A collection of the most highly-rated posts since the start of the Forum.

Thanks to Mosaic for coming up with the idea and providing the initial list

and to all the contributors.

Trading Diary

December 4, 2003

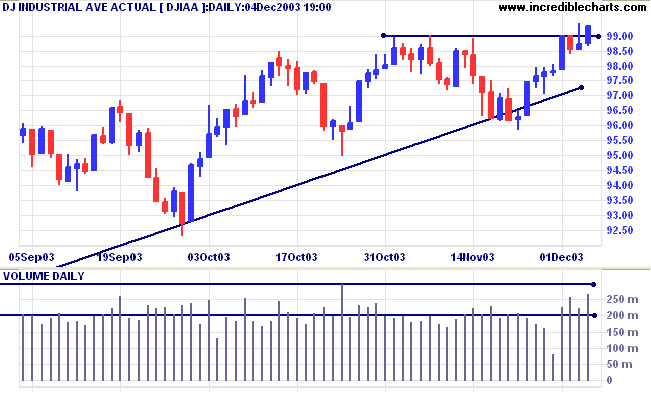

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 9000 will signal reversal.

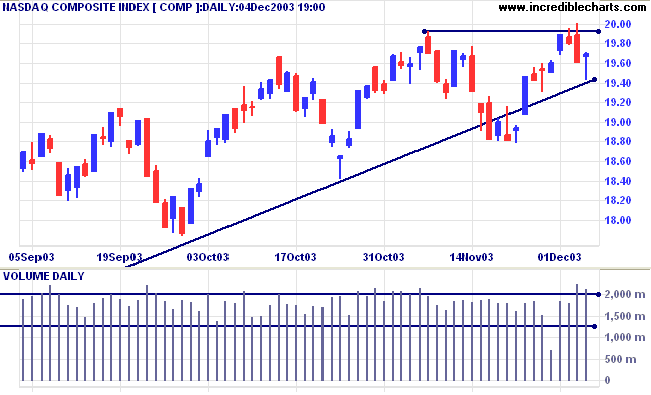

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

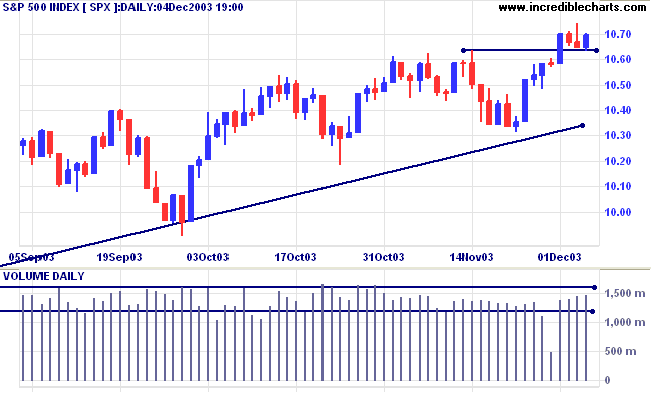

The intermediate trend is uncertain. The 3-day consolidation often occurs at the mid-point in a rally. If there is a breakout, the likely target is 1100: (1070 + (1070 - 1037) = 1103.

Short-term: Bullish if the S&P500 is above the high of 1070. Bearish below 1063 (Today's low).

Intermediate: Bullish above 1063.

Long-term: Bullish above 960.

The price of scrap steel is a useful advance indicator of the economy, but the 40% price rise in the last year warns of inflation. (more)

The president ends steel import tariffs to avert a trade war with the EU. (more)

The yield on 10-year treasury notes is consolidating in a narrow range, closing at 4.36%.

The intermediate trend is down.

The primary trend is up.

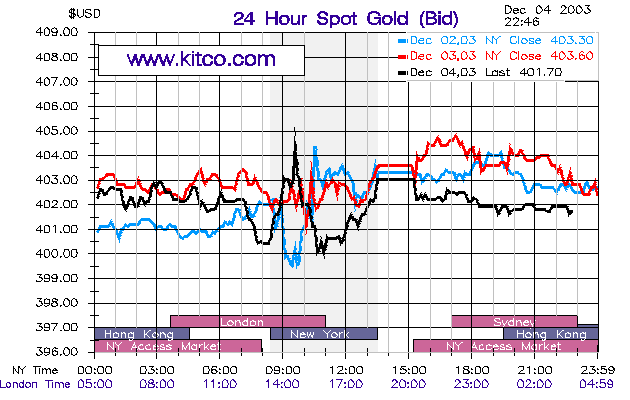

New York (20.13): Spot gold is at $401.70 after testing support at 400.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

MACD (26,12,9) has crossed above its signal line; Slow Stochastic (20,3,3) is above.

