|

We have consolidated the two daily updates

into one afternoon edition. This will be dated at the time

of issue (not the date of the market close, which succeeded

in confusing many readers). We are experimenting with more in-depth coverage but of fewer stocks. Readers appear to be split down the middle on this: some want more stock coverage while others want more in-depth coverage. Considering recent changes to Financial Services regulations, I have opted for the latter course to avoid future analysis being mistaken for financial advice. Please give us your feedback at the Chart Forum: Trading Diary Feedback. |

Trading Diary

February 18, 2004

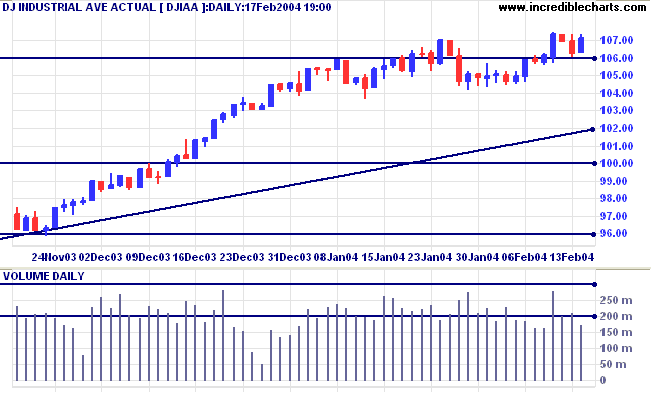

The intermediate trend is up. A rise above 10747 would be bullish. A fall below 10600, bearish.

The primary trend is up. Resistance is at 11300 to 11350. A fall below support at 9600 would indicate the start of a down-trend.

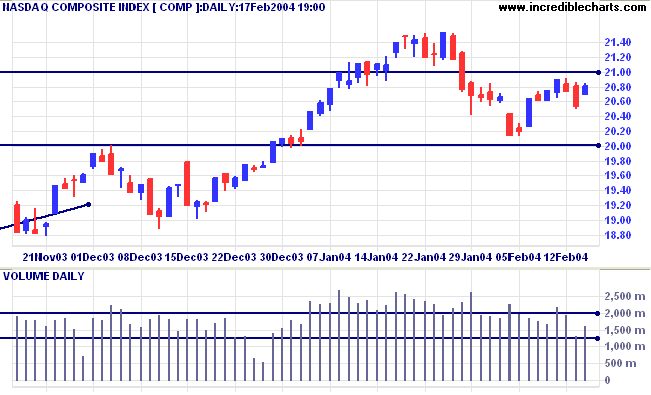

The intermediate trend is down. Support is at 2000.

The primary trend is up. A fall below support at 1640 would signal reversal.

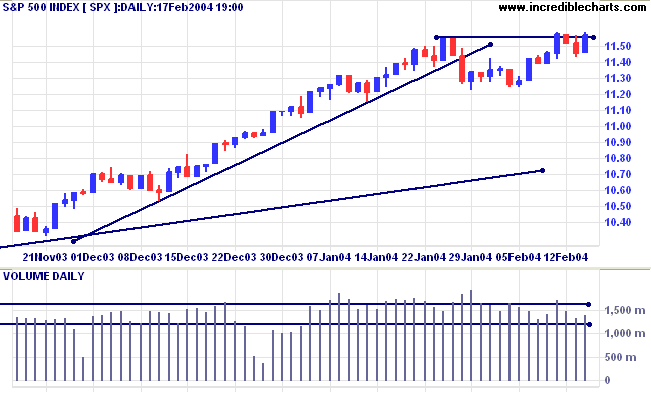

The intermediate trend is up. A rise above 1159 would be bullish. Below Friday's low of 1143, bearish.

The primary trend is up. Expect strong support at 1000. A fall below 960 would signal reversal.

The ABC News consumer confidence poll falls 7 points in a single week. (more)

The yield on 10-year treasury notes is consolidating at 4.05%, a bearish sign in an intermediate down-trend.

The primary trend is up. A close below the September low of 3.93% would signal reversal.

New York: Spot gold has rallied to $415.90 (02:51 a.m.).

The intermediate trend has turned up.

The primary trend is up. A fall below $370 would signal reversal.

