Stock Screen returns have a time stamp in the heading, showing the latest update.

Trading Diary

January 14, 2004

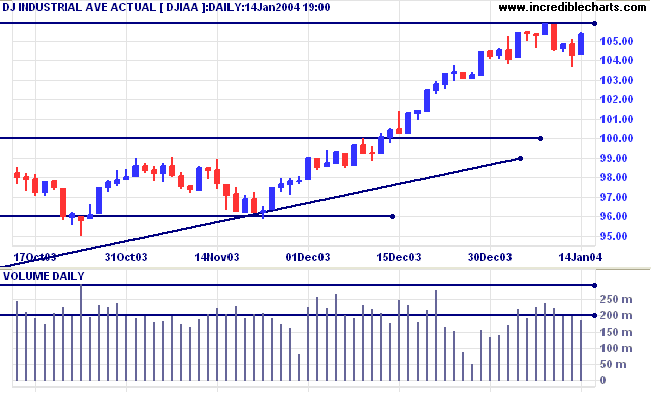

The intermediate trend is up. Consolidation in a narrow range below 10600 is a bullish sign, while a fall below 10367 would be bearish.

The primary trend is up. A fall below support at 9600 will signal reversal.

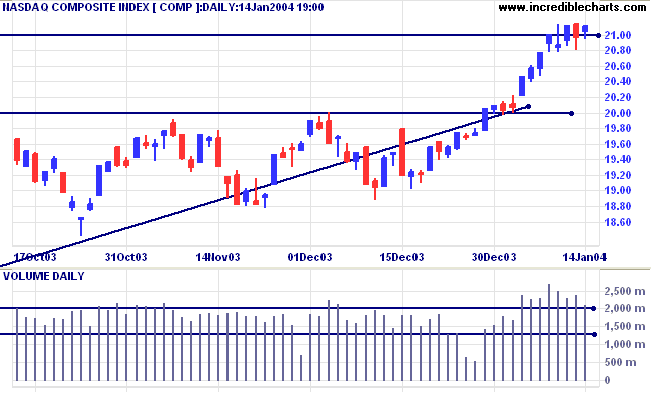

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

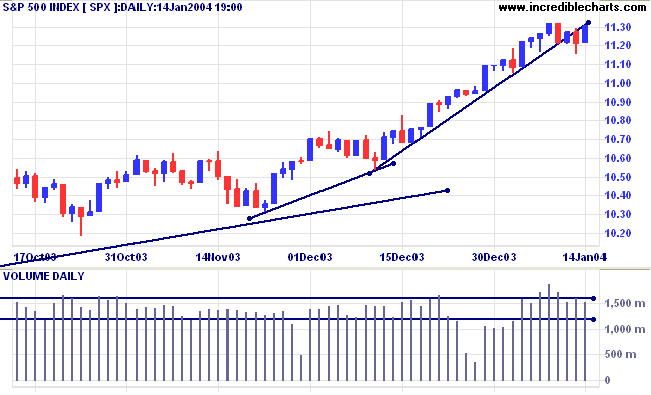

The intermediate trend is up. The next resistance level is at 1175.

Short-term: Bullish if the S&P500 is above the high of 1132 (last Thursday's high). Bearish below 1115 (Tuesday's low).

Intermediate: Bullish above 1115.

Long-term: Bullish above 1000.

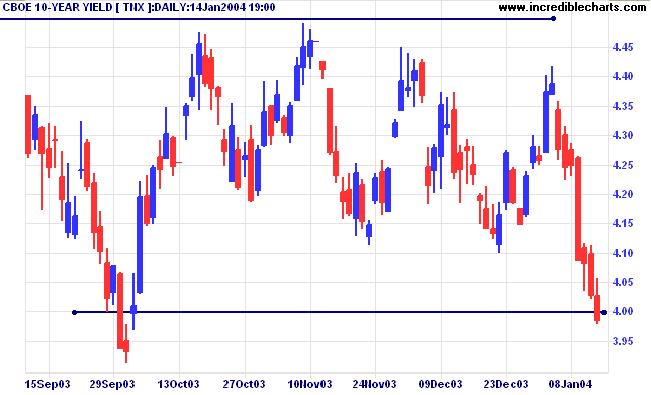

The yield on 10-year treasury notes fell to 3.986%, a bearish sign.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal - a bearish sign for stocks.

