|

Thank you for the excellent response so

far. If you have not yet completed the survey, please assist us by replying to this email and answering the questions below. Highlight answers in red or with an asterisk*.

Your feedback will be invaluable.

Thanks |

Trading Diary

February 11, 2004

USA

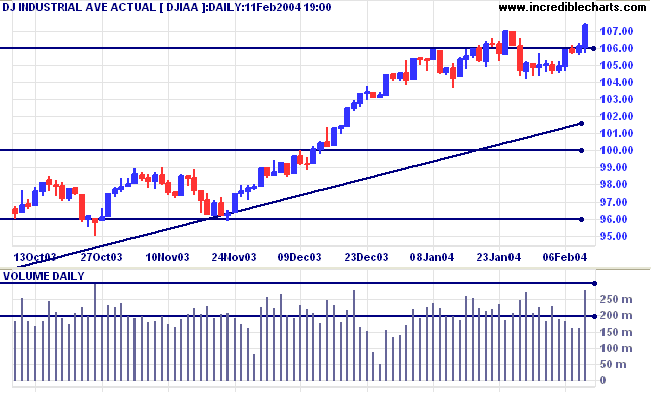

The intermediate trend is up. Overhead resistance is at 11300 to 11350.

The primary trend is up. A fall below support at 9600 would signal reversal.

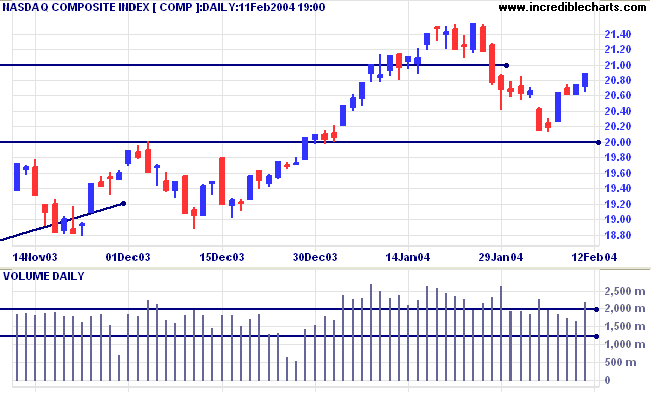

The intermediate trend is uncertain after the upward break. Resistance is at 2153; support at 2000.

The primary trend is up. A fall below support at 1640 will signal reversal.

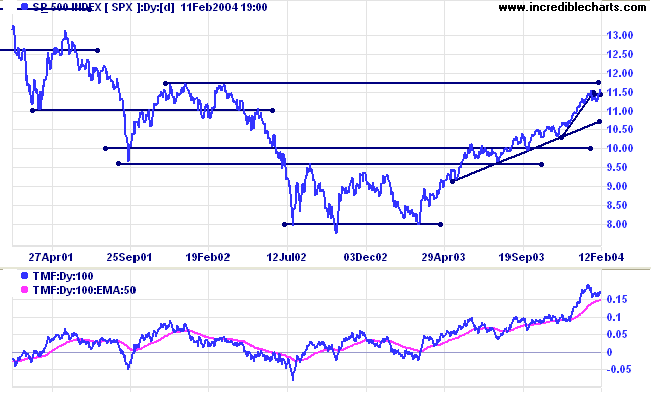

The intermediate trend is up, but overhead resistance is close by at 1175.

Short-term: Bullish if the S&P500 is above 1150. Bearish below the recent low of 1122.

Intermediate: Bullish above 1122.

Long-term: Bullish above 1000.

