Stock Screen returns have a time stamp in the heading, showing the latest update.

Trading Diary

January 15, 2004

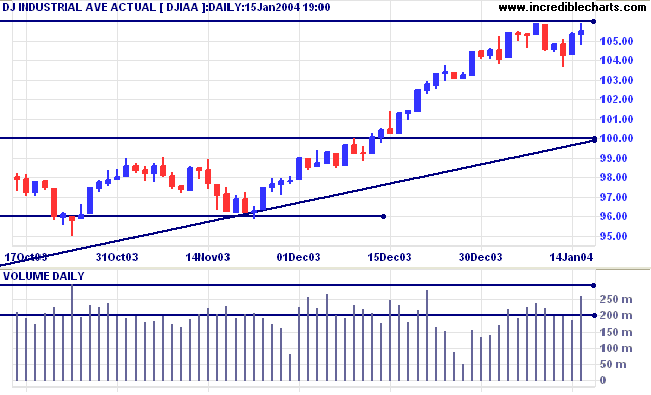

The intermediate trend is up. Consolidation in a narrow range below major resistance is a bullish sign (during an up-trend). A fall below 10367 would be bearish, signaling a re-test of support levels.

The primary trend is up. A fall below support at 9600 will signal reversal.

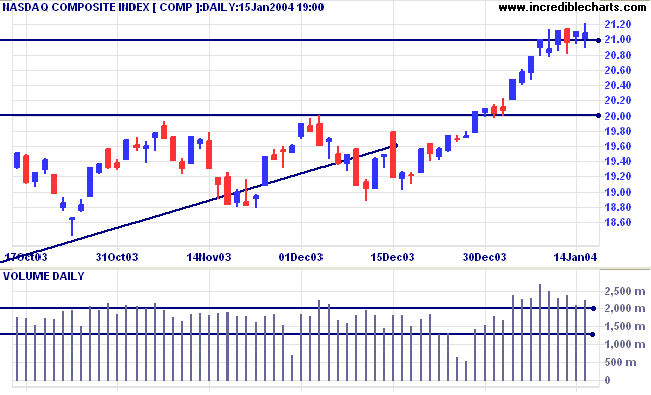

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

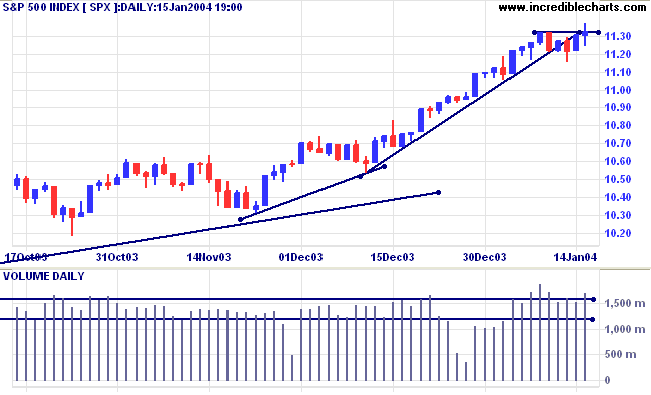

The intermediate trend is up. The next resistance level is at 1175. A fall below 1115 (Tuesday's low) would be bearish.

Short-term: Bullish if the S&P500 is above the high of 1132 (last Thursday's high). Bearish below 1115.

Intermediate: Bullish above 1115.

Long-term: Bullish above 1000.

JP Morgan Chase agrees to buy Bank One for $58 billion. (more)

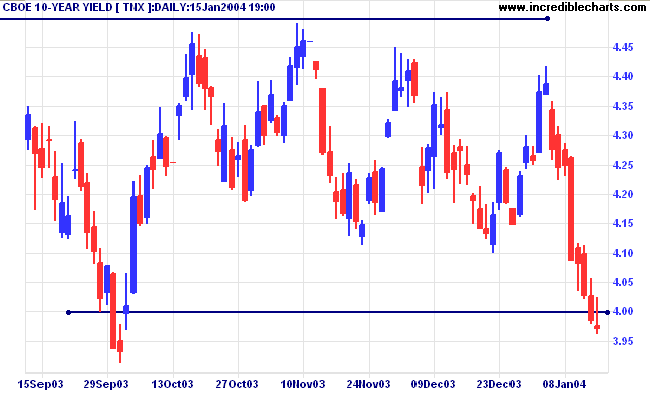

The yield on 10-year treasury notes continues to fall, closing at 3.97%, a bearish sign.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal - a bearish sign for US stocks.

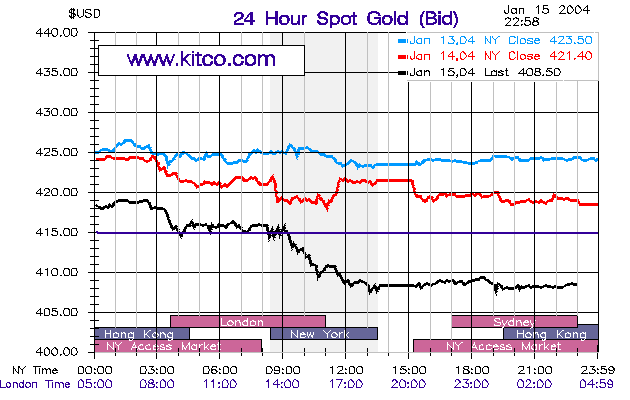

New York (16.43): Spot gold fell sharply to $408.50, below support at 415.

