Incredible Charts Premium

version

|

Trading Diary

February 28, 2004

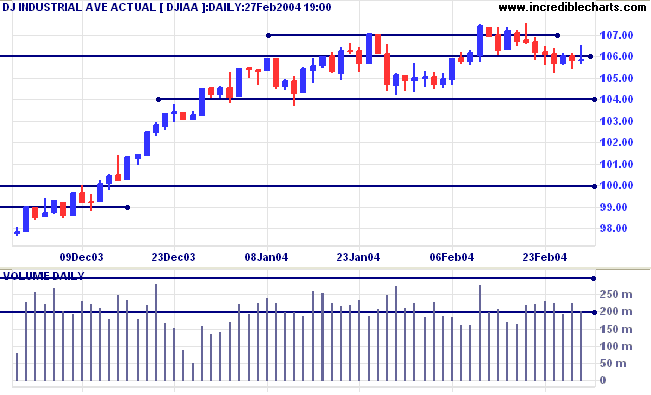

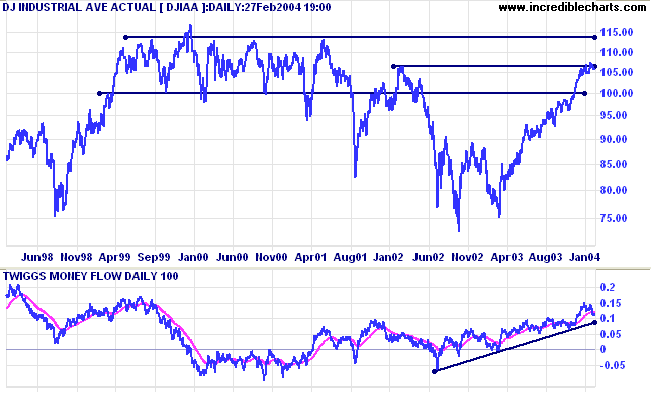

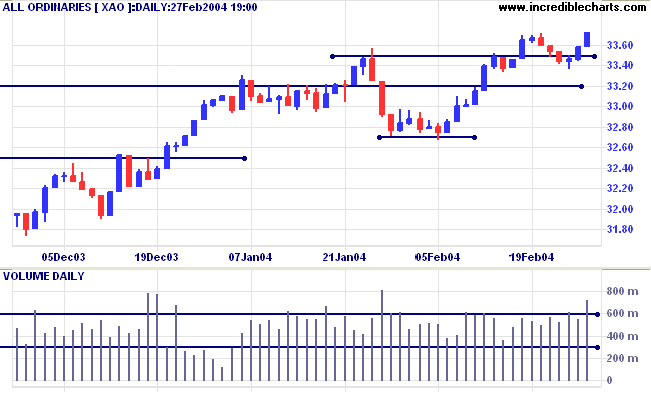

Consolidation below the the level of a recent high is a bearish sign.

The intermediate trend is uncertain. A fall below support at 10400 would signal a re-test of the 10000 level.

Twiggs Money Flow gives a weak distribution signal, having broken below its signal line.

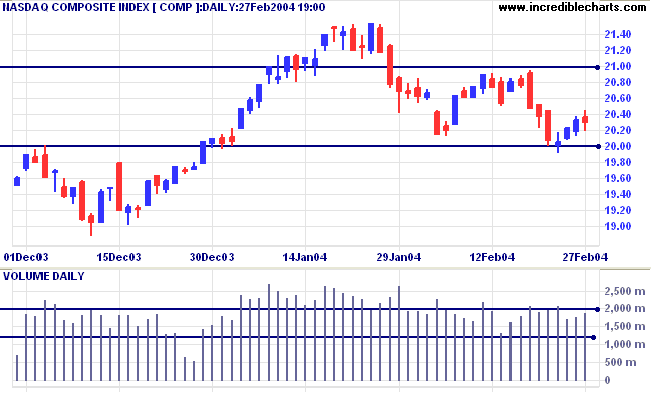

The intermediate trend is down. Support is at 2000.

The primary trend is up. A fall below 1750 would be bearish.

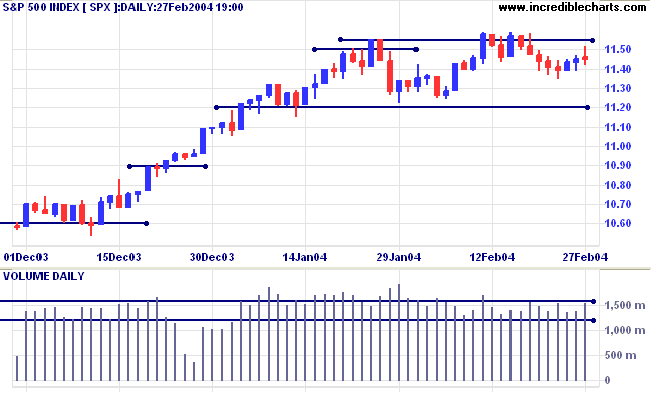

The intermediate trend is uncertain. A rise above 1155 would be bullish. A fall below support at 1120 would be bearish.

