Daily Trading Diary

|

We have been advised to remove index

coverage from the Daily Trading Diary as this may

contravene the new Financial Services regulations. I have

therefore decided to stop the newsletter from

today. We will credit members for the unexpired portion of their diary subscription. Please email any questions to members support. |

Trading Diary

March 1, 2004

New York (Mar 01 4:10). Spot gold recovered to $398.50.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

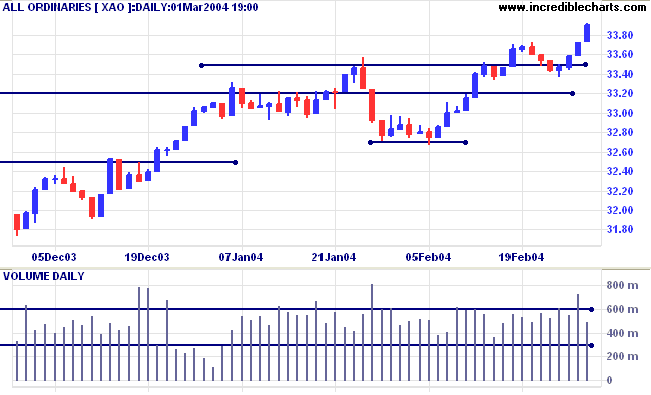

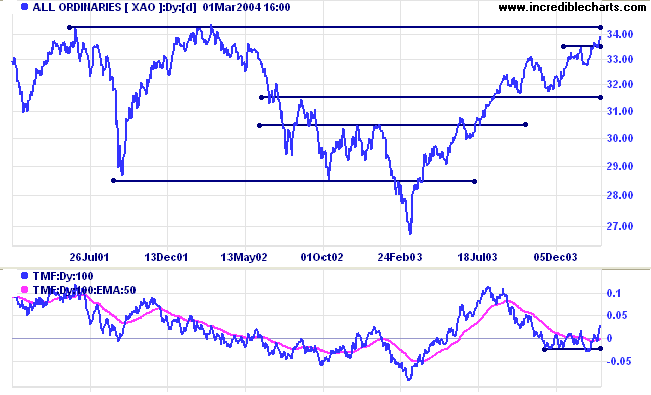

The primary trend is up. Support is at 3160.

if you will give up the belief that you can't have it.

~ Dr Robert Anthony.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.