Daily Trading Diary - Subscriptions

|

We have removed the Daily Trading Diary from the

subscription page until the new format is

resolved. |

Trading Diary

February 23, 2004

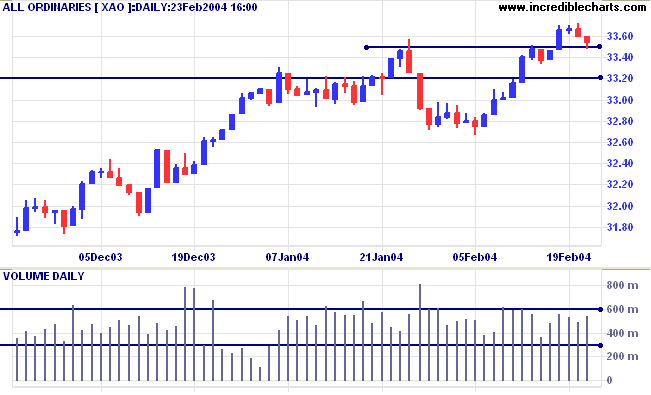

The primary trend is up. Resistance is at the 2001/2002 highs of 3425 and 3440. Support is at 3160.

I have received several requests for an explanation of how to screen for Stage 1 breakouts.

Just to ensure that everyone knows what a Stage 1 breakout is, here is an excerpt from About the Trading Diary:

|

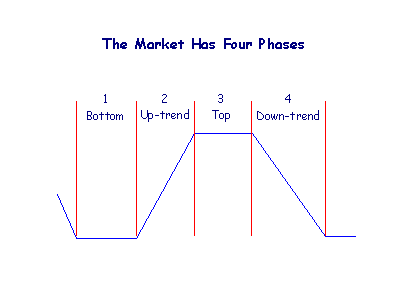

Market Stages

Sometimes the market will form a chart pattern, such as a descending or ascending triangle, in place of a rectangular trading range at a top or bottom. And fairly often the market forms a mid-point consolidation, easily mistaken for a Stage 3 Top, at roughly half-way through Stage 2. |

- price has moved sideways for an extended time period;

- moving averages whipsaw as price is ranging;

- volatility and volume decline;

- Directional Movement is low;

- Price will make a new 3-month or 6-month high at the breakout.

- The most important screen will be the % Of Price High: insert 100 as the 3-month or 6-month minimum.

-

First we eliminate all dormant or illiquid

stocks by adding a Volume Filter:

20-day Volume MA; minimum value 1000 (or 10000 depending on what stocks you wish to trade). - You could select an index such as the All Ordinaries or ASX 300 instead of the Volume Filter.

-

Next, eliminate stocks already in strong

trending moves:

enter 20 as the Maximum % Move for 3, 6 and 12 months.

An alternative is to screen for Directional Movement - I will cover that tomorrow.

Those who don't know, and those who don't know they don't know.

~ John Kenneth Galbraith.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.