|

We will appreciate your feedback and suggestions on the Chart Forum.

Trading Diary

January 8, 2004

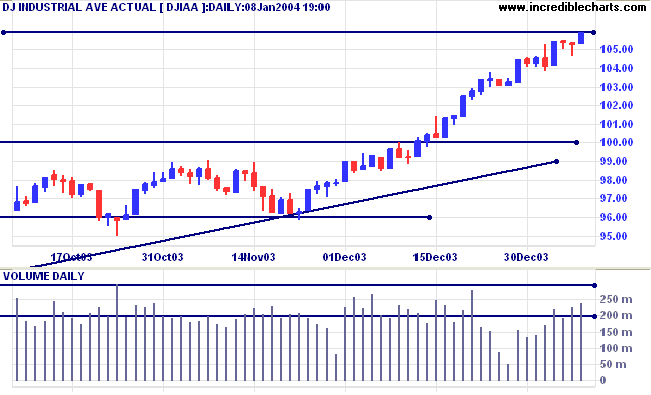

The intermediate trend is up. Resistance is at 10600 to 10673.

The primary trend is up. A fall below support at 9600 will signal reversal.

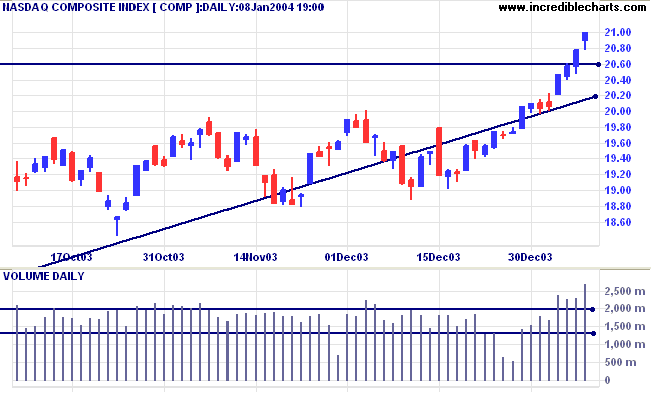

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

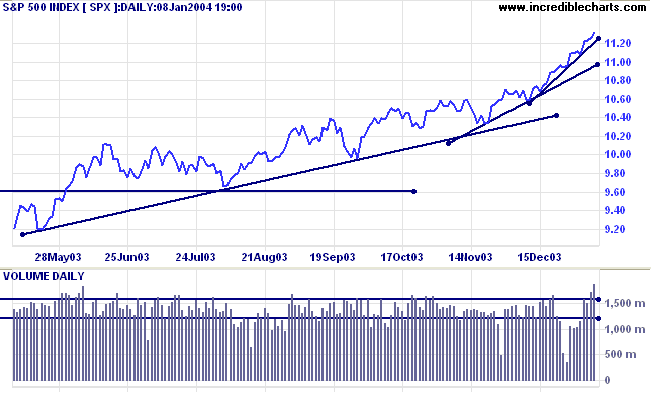

The intermediate up-trend is accelerating. A fourth, steeper trendline would signal a blow-off, with a likely correction back to the primary supporting trendline. But resistance at 1175 is likely to halt/slow the advance before this happens.

Short-term: Bullish if the S&P500 is above 1124 (last Tuesday's high). Bearish below 1124 (Today's low).

Intermediate: Bullish above 1124.

Long-term: Bullish above 960.

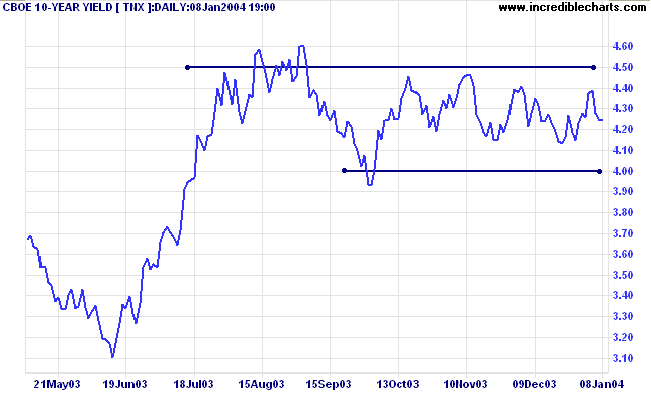

The yield on 10-year treasury notes closed almost unchanged at 4.25%.

The intermediate trend is uncertain.

The primary trend is up.

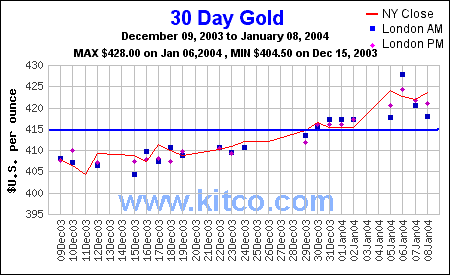

New York (22.41): Spot gold is slightly up at $422.90.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

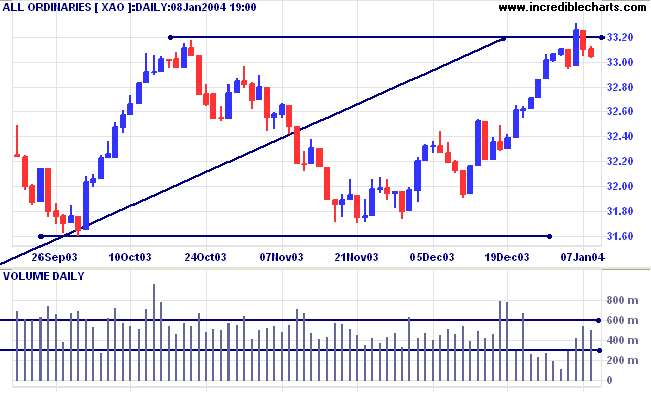

Short-term: Bullish above 3320.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

The opposite of pride is actually a lack of self esteem. A humble person is totally different

from a person who cannot recognize and appreciate himself as part of this worlds marvels.

~ Rabino Nilton Bonder

| Analysis of individual stocks will resume on Monday, January 12th. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.