|

Trading Diary

January 7, 2004

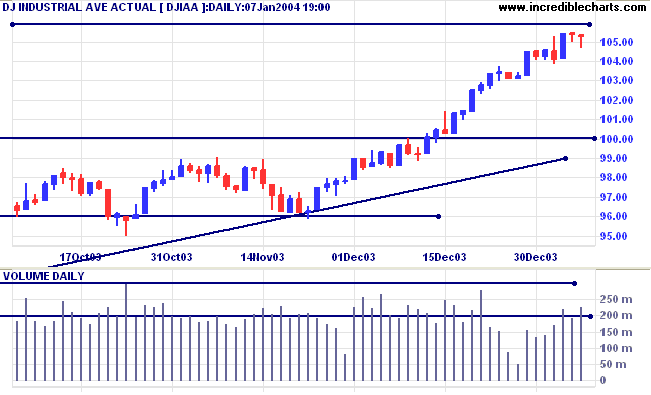

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

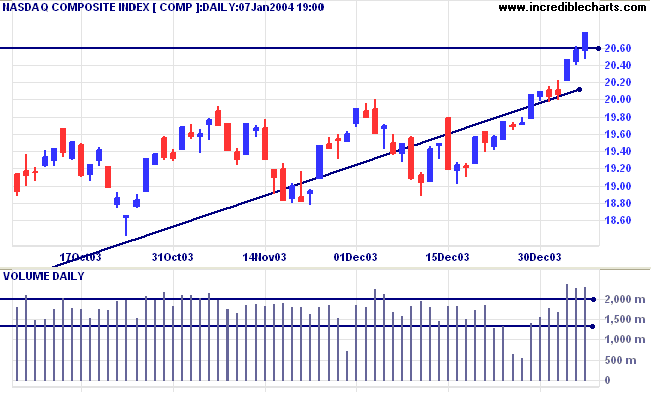

The intermediate trend is up. Resistance is at 2060 to 2100.

The primary trend is up. A fall below support at 1640 will signal reversal.

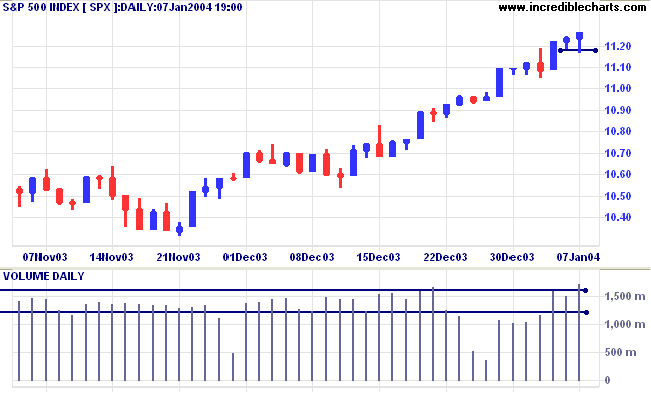

The intermediate trend is up. The next resistance level is at 1175.

Short-term: Bullish if the S&P500 is above 1124 (Tuesday's high). Bearish below 1118 (Tuesday's low).

Intermediate: Bullish above 1124.

Long-term: Bullish above 960.

Credit card delinquencies are at a record high of 4.09%. (more)

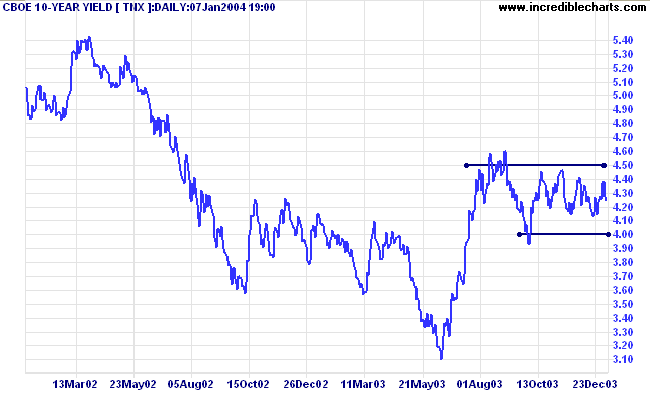

The yield on 10-year treasury notes slipped to 4.24%.

The intermediate trend is uncertain. Support is at 4.00% and resistance at 4.50%.

The primary trend is up.

New York (23.37): Spot gold is almost unchanged at $420.20.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

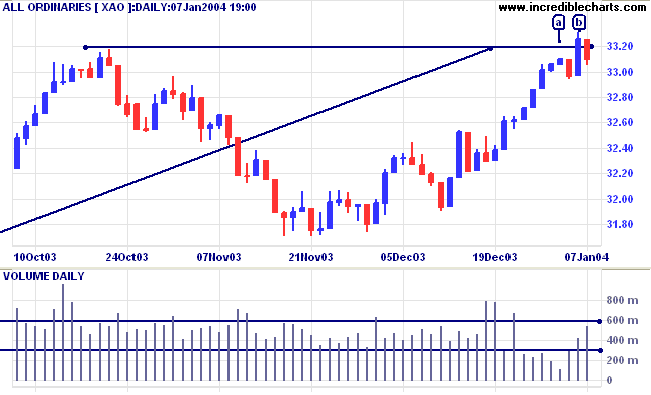

Short-term: Bullish above today's high of 3325.

Intermediate term: Bullish above 3325. Bearish below 3160.

Long-term: Bearish below 3160.

It is the highest form of self-respect

to admit mistakes and to make amends for them.

~ John (Jay) McCloy.

| Analysis of individual stocks will resume on Monday, January 12th. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.