The intermediate trend is up. We are likely to see a test of support at 400.

The primary trend is up.

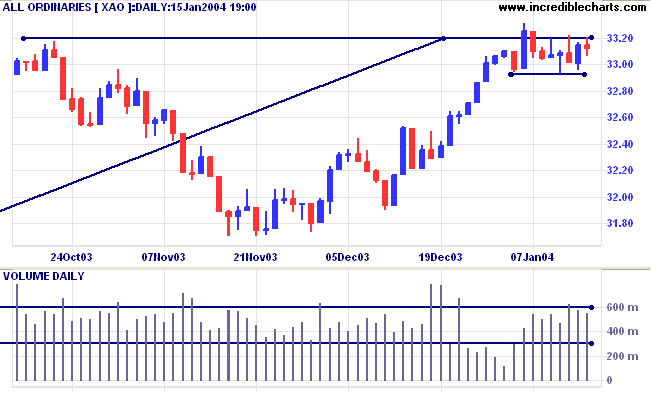

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed above.

Short-term: Bullish above 3320. Bearish below 3293.

The primary trend is up but will reverse if there is a fall below support at 3160 (Oct 1 low). Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3293.

Long-term: Bearish below 3160.

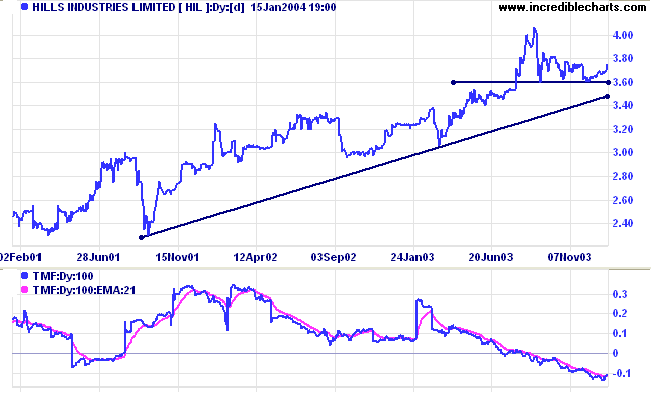

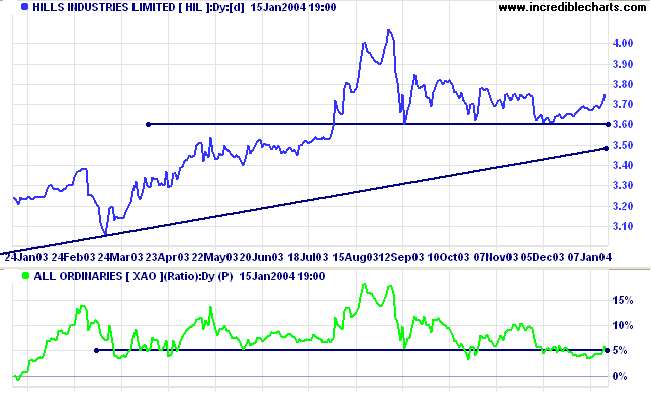

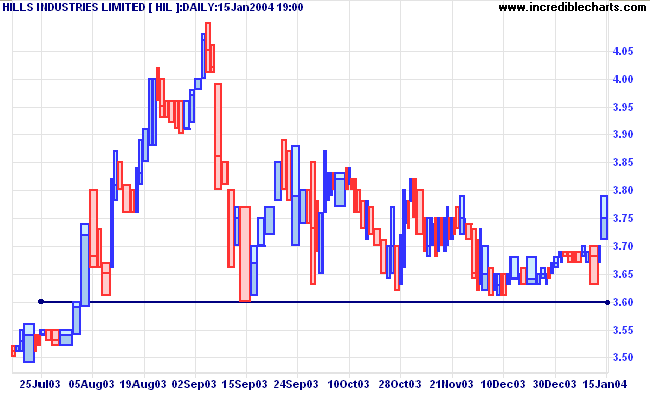

HIL has formed a consolidation pattern, roughly in the shape of a bearish descending triangle, after a lengthy up-trend. Twiggs Money Flow (100) is falling, signaling strong distribution.

"Lose" means when you don't get back up.

A "setback" means that, hey, something happened, something that you did wrong and then you're corrected.

Now you mend it back together. Now it's stronger than it was the first time,

and you know you're going through here because of the experience that you're gonna have behind you.

~ Evander Holyfield

(talking about day trading of course)

| In response to a number of requests, subscriptions for the Daily Trading Diary and Incredible Charts Premium Data will be offered separately, at $180 (AUD) each. The combined subscription remains at $270 (AUD). Some development work is required before the new subscription page will be ready, so this will not happen immediately. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.