US stocks and indexes are being added to the stock screen module

and should be available by next week.

Trading Diary

December 10, 2003

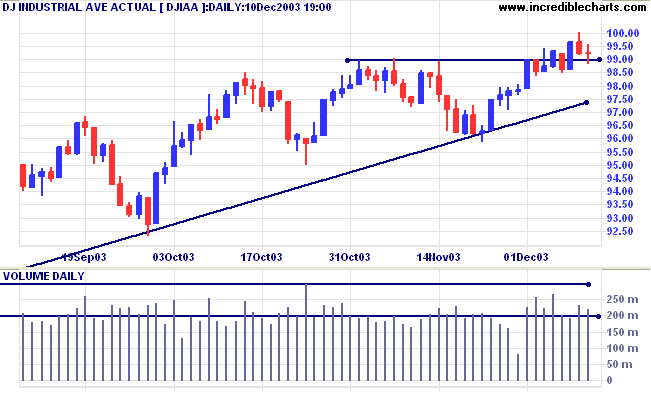

The intermediate trend is uncertain. Expect support at 9500 and 9600, resistance at 10000.

The primary trend is up. A fall below support at 9000 will signal reversal.

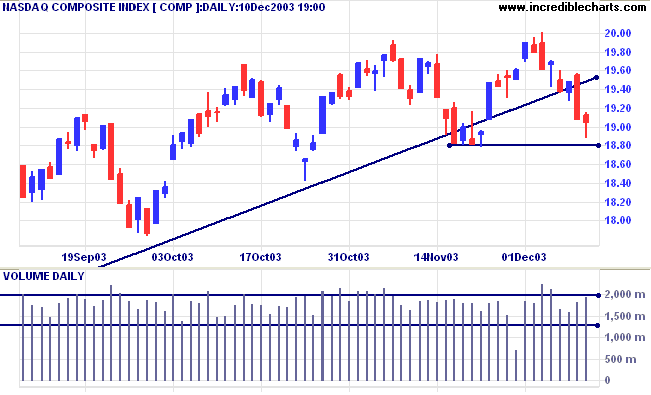

The intermediate trend is uncertain. A fall below 1880 would complete a double top reversal, with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1640 will signal reversal.

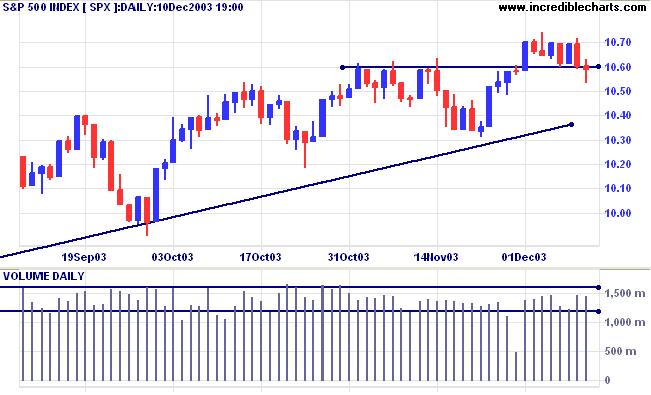

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above 1070. Bearish below 1053 (Today's low).

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

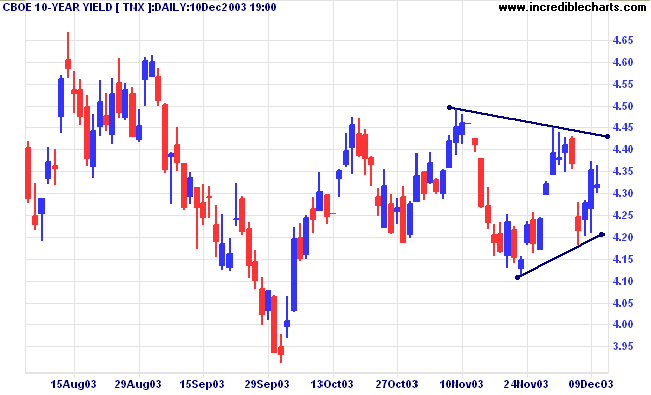

The yield on 10-year treasury notes is consolidating, with an inside day closing at 4.31%.

The intermediate trend is down.

The primary trend is up.

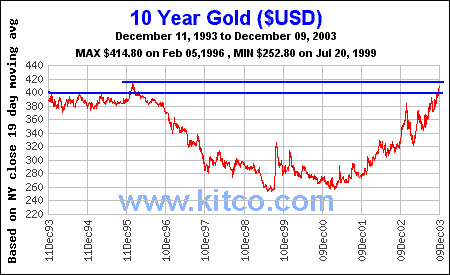

New York (22.03): Spot gold retreated to $404.70.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

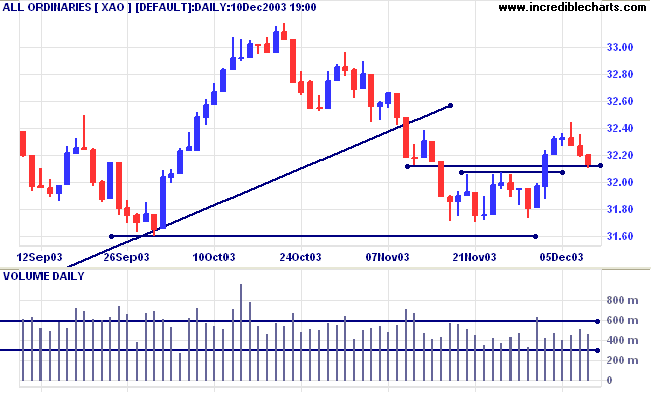

The intermediate up-trend continues.

Short-term: Bullish above 3221, today's high. Bearish below 3173 (December 1st low).