The primary trend is up. Expect strong support at 1000.

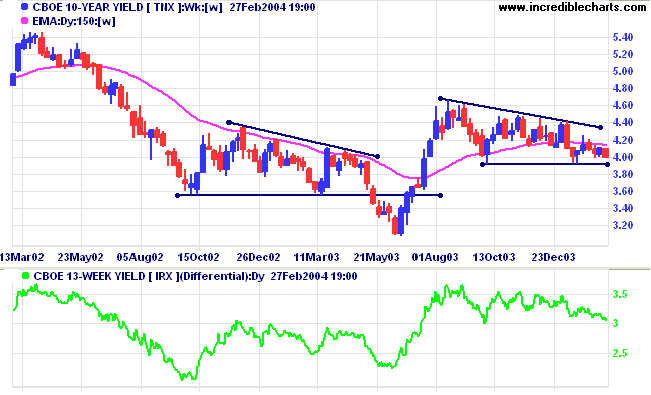

The yield on 10-year treasury notes closed at 3.984%, below support at 4.0%.

The intermediate trend is down.

The primary trend is up. A bearish descending triangle has formed on the weekly chart; a close below the low of 3.93% would signal reversal.

New York: Spot gold tested support at 390 before closing at $396.10.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

The primary trend is up. Support is at 3160.

We have had to curtail our coverage of sectors to ensure compliance with Australian Financial Services Regulations. The new weekly format will include coverage of stock screens, indicators, chart patterns, support and resistance and other items of general interest to subscribers.

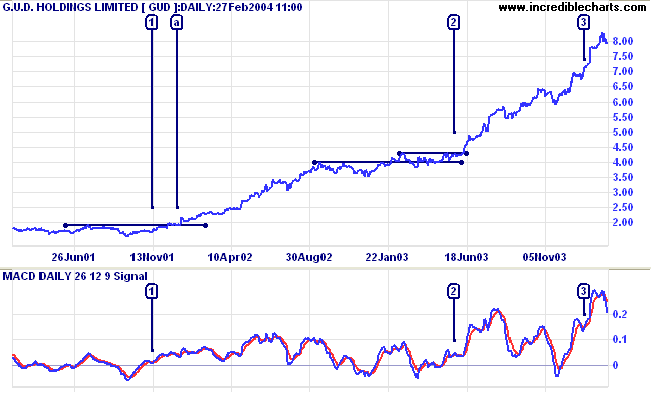

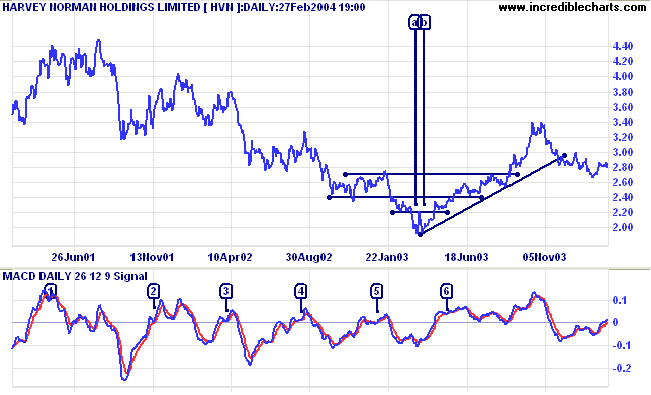

A useful screen for identifying strong trends is the MACD. MACD is a fairly short-term oscillator, plotting the difference between the 26- and 12-day exponential moving averages.

-

MACD (26,12,9): select bull signal within the last 3

days.

If you are screening for stocks commencing a down-trend, select bear signal instead.

-

MACD (26,12,9) above/below Zero: select

bull signal within the last 9999 days.

This will return all stocks where MACD is above zero.

If you are screening for stocks commencing a down-trend, select bear signal instead. - Do a sort on the Stock Screen Return: click on the MACD (26,12,9,0) header to arrange stocks in terms of the number of days above zero.

GUD Holdings is one of the better examples of what may turn up. MACD crossovers occur at [1] [2] and [3], while the indicator is above zero. The first two alert us to excellent setups - where price consolidates in a narrow range above a former resistance level, at [a] and at [2], before breaking into a strong up-trend.

Incredible Charts Premium

version

|

If unable to connect to Incredible Charts, configure your firewall to allow IncredibleCharts.exe to contact the following IP addresses:

- http://66.70.45.174 Port 80 HTTP (TCP)

-

https://66.70.45.174 Port

443 HTTPS (TCP)

- http://app.incrediblecharts.com Port 80 HTTP (TCP)

- https://app.incrediblecharts.com Port 443 HTTPS (TCP)

- Select Tools >> Internet Options >> Security >> Trusted Sites

- Un-check the Require Server Verification (https) box if selected

- Enter the above domain addresses (one at a time) and click the Add button.

Norton Personal Firewall or Norton Internet Security

Norton PF or Norton IS may prevent you from connecting to secure (https) servers.

Check Symantec Support to ensure that you have the latest patches and that Block access to secure sites is not activated.

doing them regularly and never neglecting to do them.

~ William Hesketh Lever

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.