In future an early edition of the Trading Diary (sans US charts)

will be available on the website and emailed before 7:00 a.m. (Sydney time).

A later US market update will be emailed around midday.

Trading Diary

November 27, 2003

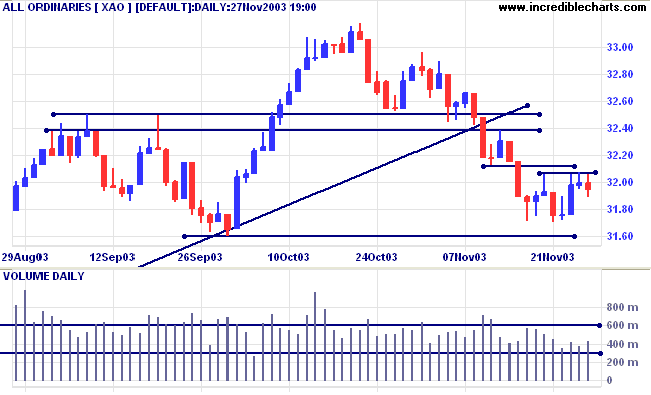

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above its signal line.

Short-term: Bullish if the All Ords rises above 3212 (the November 12 low). Bearish below Wednesday's low of 3194.

The primary trend is up but will reverse if there is a fall below 3160 (the October 1 low).

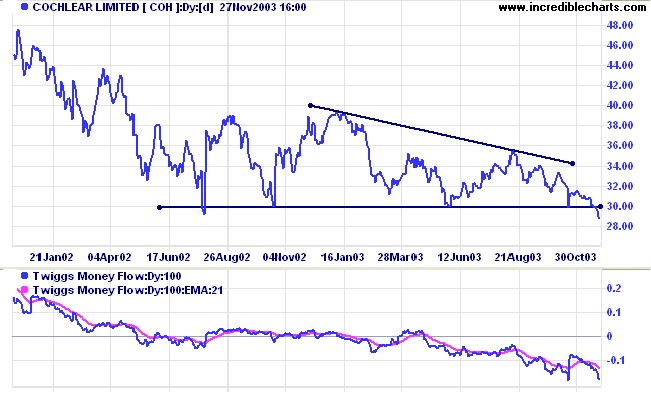

Twiggs Money Flow (100) signals distribution after a bearish triple divergence.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Neutral. Bearish below 3160.

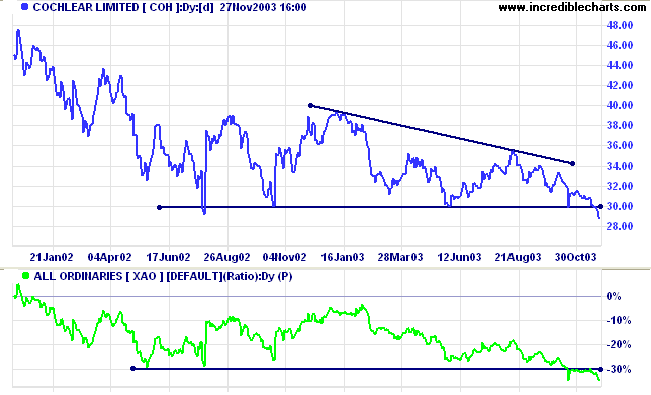

Last covered on February 12, 2003.

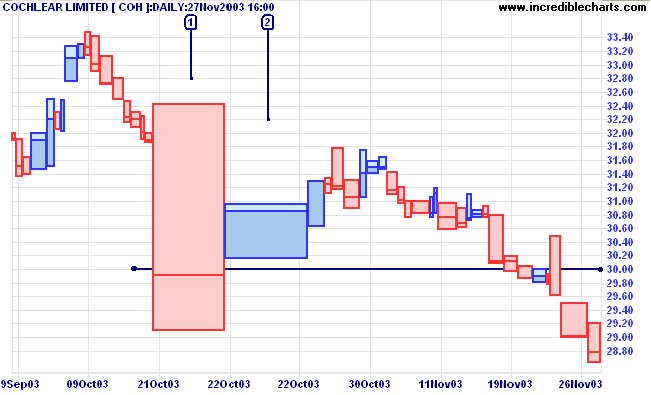

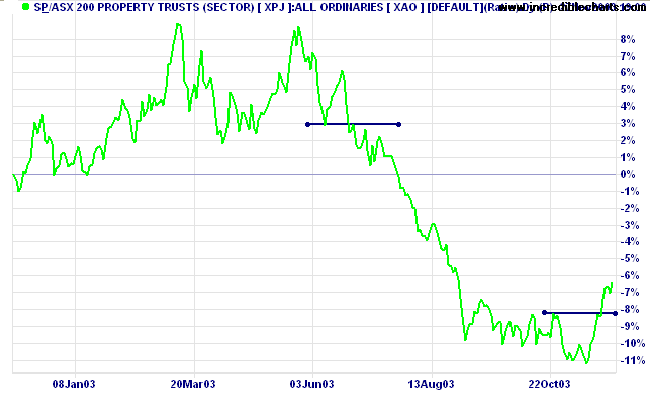

Relative Strength (xao) fell to a 2-year low, with a pull-back respecting resistance on the RS chart, while price has penetrated the 30.00 support level.

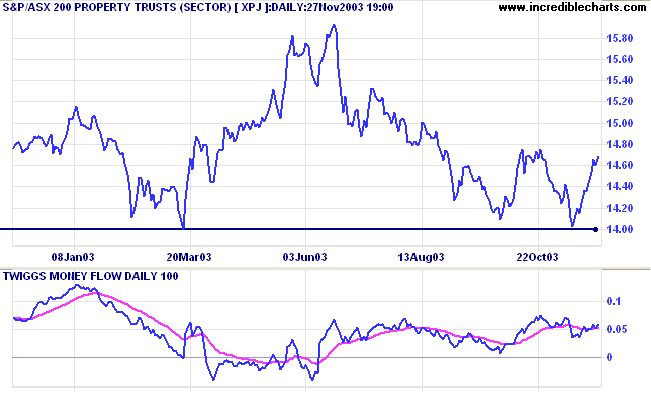

XPJ has rallied after testing support at 14.00. Twiggs Money Flow (100) continues to signal accumulation.

but pushes the aimless drifter aside.

~ Roman proverb.

We are now in the final stages of the setup.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.