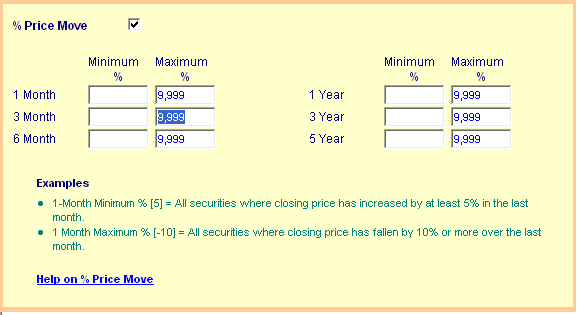

- Open the % Price Move filter and add 99999 as the Maximum for each of the required time periods.

Incredible Charts Premium

version

|

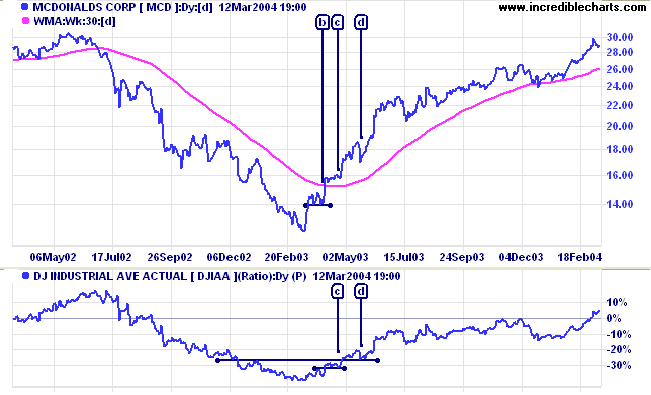

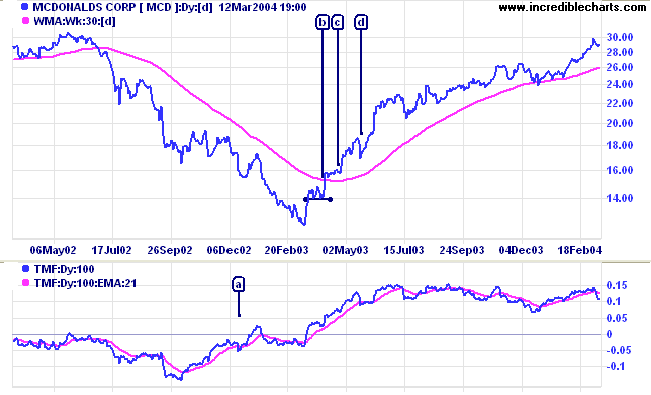

Equal higher lows at [b], confirming support at 14.00 above the March low of 12.00, gave the first bull signal.

This was followed by a consolidation above the 30-week MA at [c], with Relative Strength (price ratio: djia) respecting the previous 1-month RS high - a strong bull signal.

The final confirmation, for the most conservative traders, comes with RS respecting the previous 3-month high at [d].

There is only opportunity.

~ General Douglas MacArthur.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.