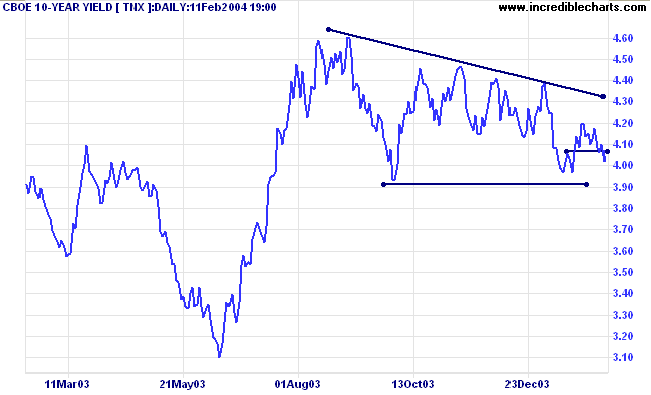

Following the Fed Chairman's comments, the yield on 10-year treasury notes fell to 4.02%, continuing the intermediate down-trend.

The primary trend is up. A close below 3.93% would signal reversal.

New York (21.11): Spot gold is up at $411.70.

The intermediate trend is still down. Support is at 400.

The primary trend is up.

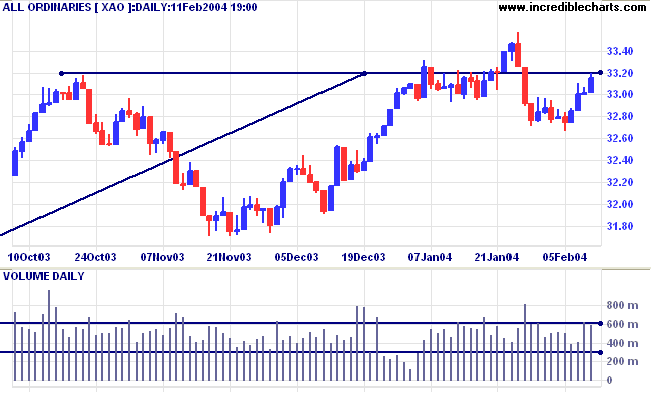

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

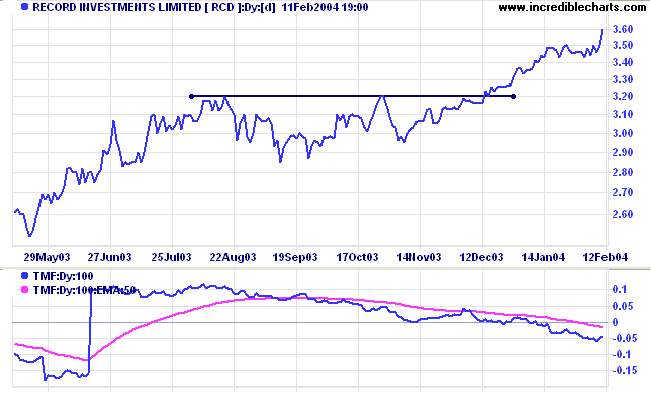

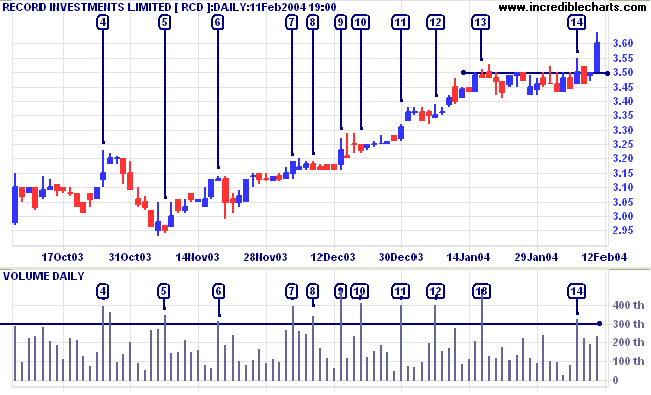

One of our readers pointed this out: RCD has rallied above a mid-point consolidation but Twiggs Money Flow continues to fall, displaying a strong bearish divergence.

Anyone who keeps learning stays young.

The greatest thing in life is to keep your mind young.

~ Henry Ford.

We will appreciate your honesty in highlighting areas that require attention.

Thanks

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.