We wish our readers peace and goodwill over Christmas

and prosperity in the year ahead.

Trading Diary

December 19, 2003

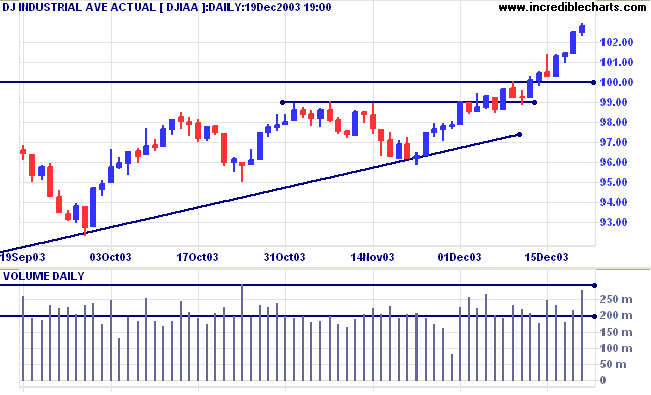

The intermediate trend is up.

The primary trend is up. A fall below support at 9000 will signal reversal.

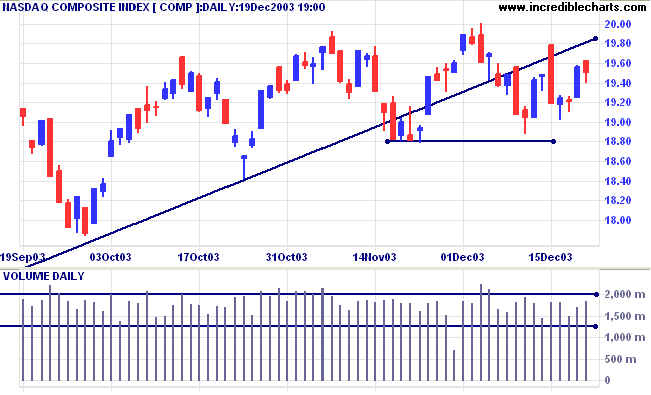

The intermediate trend is uncertain. Resistance is at 2000. A fall below 1880 will complete a double top reversal with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1640 will signal reversal.

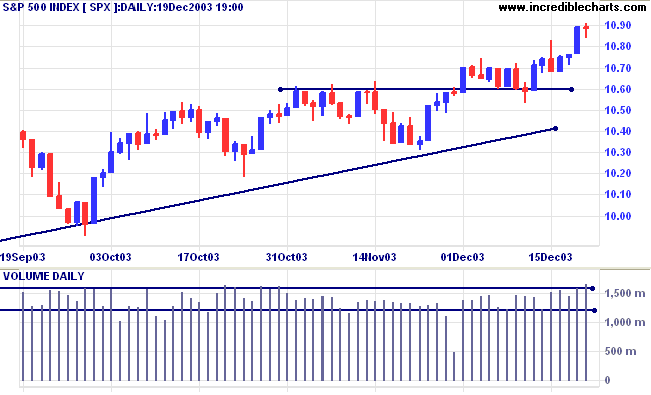

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above resistance at 1090. Bearish below 1053 (the December 10 low).

Intermediate: Bullish above 1090.

Long-term: Bullish above 960.

New unemployment claims fell to 353,000 last week, while total unemployment is at 5.9%, down from the peak of 6.4%. (more)

Some economists dismiss the figures as insignificant, while others are concerned. (more)

A new version of Incredible Charts will be released early next week,

with stock screens covering the US and Australian markets.

Adjusted end-of-day charts for NYSE, Nasdaq, Amex, US indexes

are accessible from the free version Securities menu until early 2004.

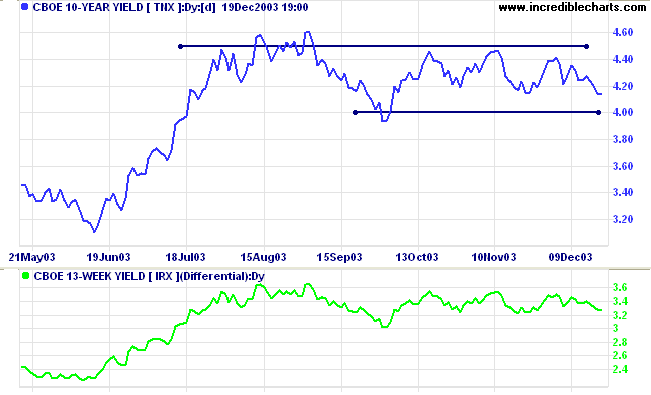

The yield on 10-year treasury notes has eased to 4.13%.

The intermediate trend is uncertain.

The primary trend is up.

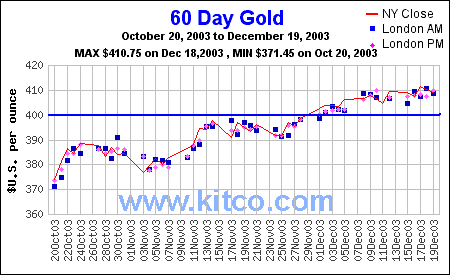

New York (13.30): Spot gold eased to $408.70 after reaching 413 mid-week.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415 (the 10-year high).