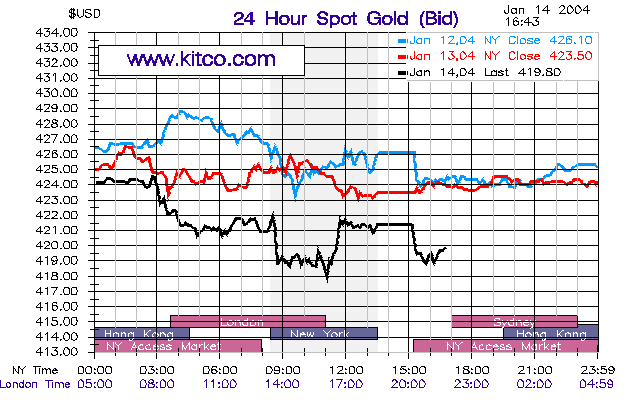

New York (16.43): Spot gold fell to $419.80.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

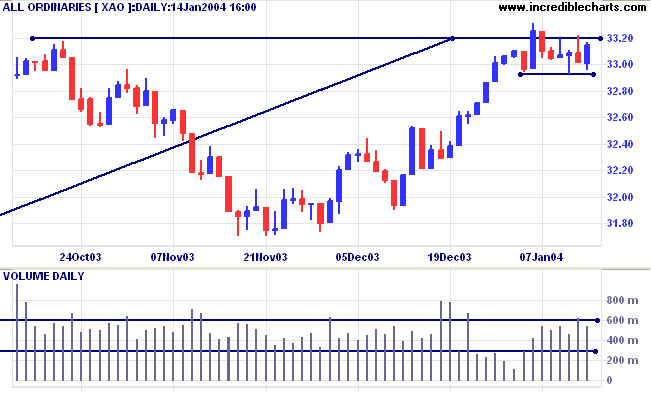

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below.

Short-term: Bullish above 3320. Bearish below 3293.

The primary trend is up but will reverse if there is a fall below support at 3160 (Oct 1 low). Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3293.

Long-term: Bearish below 3160.

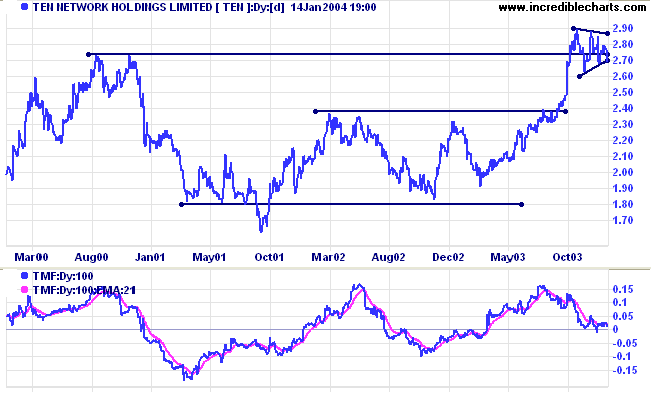

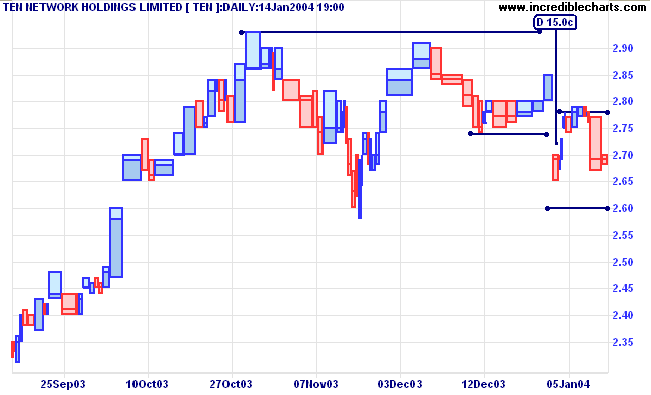

Last covered on October 13, 2003.

TEN broke through the major 2.74 resistance level after a strong rally. Since then price has consolidated in a narrow range between 2.60 and 2.90, normally a bullish sign at resistance. Twiggs Money Flow (100), however, is falling, signaling distribution.

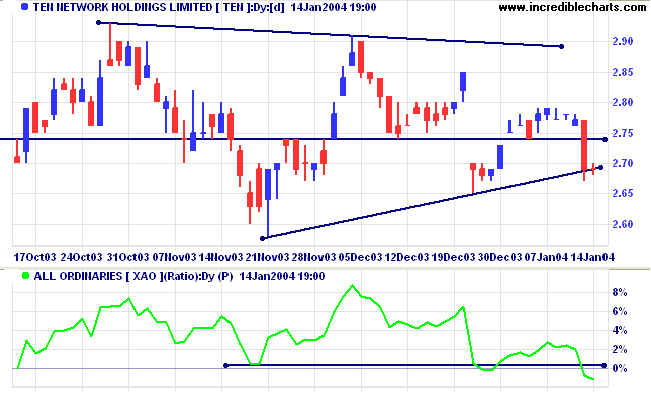

The latest bar traded within the range of Tuesday's strong downward candle, exhibiting a narrow range and low volume. A follow-through below Tuesday's low will be a bear signal.

Now when does a person become fearless? You never know! You just take one step at a time..........

It took me all them years when I used to panic to come to the point of realizing that,

as a professional fighter, when I get in the ring, I'm in control.

And once I've realized I'm in control, he can't hurt me unless I allow him to hurt me.

~ Evander Holyfield

(talking about the day trading of course)

| In response to a number of requests, subscriptions for the Daily Trading Diary and Incredible Charts Premium Data will be offered separately, at $180 (AUD) each. The combined subscription remains at $270 (AUD). Some development work is required before the new subscription page will be ready, so this will not happen immediately. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.