|

Some members have reported that earlier versions of

Internet Explorer interfere with the Live Update. If you

experience a timeout error during the Live Update, update

to Internet Explorer 6 at

Microsoft Download. There are further Internet Explorer issues that Microsoft will address in their next update. (more) |

Trading Diary

February 6, 2004

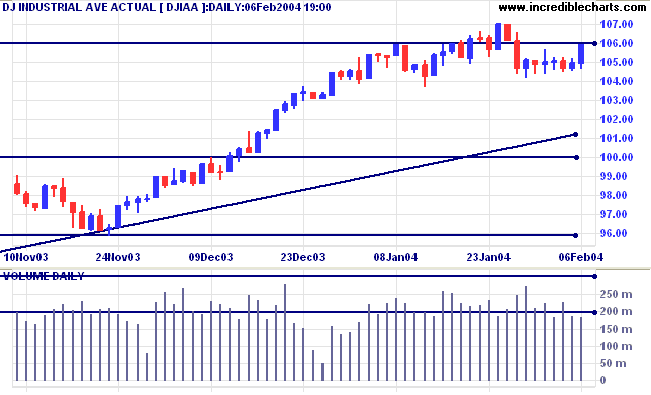

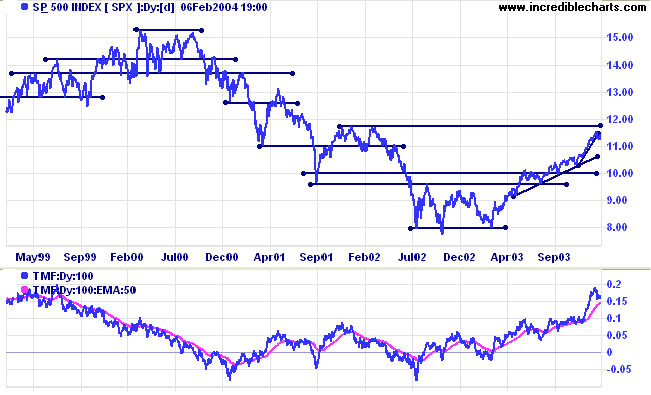

The primary trend is up. Resistance is at 10600 and 11300 to 11350. A fall below support at 9600 would signal reversal.

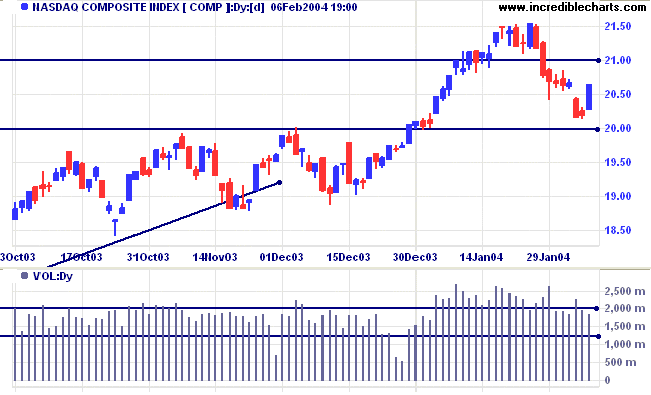

The intermediate trend is down. Initial support is at 2000, resistance at 2100, 2150 and 2300 (May 2001).

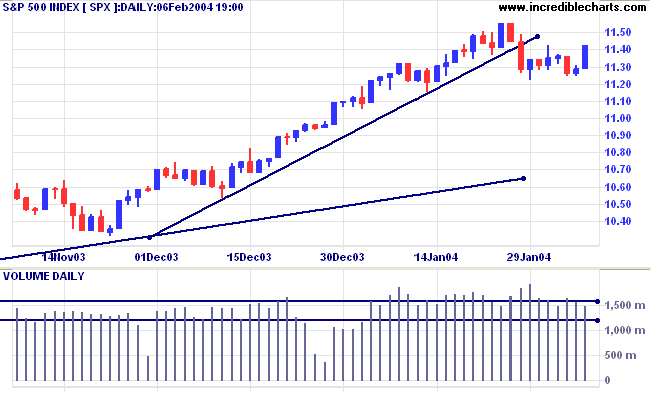

The primary trend is up. A fall below support at 1640 would signal reversal.

The intermediate trend is uncertain, with resistance overhead at 1155 and 1175.

Short-term: Bullish if the S&P500 is above 1155. Bearish below 1122, last Thursday's low.

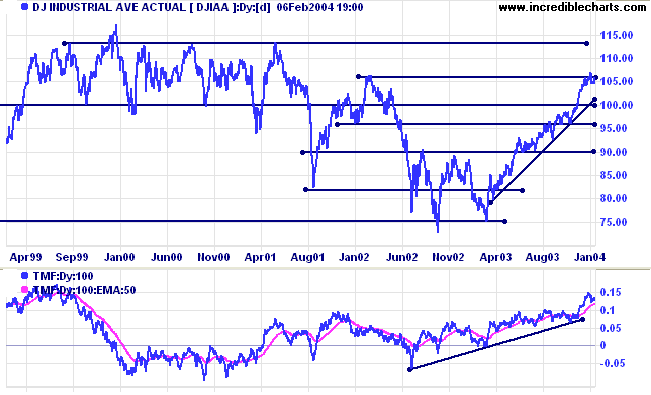

Twiggs Money Flow (100) may have turned down but continues to signal accumulation.

Intermediate: Bullish above 1155.

Long-term: Bullish above 1000.

More than 80% of NYSE stocks are in an up-trend, the highest level in 10 years.

Non-farm payrolls grew by 112,000 in January, while unemployment fell to 5.6%, the lowest level in 2 years. (more)

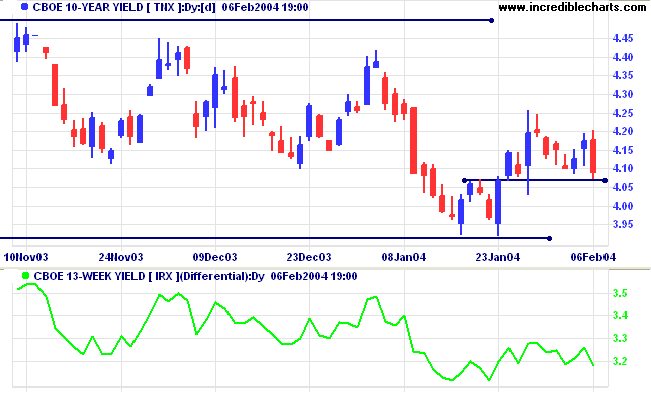

The yield on 10-year treasury notes retreated to 4.089%, signaling weakness in the intermediate up- trend.

The primary trend is up. A close below the September low of 3.93% would signal reversal.

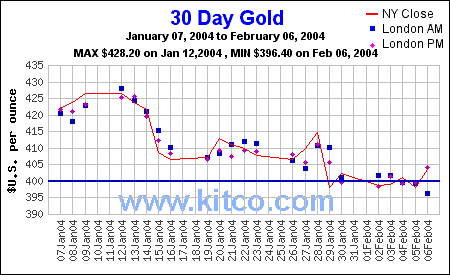

New York (13.00): Spot gold rallied to $403.20, after testing support at 400.

The intermediate trend is down.

The primary trend is up. A fall below $370 would signal reversal.

Subscribe to Incredible Charts Premium

Charting service with:

|

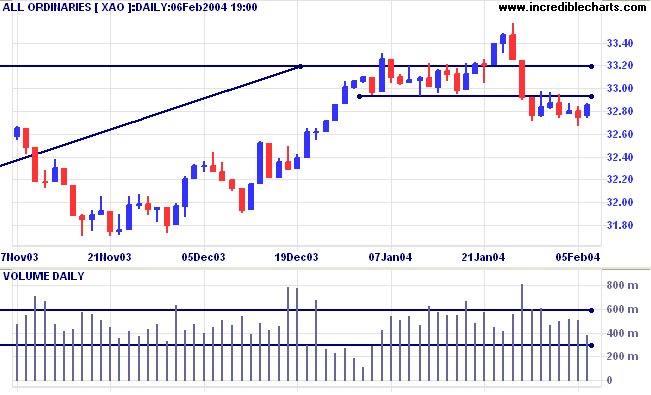

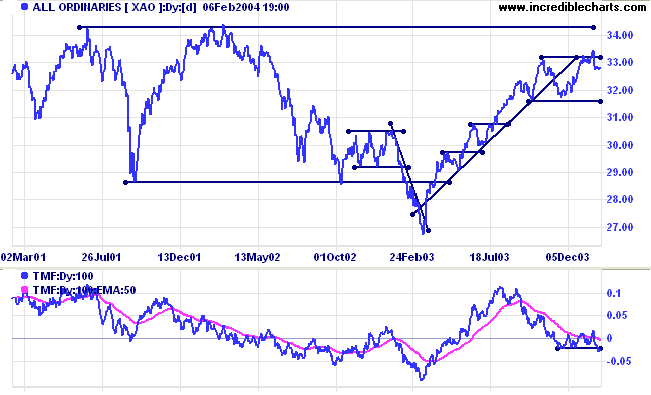

Short-term: Bullish above 3350. Bearish below 3266.

Twiggs Money Flow (100) has broken below its 3-month support level, another bearish sign.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

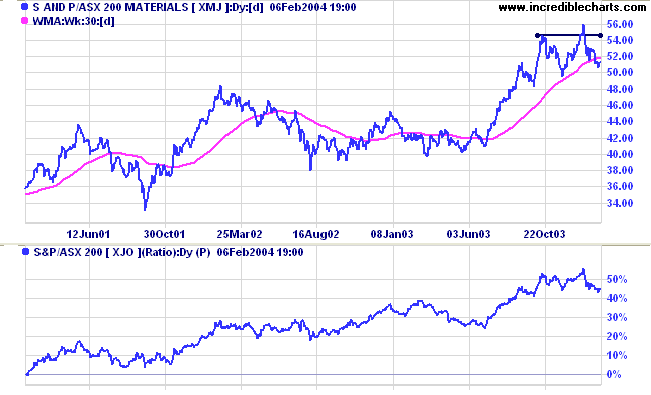

The 11 sectors (10 + Property) are in various market stages. Relative Strength (xjo) measures the performance of each sector relative to the overall index.

- Energy [XEJ] - stage 2 (RS is rising)

- Materials [XMJ] - stage 2 (RS is falling)

- Industrials [XNJ] - stage 2 (RS is rising)

- Consumer Discretionary [XDJ] - stage 3 (RS is falling)

- Consumer Staples [XSJ] - stage 3 (RS is level)

- Health Care [XHJ] - stage 1 (RS is rising)

- Property Trusts [XPJ] - stage 3 (RS is level).

- Financial excl. Property [XXJ] - stage 3 (RS is level)

- Information Technology [XIJ] - stage 2 (RS is falling)

- Telecom Services [XTJ] - stage 2 (RS is level)

- Utilities [XUJ] - stage 2 (RS is level)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) fell to 21 stocks, from 50 two weeks ago. The highest reading was 131 on April 11, 2003 and the lowest, 8 on March 14, 2003. Prominent sectors are:

- Casinos & Gaming (3)

that we don't take the time to enjoy where we are.

Days go by and we hardly notice them. Life becomes a blur.

Often, it takes some calamity to make us live in the present.

Then suddenly we wake up and see all the mistakes we've made.

But it's too late to change anything.

~ Calvin & Hobbes.

|

Subscribe as a Premium Member and receive:

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.