Trading Diary Feedback

|

We have been advised to remove index

coverage from the Daily Trading Diary as this may

contravene the new Financial Services regulations. I feel

that the Daily Diary will be decimated by the change and

am inclined to stop the newsletter at the end of this

month.

The survey also highlighted a need for

earlier US updates and a wider array of data. We have

taken this up with our data suppliers and will keep you

appraised of developments. Please post your feedback or questions at Chart Forum: Trading Diary Feedback or contact members support. |

Trading Diary

February 26, 2004

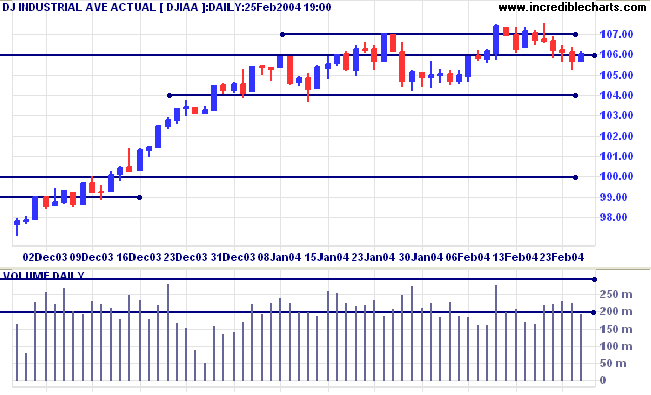

The intermediate trend is uncertain. A fall below support at 10400 would be bearish.

The primary trend is up. Resistance is at 11300 to 11350. A fall below support at 9600 would indicate the start of a down-trend.

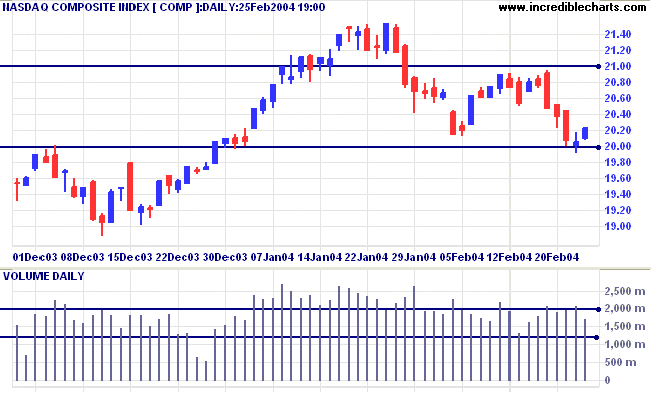

The intermediate trend is down. Narrow consolidation above the 2000 support level would be a bearish sign.

The primary trend is up. A fall below support at 1640 would signal reversal.

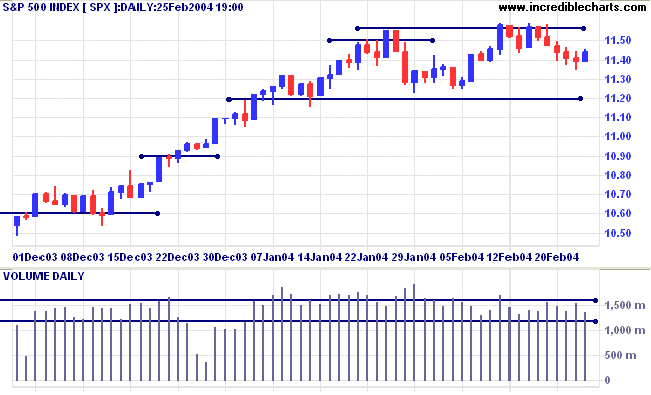

The intermediate trend is uncertain. A rise above 1155 would be bullish. A fall below support at 1120 would signal a down-trend.

The primary trend is up. Expect strong support at 1000. A fall below 960 would signal reversal.

New York (Feb 26 00:47). Spot gold is down at $397.10.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

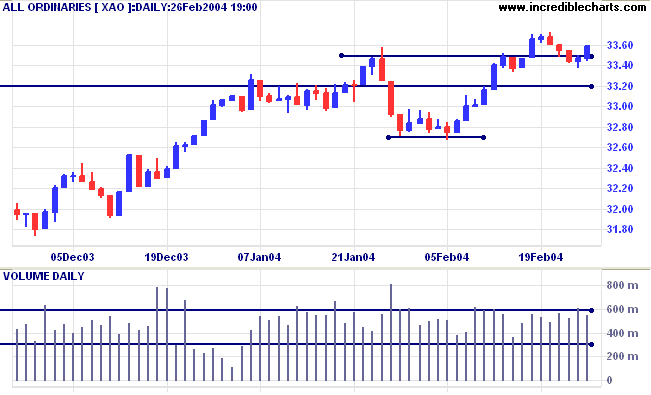

The primary trend is up. Support is at 3160.

Shakeout bars generally occur at the bottom of a down-trend and exhibit two features: a wide range and large volume. To screen for the presence of a strong-down trend, we can use a Moving Average Crossover or Directional Movement filter.

- Moving Average Crossover: 10-day and 50-day moving averages; bear signal within the last 9999 days.

-

Sort the Return page according to the

length of time that the fast MA has been above the slow

MA:

click on the heading MA (10,50) and ignore all readings below 20 or 30 days when sorted.

-

Volatility Schwager: VR > 2.0 within the

last 2 days.

This will return stocks where the true range is more than twice the 14-day average, in one of the last 2 days.

- Volume Spikes: Volume exceeds the 50-day Volume MA by 2 times within the last 2 days.

I refer to narrow range bars with high volume as "compressed springs". They signal high potential energy which is likely to be released on a breakout. We can screen for large volumes using the Volume Spike filter above, but there is no available screen for low volatility.

We plan to add further options to the Volatility Schwager screen to screen for low readings (e.g. VR less than 0.6) with our next revision. Likewise, we plan to add screens for low volume (e.g. Volume is less than half the 50-day Volume MA).

Another screen that can be used to identify strong trends is Bollinger Bands. The bands enclose all data within a specified number of standard deviations from a selected moving average. If we select a longer-term MA, fast-trending stocks will tend to be farthest away from the MA.

-

Bollinger Bands: 1 Standard Deviation

Enter 200 as the 100-day minimum.

If that is happening, no other reason is required.

If that is not happening, no other reason is worth considering

~ Nicolas Darvas.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.