Trading Diary

November 21, 2003

| The service may be interrupted on Sunday between 2:00 a.m. and 4:00 a.m. (Sydney time) to replace a faulty network card on the new server. |

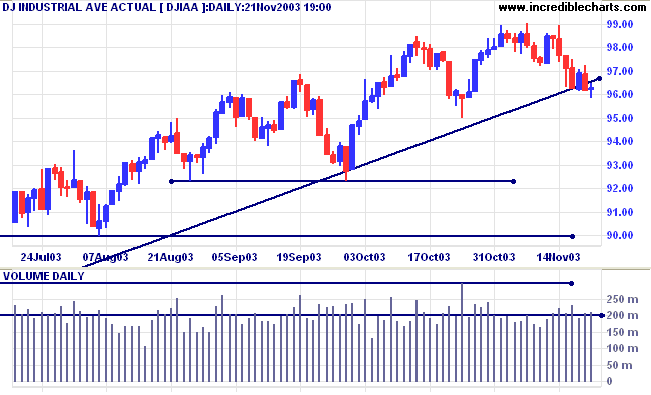

The intermediate trend is down. Expect support at 9500 and 9230.

The primary trend is up. A fall below support at 9000 will signal reversal.

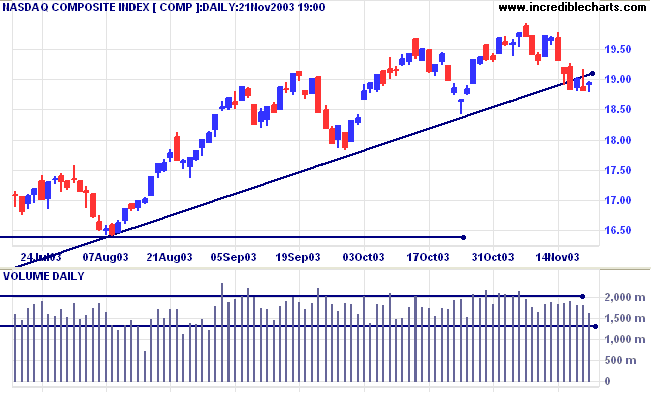

The intermediate trend is down. Expect support at 1840 and 1780.

The primary trend is up. A fall below support at 1640 will signal reversal.

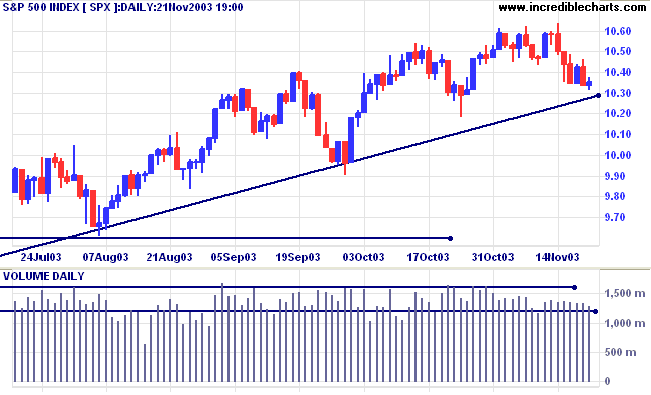

The intermediate trend is down. Expect a test of the primary trendline, with further support at 990.

Short-term: Bullish if the S&P500 is above the high of 1062. Bearish below 1034 (Tuesday's low).

Intermediate: Bullish above 1062.

Long-term: Bullish above 960.

Dorsey maintains that a fall below 70 ( and not a 3-box reversal) signals a bear alert.

A weak dollar will make US exports more competitive in overseas markets. But a fall in the dollar will hurt US bond and stock markets, placing upward pressure on interest rates, with a negative impact on the economy. (more)

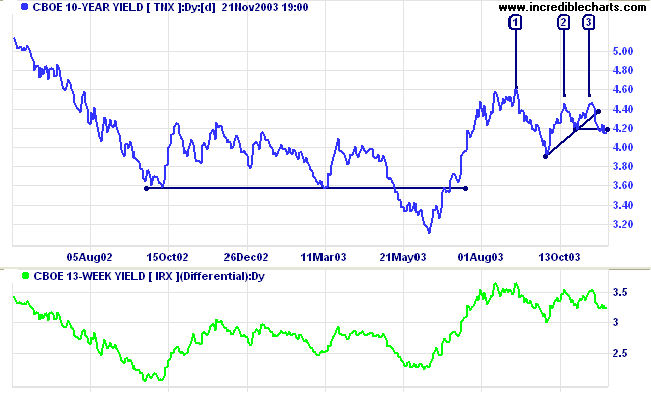

The yield on 10-year treasury notes closed down at 4.15%.

