|

We have consolidated the two daily updates

into one afternoon edition. This will be dated at the time

of issue (not the date of the market close, which succeeded

in confusing many readers). We are experimenting with more in-depth coverage but of fewer stocks. Readers appear to be split down the middle on this: some want more stock coverage while others want more in-depth coverage. Considering recent changes to Financial Services regulations, I have opted for the latter course to avoid analysis being mistaken for financial advice. |

Trading Diary

February 20, 2004

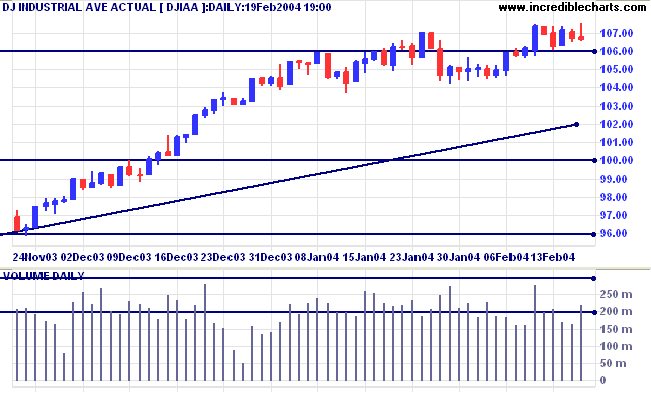

The intermediate trend is up. The index is consolidating above 10600; generally a bullish sign in an up-trend. A break above 10747 would be bullish; below 10600, bearish.

The primary trend is up. Resistance is at 11300 to 11350. A fall below support at 9600 would signal the start of a down-trend.

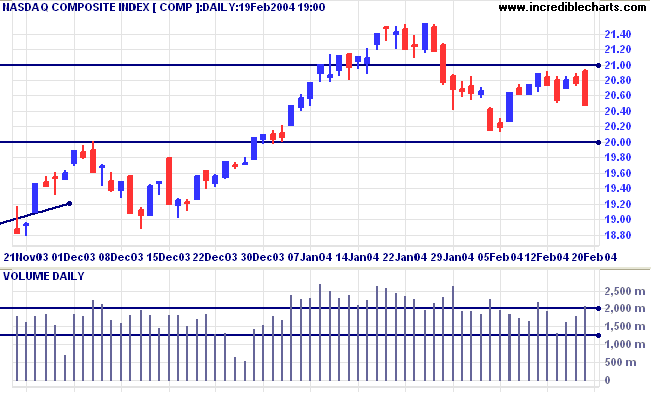

The intermediate trend is down. Initial support is at 2000.

The primary trend is up. A fall below support at 1640 would signal reversal.

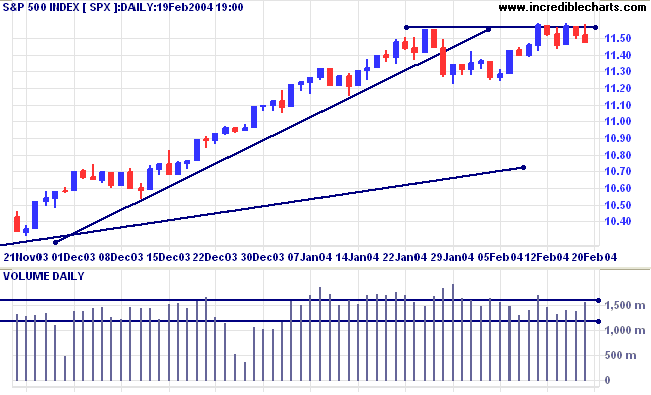

A rise above 1159 would be bullish.

The intermediate trend is up. A fall below the January 29 low of 1122 would be bearish.

The primary trend is up. Expect strong support at 1000. A fall below 960 would signal reversal.

New York (03.06): Spot gold eased to $407.60.

The intermediate trend is up. Support is at 400.

The primary trend is up. A fall below $370 would signal reversal.

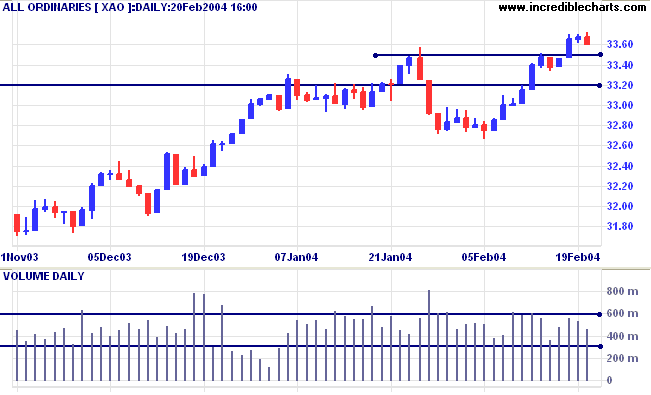

For the fast up-trend to continue, the index must respect support at 3350. A follow-through above the high of 3372 will be a bull signal. A fall below Monday's low of 3333 would be bearish.

The primary trend is up. Resistance is at the 2001/2002 highs of 3425 and 3440. Support is at 3160.

"Before entering a trade -

1. Know your entry

2. Know your risk

3. Know your exit

4. Know you will stick to them" - from Adam (opm) on the Chart Forum.

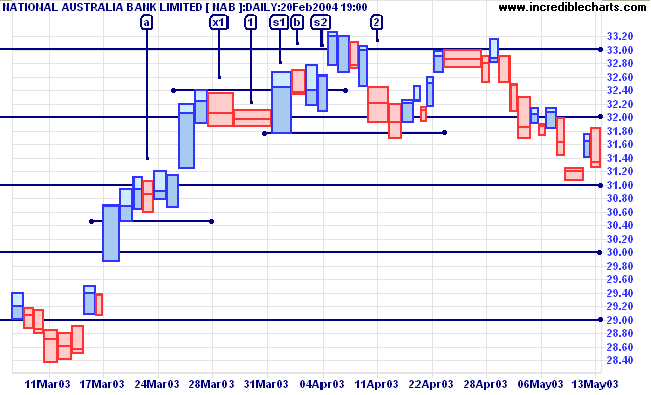

The target for the NAB pattern is around 33.00: 31.00 + (31.00 - 29.00).

Assuming an average entry price of 31.00 and a stop loss at 30.40, your potential loss is roughly 2%. Add brokerage and slippage and you are likely to face a total risk of 2.5% to 3.0%.

Projected return is 6.5%: (33.00 / 31.00 - 1 )* 100%; giving a risk-reward ratio of between 2.6 and 2.1.

High brokerage costs lower your risk-reward ratio and reduce your safety margin.

Another strategy worth considering is to continue holding through consolidations/ retracements, provided the fast up-trend continues. A fast up-trend has no overlap between short-term troughs and preceding peaks; so the position will be exited at the first bar [b] to break below support (32.40) from a previous high.

Adjusting stops to lock in profits is a tricky business, increasing the risk of being taken out too early in the trend. Adjust stops up to below the low of subsequent retracements: [s1] and [s2]. Retracements should be at least 2 days duration, unless in a blow-off spike. Do not adjust the stop until price has rallied above resistance from the previous short-term high: above 32.40 in the case of [s1].

Stop [s2] is activated on day [2] when price falls below 32.00.

~ Alexis de Tocqueville in his 1830s treatise: Democracy in America.

| We will be revising the Stock Screens over the next few weeks. Many readers have already offered suggestions for improvements, but if you have any further requests, please email Support, with Stock Screen Suggestions in the subject line. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.