Subscribe to Incredible Charts Premium

version with:

|

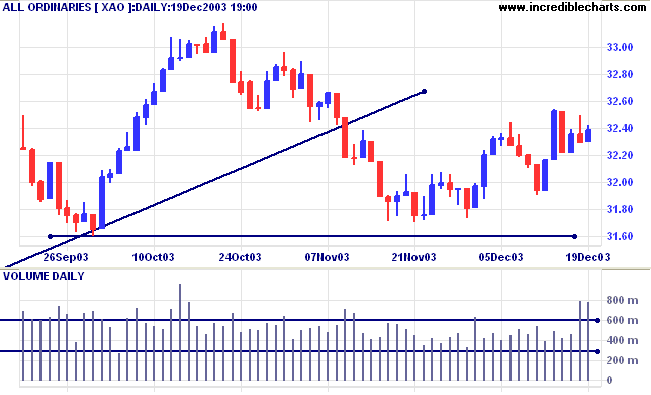

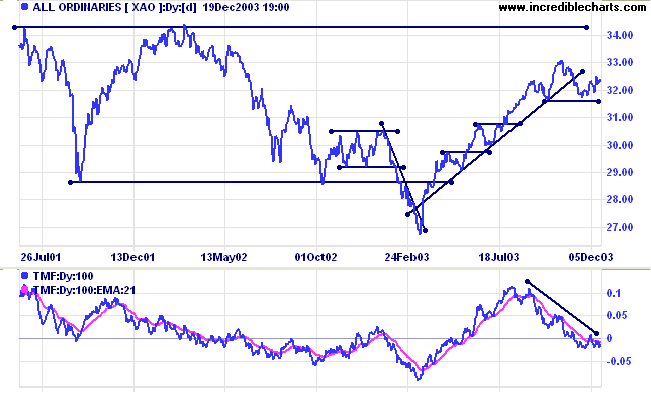

Short-term: Bullish above 3253, Monday's high. Bearish below 3220 (Tuesday's low).

Twiggs Money Flow (100) is below its signal line, indicating distribution, after a bearish triple divergence.

Intermediate term: Bullish above 3253. Bearish below 3160.

Long-term: Bearish below 3160.

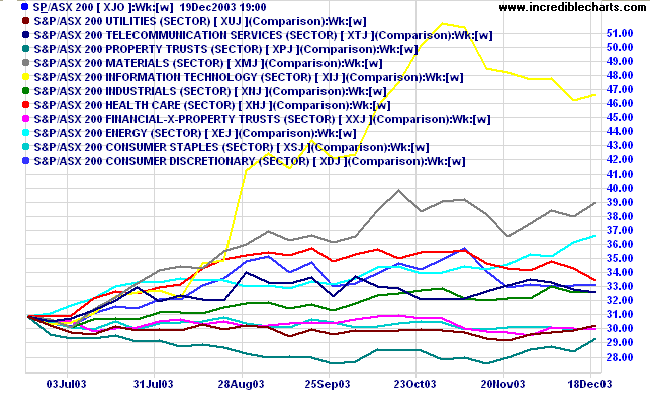

The 11 sectors (10 + Property) are in various market stages. Relative Strength (xjo) measures the performance of each sector relative to the overall index.

- Energy [XEJ] - stage 2 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 2 (RS is rising)

- Consumer Discretionary [XDJ] - stage 3 (RS is falling)

- Consumer Staples [XSJ] - stage 1 (RS is level)

- Health Care [XHJ] - stage 1 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising).

- Financial excl. Property [XXJ] - stage 4** (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is falling)

- Utilities [XUJ] - stage 3 (RS is level)

The 6-month sector comparison shows Information Technology [XIJ] retreating after a heady climb. Energy [XEJ] looks promising, while Property [XPJ] is starting to recover.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) recovered to 50 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003). Prominent sectors are:

- Real Estate Investment Trusts (12)

- Diversified Metals & Mining (4)

- Oil & Gas Exploration & Production (3)

- Broadcasting & Cable TV (3).

Stocks analyzed during the week were:

- ERG Limited - ERG

- Foodland - FOA

And a time for every matter under heaven:

A time to be born, and a time to die;

A time to plant, and a time to pluck up what is planted;

A time to kill, and a time to heal;

A time to break down, and a time to build up;

A time to weep, and a time to laugh;

A time to mourn, and a time to dance;

A time to throw away stones, and a time to gather stones together;

A time to embrace, And a time to refrain from embracing;

A time to seek, and a time to lose;

A time to keep, and a time to throw away;

A time to tear, and a time to sew;

A time to keep silence, and a time to speak;

A time to love, and a time to hate,

A time for war, and a time for peace.

- Ecclesiastes 3:1-8

The Daily Trading Diary will resume on January 5th 2004,

after the Christmas break.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.