|

Trading Diary

January 19, 2004

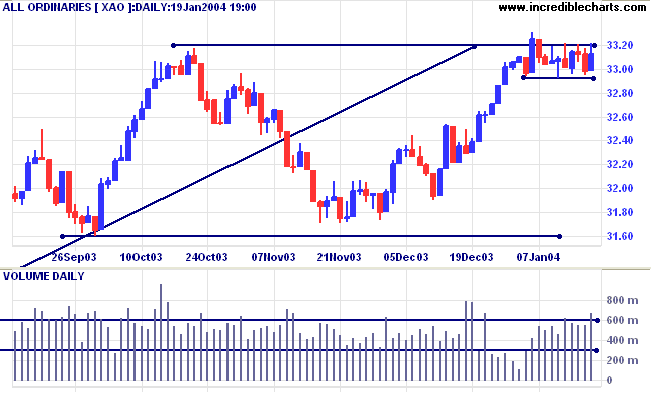

Short-term: Bullish above 3320. Bearish below 3293.

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

Last covered October 20, 2003.

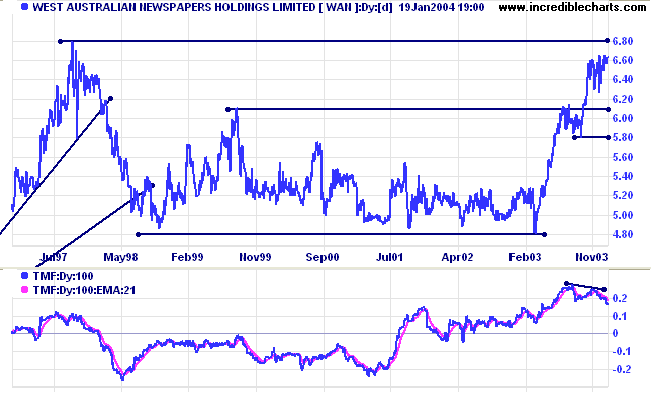

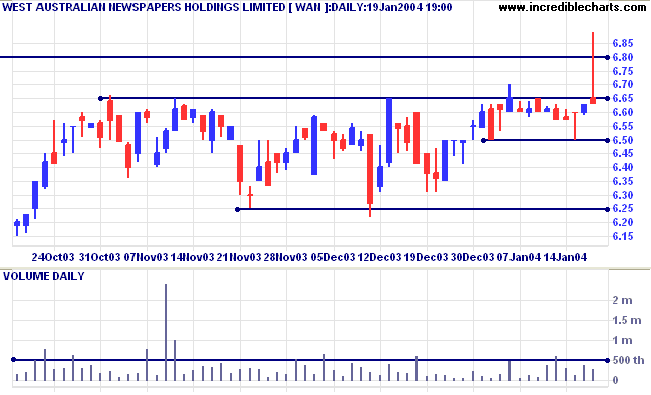

WAN is in a fast up-trend, consolidating twice without correcting back to test support at the previous peaks. The stock is now approaching the target of 6.80; the 10-year high. Twiggs Money flow (100) displays a bearish divergence, signaling potential weakness.

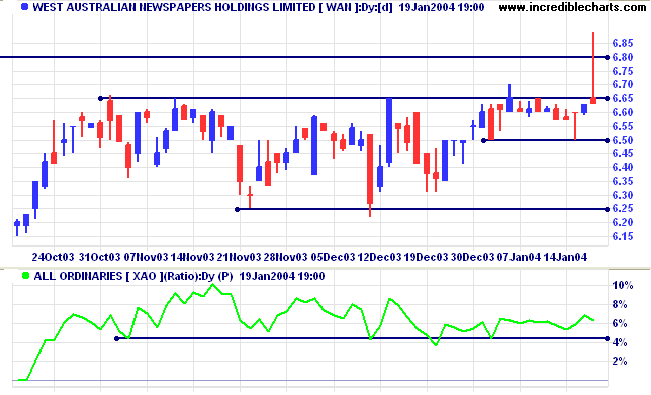

Relative Strength (price ratio: xao) is still above its support level.

Resistance is at 6.65 and 6.80. At present, 6.80 appears to be the stronger barrier.

"Well, everybody got a plan until they get hit."

~ Evander Holyfield

(talking about trading on margin ... of course).

We would like to add more 5-star posts to

the

Incredible Posts thread.

If you have any suggestions, please post the

links at

the

Suggestion box.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.