The intermediate trend has turned down after bearish equal highs at [2] and [3] below a higher peak at [1].

The primary trend is up.

New York (13.30): Spot gold consolidated just below resistance at 400, a bullish sign, closing the week at $395.80.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has whipsawed above.

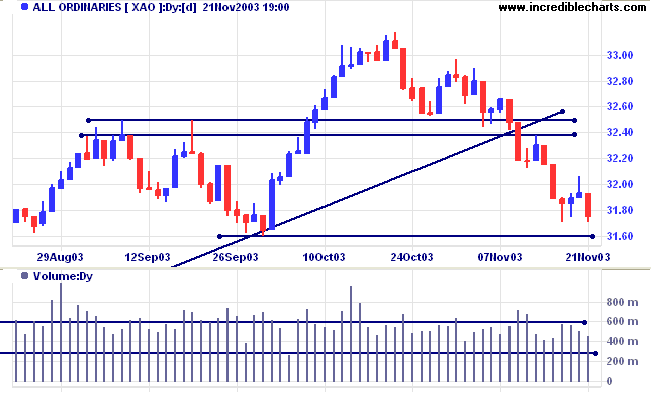

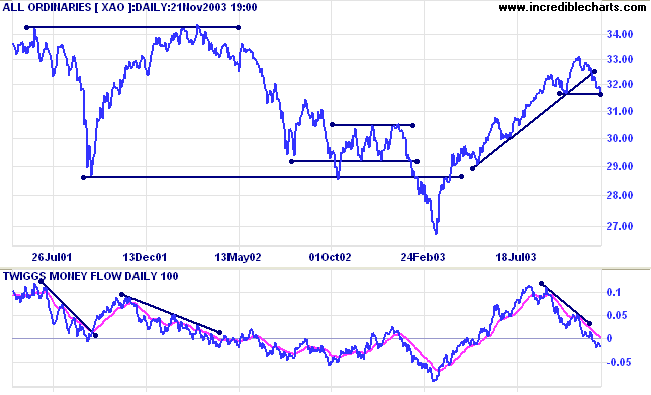

Short-term: Bullish if the All Ords crosses back above resistance at 3250. Bearish below 3189 (Thursday's low).

Twiggs Money Flow (100) signals distribution after a bearish triple divergence.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Bearish below 3160.

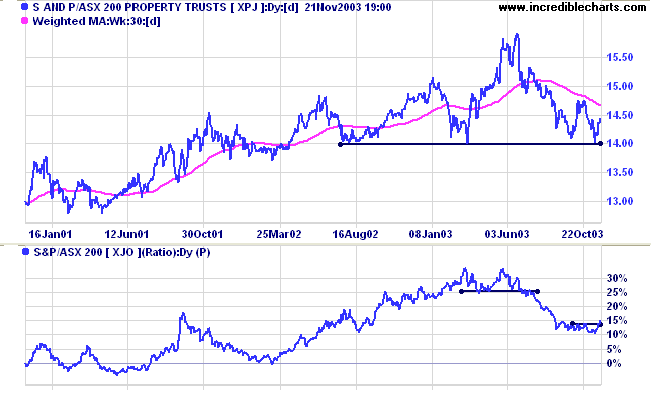

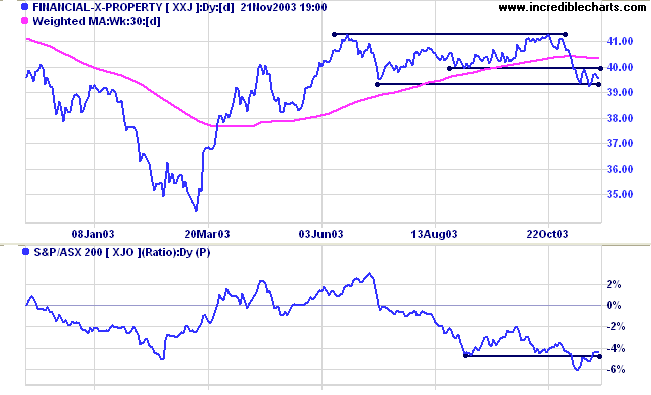

The 11 sectors (10 + Property) are in various market stages. Relative Strength (xjo) measures the performance of each sector relative to the overall index.

- Energy [XEJ] - stage 2 (RS is rising)

- Materials [XMJ] - stage 2 (RS is falling)

- Industrials [XNJ] - stage 2 (RS is rising)

- Consumer Discretionary [XDJ] - stage 2 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is level)

- Property Trusts [XPJ] - stage 3 (RS is level).

- Financial excl. Property [XXJ] - stage 3 (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is falling)

- Utilities [XUJ] - stage 3 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) continues to fall, reaching 15 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003). There are no prominent sectors.

Stocks analyzed during the week were:

- