| Some members have reported that earlier versions of Internet Explorer interfere with the Live Update. If you experience a timeout error during the Live Update, update to Internet Explorer 6 at Microsoft Download. |

Trading Diary

January 26, 2004

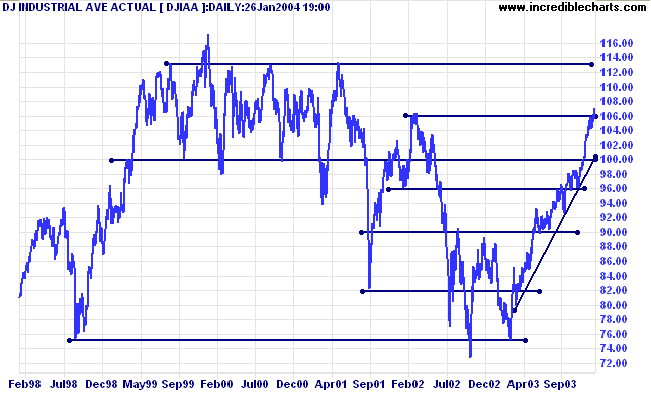

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 9600 would signal reversal.

The intermediate trend is up. Momentum is increasing, with little or no overlap between troughs and previous peaks.

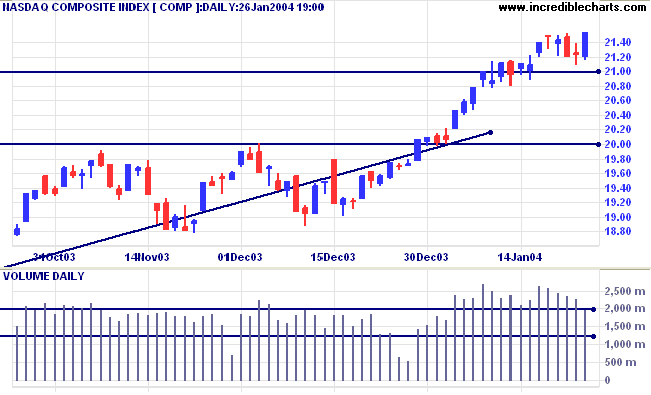

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 1640 would signal reversal.

The intermediate trend is up, with resistance overhead at 1175.

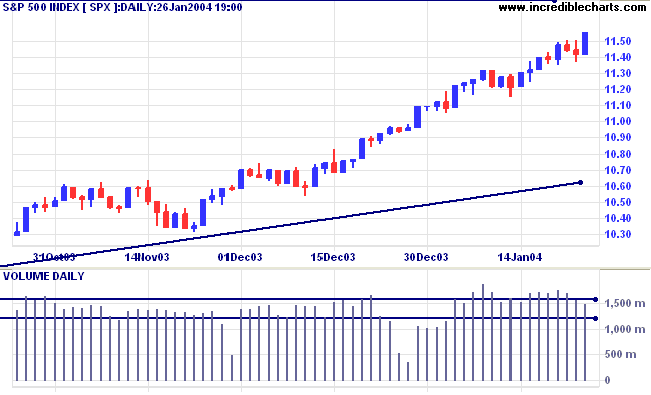

Short-term: Bullish if the S&P500 is above 1150.

Intermediate: Bullish above 1136 (from January 23).

Long-term: Bullish above 1000.

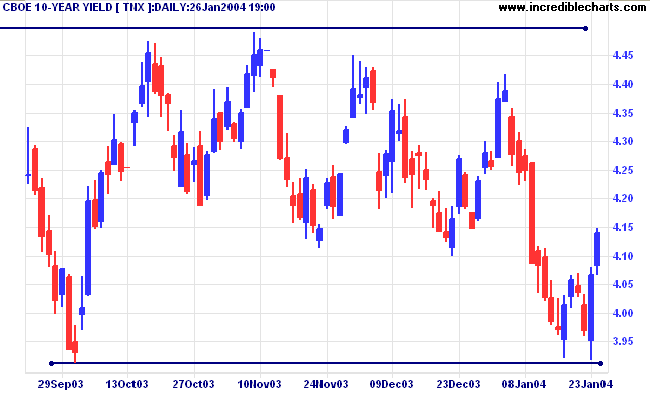

The Federal Reserve Board is expected to leave rates unchanged at this week's meeting. (more)

The yield on 10-year treasury notes followed through to close at 4.14%, completing a double bottom reversal. A re-test of resistance at 4.4% to 4.5% is likely.

The primary trend is up. A close below the September low of 3.93% would signal a reversal.

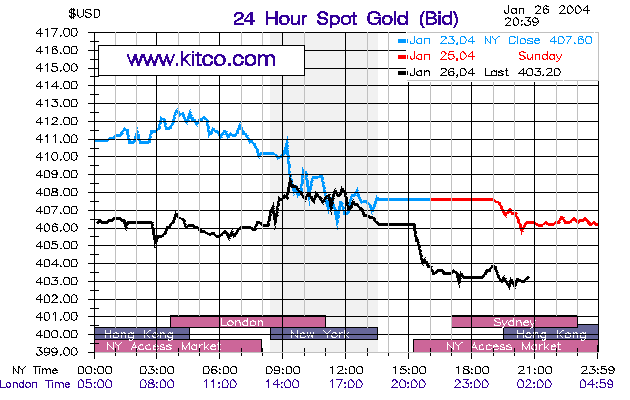

New York (20.39): Spot gold fell to $403.20.

The intermediate trend has reversed downwards and is likely to test support at 400.

The primary trend is up.

than those using no data at all.

~ Charles Babbage, English mathematician (1792 - 1871).

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the links

at

the

Suggestion box.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.