Incredible Charts should automatically update when you connect to the server.

The new version offers adjusted end-of-day charts and stock screens

for ASX, NYSE, Nasdaq and Amex exchanges and US Indexes.

US sector allocations will be added later.

Trading Diary

January 5, 2004

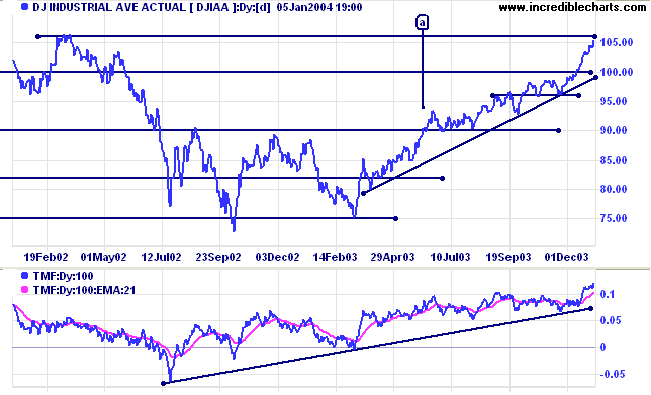

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

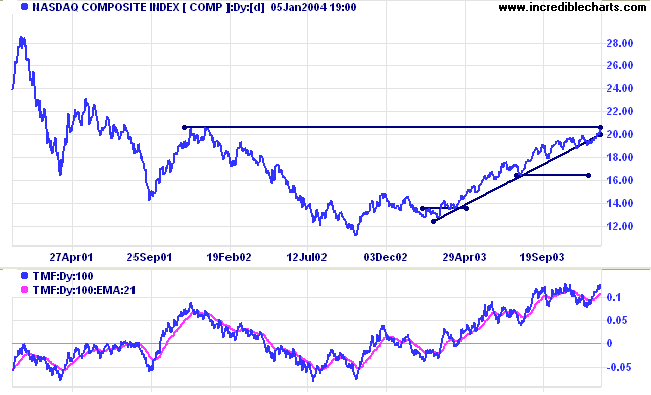

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

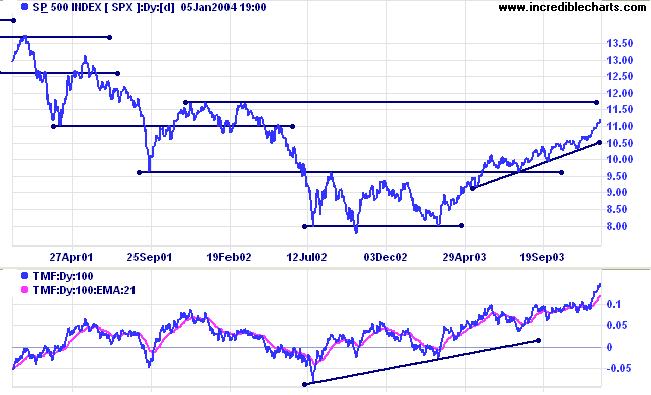

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above the high of 1109 (last Monday's high). Bearish below 1106 (Tuesday's low).

Intermediate: Bullish above 1109.

Long-term: Bullish above 960.

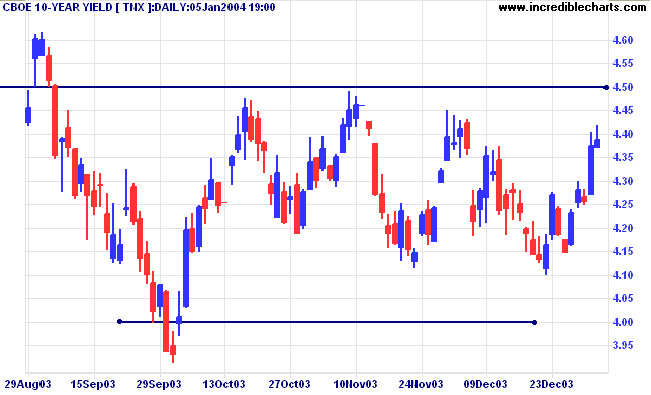

The yield on 10-year treasury notes is up at 4.38%.

The intermediate trend is uncertain.

The primary trend is up.

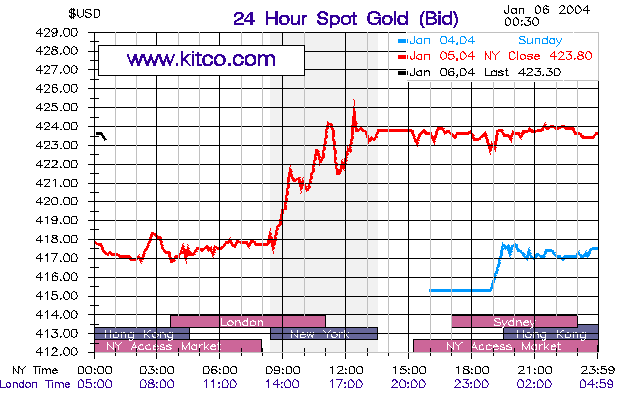

New York (00.30): Spot gold jumped to $423.30.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

Short-term: Bullish above 3317.

Intermediate term: Bullish above 3317. Bearish below 3160.

Long-term: Bearish below 3160.

| The object of a New Year is not that we should have a new year. It is that we should have a new soul and a new nose; new feet, a new backbone, new ears, and new eyes. Unless a particular man made New Year resolutions, he would make no resolutions. Unless a man starts afresh about things, he will certainly do nothing effective. Unless a man starts on the strange assumption that he has never existed before, it is quite certain that he will never exist afterwards. Unless a man be born again, he shall by no means enter into the Kingdom of Heaven. |

~ GK Chesterton: Daily News (circa

1907).

We wish you peace, health and prosperity in the year ahead.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.