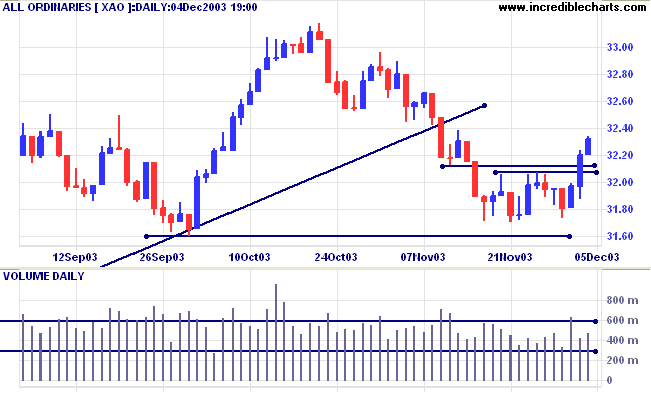

Short-term: Bullish if the All Ords is above 3212, the November 12 low. Bearish below 3173 (Monday's low).

XAO is below its long-term trendline, signaling weakness. The primary trend is up but will reverse if there is a fall below 3160 (the October 1 low). Declining weekly volume increases the likelihood that support at 3160 will hold. Twiggs Money Flow (100) is still in a down-trend but has crossed above its signal line.

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

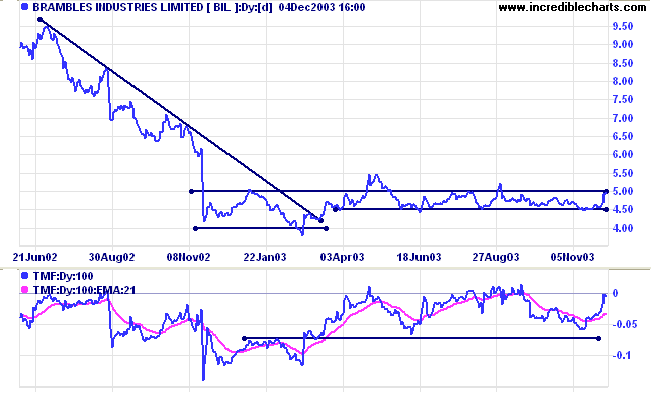

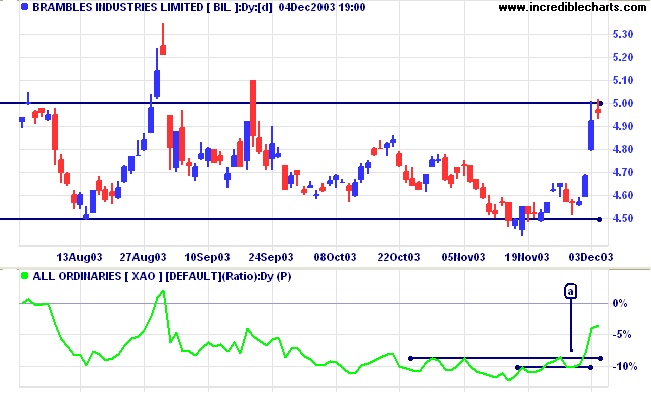

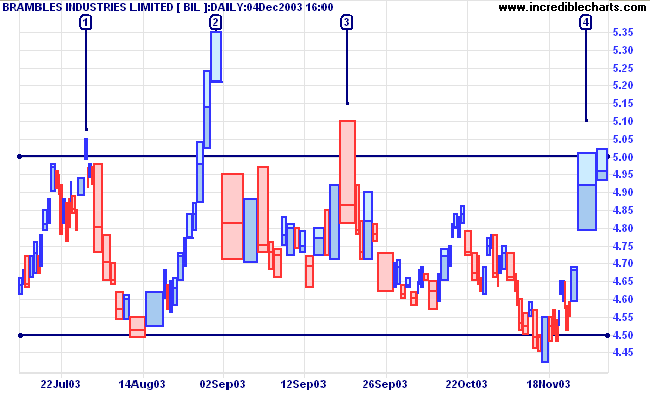

BIL has formed a broad base over the last 12 months, covered in my Diary on August 26, 2003. Price is once again testing resistance at 5.00, while Twiggs Money Flow (100) is rising.

If you risk too much on a trade and you lose,

you can (and probably will) have trouble recovering.

~ Van K Tharp: Trade your way to Financial Freedom.

US stocks

The complete NYSE, Nasdaq and Amex exchanges are on the new server.

We are adding some finishing touches before releasing the new version in the next day or two.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.