Trading Diary Feedback

|

We have been advised to remove index

coverage from the Daily Trading Diary as this may

contravene the new Financial Services regulations. I feel

that the Daily Diary will be decimated by the change and

am inclined to stop the newsletter at the end of this

month.

The survey also highlighted a need for

earlier US updates and a wider array of data. We have

taken this up with our data suppliers and will keep you

appraised of developments. Please post your feedback or questions at Chart Forum: Trading Diary Feedback or contact members support. |

Trading Diary

February 27, 2004

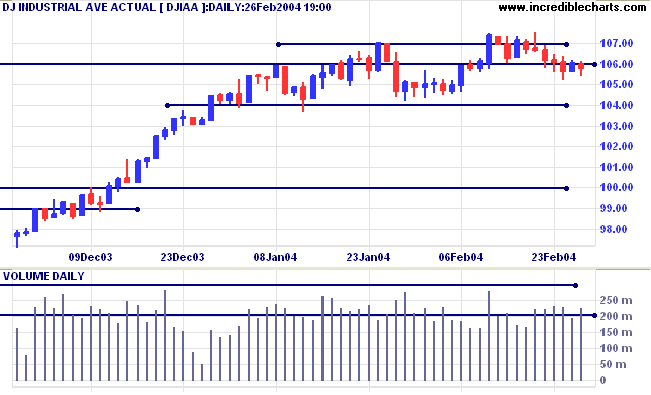

The intermediate trend is uncertain. A fall below support at 10400 would be bearish.

The primary trend is up. Resistance is at 11300 to 11350. A fall below support at 9600 would indicate the start of a down-trend.

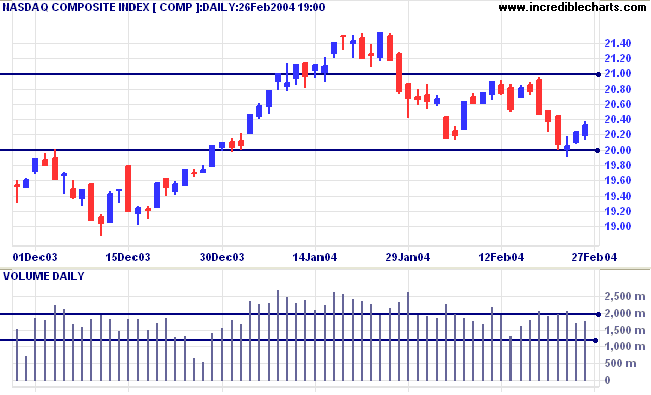

The intermediate trend is down. Narrow consolidation above the 2000 support level would be a bearish sign.

The primary trend is up. A fall below support at 1640 would signal reversal.

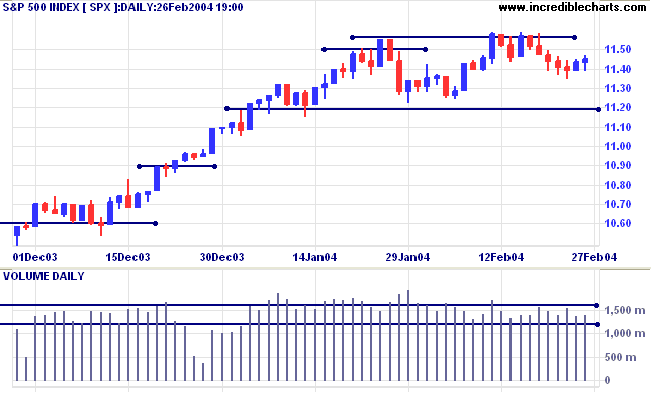

The intermediate trend is uncertain. A rise above 1155 would be bullish. A fall below support at 1120 would signal a down-trend.

The primary trend is up. Expect strong support at 1000. A fall below 960 would signal reversal.

New York (Feb 27 03:54). Spot gold has fallen to $393.20.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

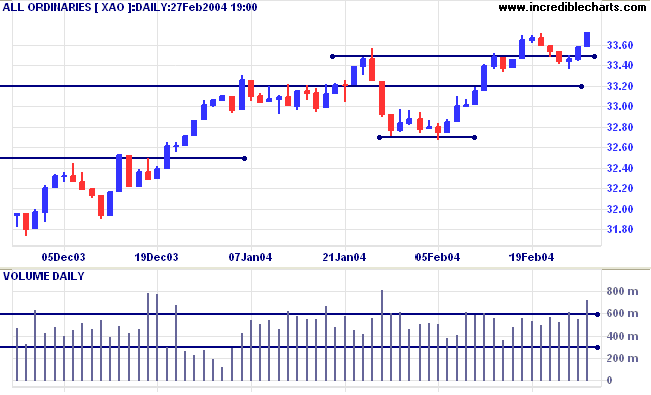

The primary trend is up. Support is at 3160.

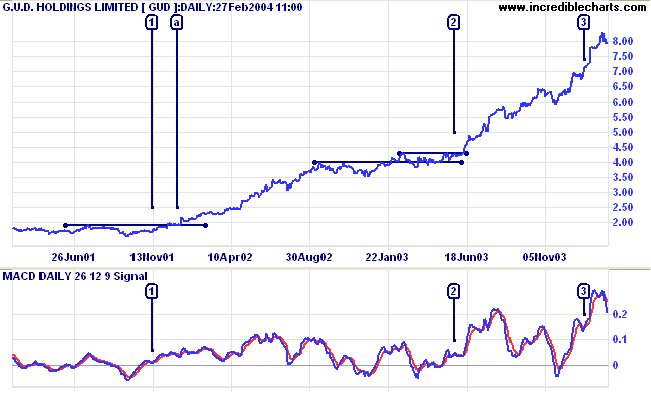

A useful screen for identifying strong trends is the MACD. MACD is a fairly short-term oscillator, plotting the difference between the 26- and 12-day exponential moving averages.

-

MACD (26,12,9): select bull

signal within the last 3 days.

If you are screening for stocks commencing a down-trend, select bear signal instead.

-

MACD (26,12,9) above/below Zero: select

bull signal within the last 9999 days.

This will return all stocks where MACD is above zero.

If you are screening for stocks commencing a down-trend, select bear signal instead. - Do a sort on the Stock Screen Return: click on the MACD (26,12,9,0) header to arrange stocks in terms of the number of days above zero.

GUD Holdings is one of the better examples of what may turn up. MACD crossovers occur at [1] [2] and [3], while the indicator is above zero. The first two alert us to excellent setups - where price consolidates in a narrow range above a former resistance level, at [a] and at [2], before breaking into a strong up-trend.

In this game, the market has to keep pitching, but you don't

have to swing.

You can stand there with the bat on your shoulder for six

months until you get a fat pitch.

~ Warren Buffett.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.