Incredible Charts Premium

version

|

Trading Diary

March 6, 2004

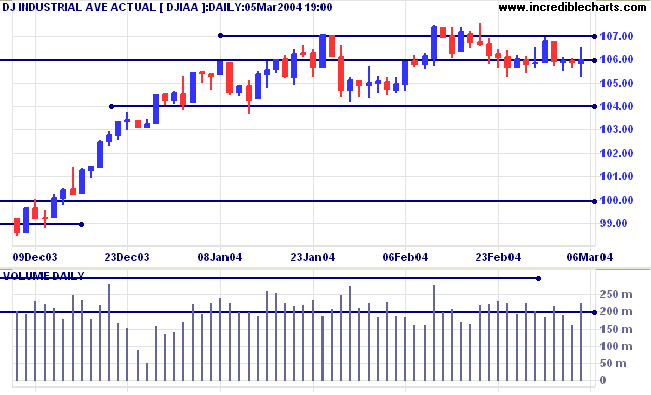

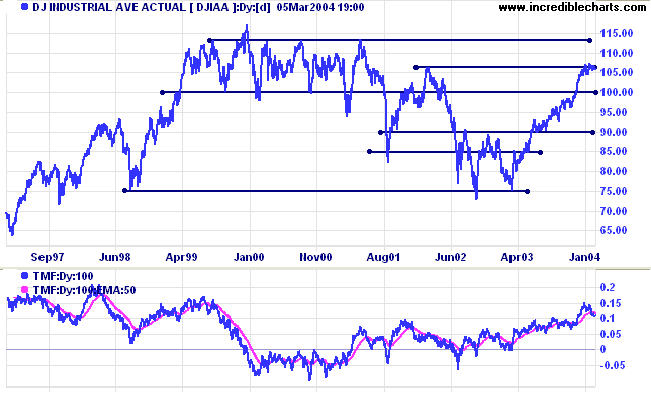

The intermediate trend is uncertain. A fall below support at 10400 would signal reversal to a down-trend, favoring a re-test of support at 10000.

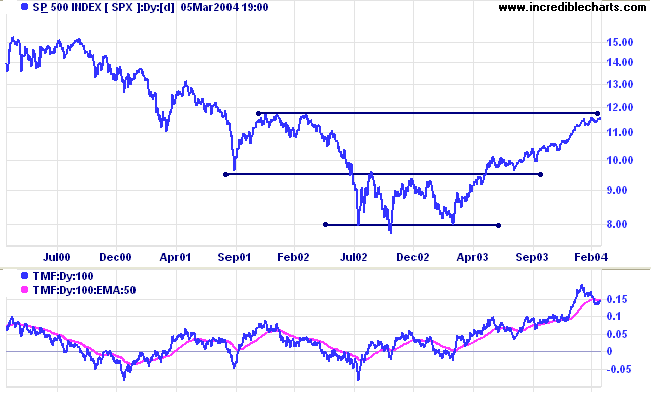

Twiggs Money Flow gives a weak distribution signal, having broken below its signal line.

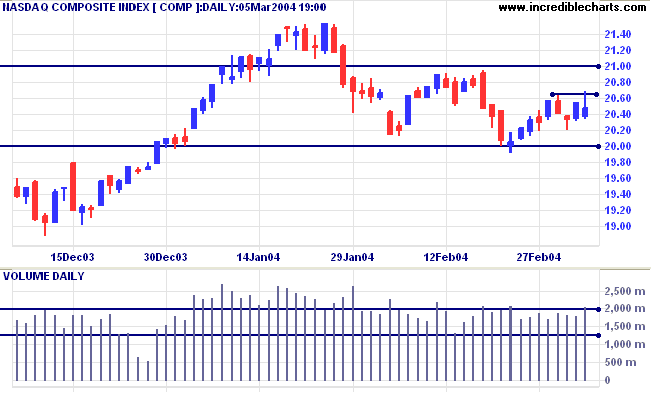

The intermediate trend is down.

The primary trend is up. A fall below 1750 would be bearish.

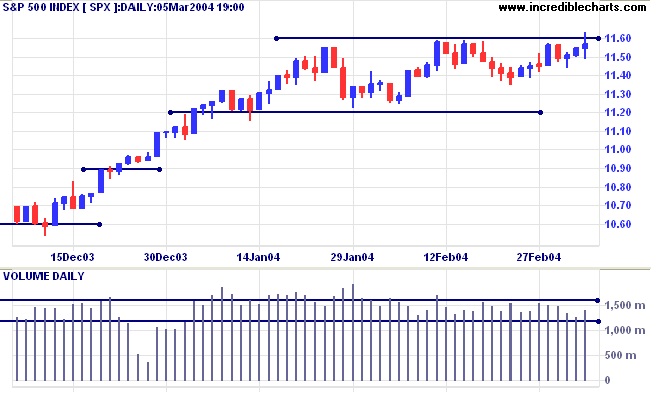

The intermediate trend is uncertain. A rise above 1160 would be bullish. A fall below support at 1120 would be bearish.