Intermediate term: Bullish above 3221. Bearish below 3160.

Long-term: Bearish below 3160.

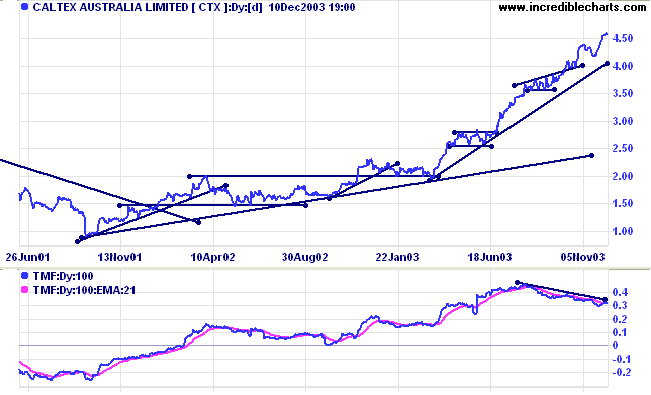

Last covered on September 11, 2003.

Caltex accelerated into a fast intermediate up-trend in April 2003, after an earlier creeping trend. Twiggs Money Flow (100) now displays a strong bearish divergence.

Keep stops below the latest short-term trough, but switch to a tighter trailing % stop if the trend accelerates into a blow-off.

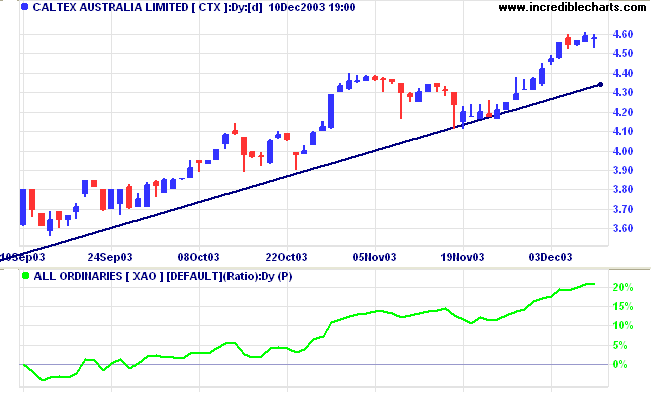

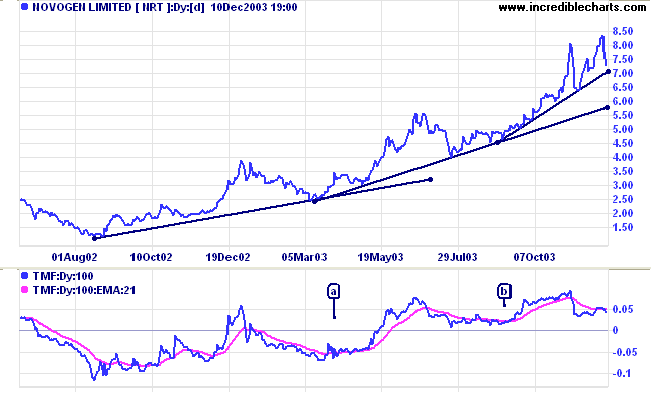

Last covered October 14, 2003.

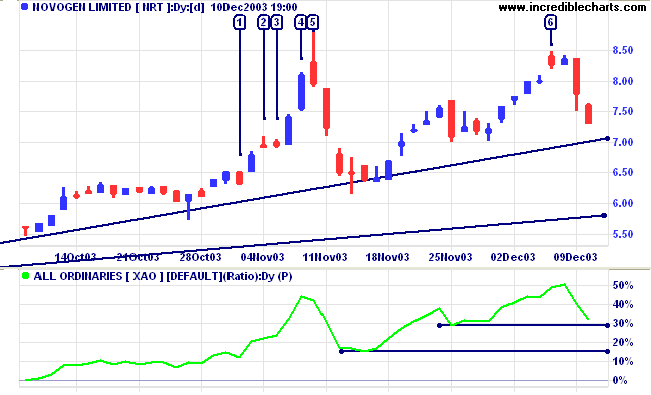

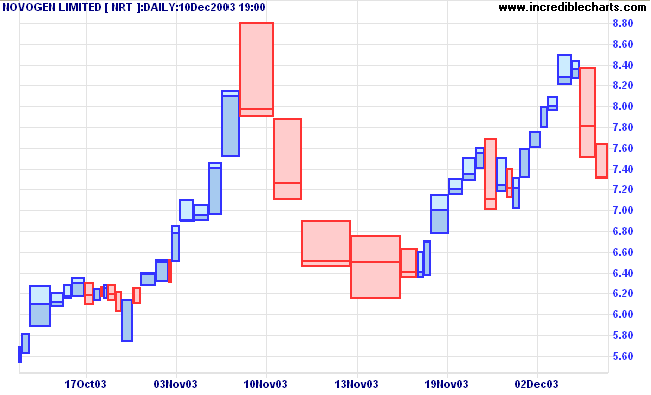

Novogen provides a good example of a blow-off following an accelerating trend. The trend accelerates at each higher trough on Twiggs Money Flow (100), ending in a blow-off spike.

The subsequent attempt at [6] failed to make a new high; a bearish sign. A fall below support at 7.00, accompanied by a similar break of the RS support level, will strengthen the signal, while a fall below the November 13 low will complete a double top reversal.

gracefully surrendering the things of youth.

Nurture strength of spirit to shield you in sudden misfortune.

But do not distress yourself with dark imaginings.

Many fears are born of fatigue and loneliness.

~ Max Ehrmann: Desiderata (1927)

Where price history is adjusted for the effect of corporate actions.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.