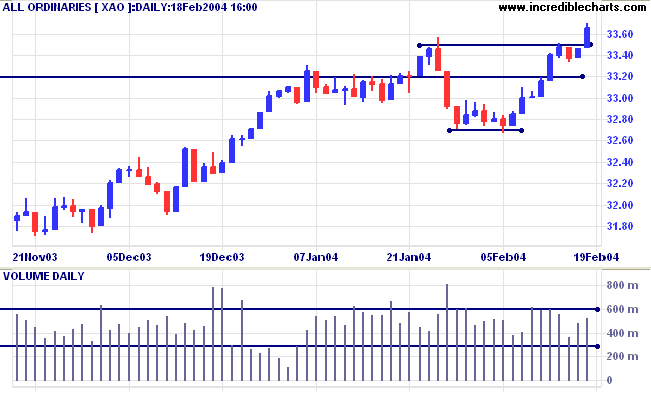

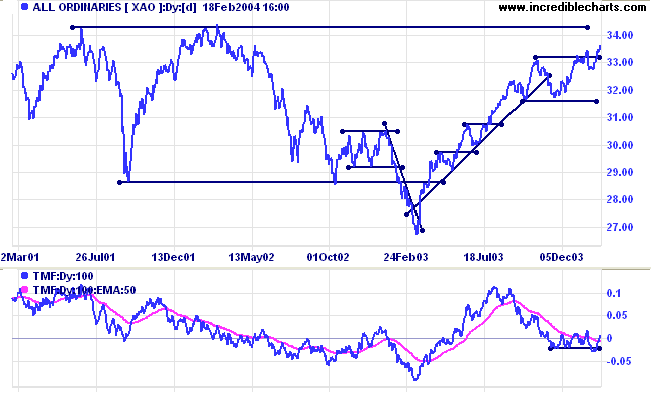

Support is at 3160.

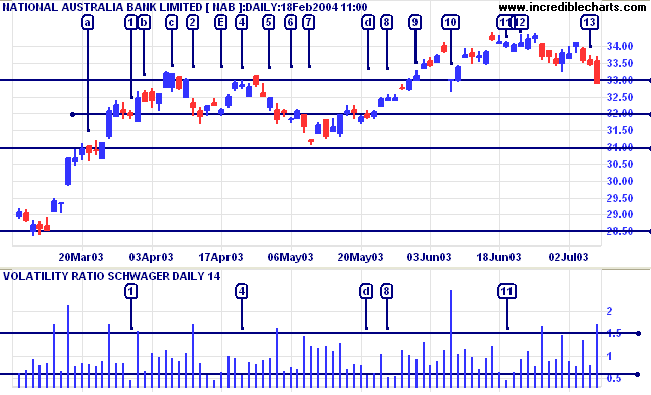

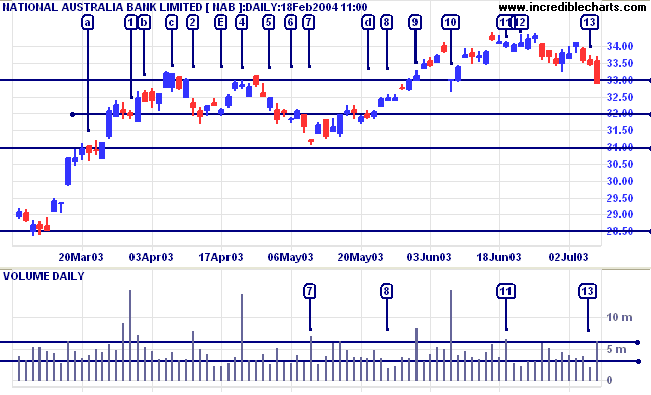

All too often our attention is captured by wide-ranging days with big volume, normally indicating either a strong trend or a reversal, depending on the position of the open and close. Reversal days are covered in a fair amount of depth in the Trading Guide but the most important signals can often be found in insignificant-looking bars: narrow range days.

How do we identify narrow range days? Jack Schwager introduces a simple Volatility Ratio in his book Schwager on Futures. It compares each day's true range to the 14-day moving average (of true range). High readings are wide-ranging days and low readings indicate days with a narrow range. I find this a very useful tool and often include it in my Stock Screens.

| Before you use an indicator, study it carefully. Examine the construction and make sure that you understand the reasoning. Never use an indicator without testing it extensively on historical data. There are a number of programs that offer automated back-testing but I am more comfortable working manually through historical charts. Most historical data is not adjusted for dividends, for example; so some automated results may be misleading. |

Compare these narrow days to the volume chart. Narrow days with strong volume are the same as over-square bars on the equivolume chart, signaling resistance.

[1] displays really big volume and acts like a compressed spring. The next day has a wide range when the spring is released.

[4] shows similar volume, signaling resistance. There is a false break above resistance at 33.00 two days later, followed by a strong downward move.

[8] on the other hand, has low volume; a bullish sign during a consolidation in an up-trend.

[11] is not followed by a wide-ranging day but signals a change in the underlying forces. The subsequent attempt to take out the high fails on low volume, commencing a strong down-trend.

More on narrow ranging days tomorrow: How to combine them with Relative Strength and Twiggs Money Flow.

it is dearness only that gives everything its value.

~ Thomas Paine.

| We will be revising the Stock Screens over the next few weeks. Many readers have already offered suggestions for improvements, but if you have any further requests, please email Support, with Stock Screen Suggestions in the subject line. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.