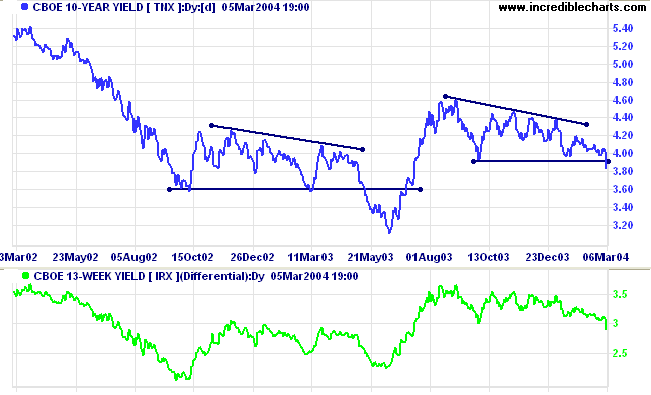

The yield on 10-year treasury notes closed down sharply at 3.83%, breaking below support at 3.93%.

The intermediate trend is down.

The primary trend has reversed down, after the breakout from the bearish descending triangle.

New York: Spot gold jumped sharply before Friday's close, ending at $401.00.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

Trading Diary

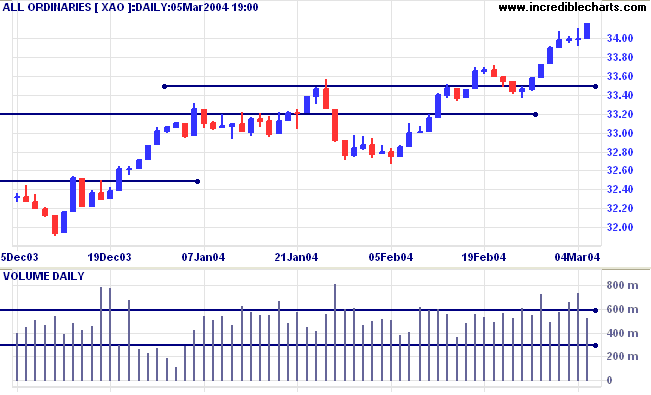

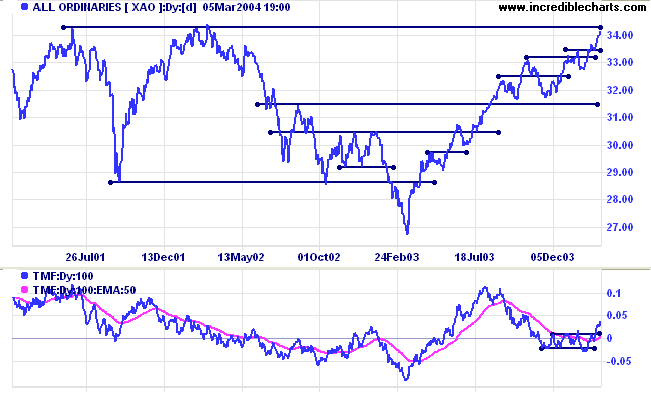

resistance

at 3425 to 3450, the highs from 2001 and 2002

The primary trend is up. Support is at 3160.

We have had to curtail our coverage of sectors to ensure compliance with Australian Financial Services Regulations. The new weekly format will include coverage of stock screens, indicators, chart patterns, support and resistance and other items of general interest to subscribers.

Wide ranging days have a significantly wider true range than surrounding bars. They have as much significance as gaps, and often signal a reversal, false break, shake-out, blow-off or strong follow-through after a trend reversal. I have found the Volatility Ratio, introduced by Jack Schwager in his book Schwager on Futures: Technical Analysis, particularly useful. Any day that has a true range more than twice the 14-day average is identified as a wide-ranging day.

- To set up a stock screen filter: select Volatility Ratio (Schwager) > 2.0 within the last 2 days.

Many gaps are also wide ranging days: true range is measured from the previous day's Close to the current High or Low, where this is wider than the current High minus Low. To screen for significant gaps it may be advisable to combine the above Volatility Ratio filter with the following:

- Select Gaps: Price Gapped Up or Price Gapped Down, depending on whether you want bullish or bearish gaps, within the last 2 days.

To narrow your search even further, add a volume spike filter:

- Select Volume Spikes: Volume exceeds the 50-Day Volume EMA by 2.0 times within the last 2 trading days.

Incredible Charts Premium

version

|

The Chart Forum can be accessed from the Home page or from Incredible Charts. It features more than 30,000 posts discussing:

- stocks (create a separate thread for each new stock);

- market trends;

- chart patterns;

- trading systems; and

- for the more analytical reader - Does Technical Analysis Really Work?

To become a contributor, you need to register.

Open the Forum and create your own username and password (lowercase only).

Login to your Profile to set up email notifications, edit your profile, remember or change your password.

but talks about what he'll do if he wins,

and a winner doesn't talk about what he'll do if he wins,

but knows what he'll do if he loses.

~ Eric Berne.

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.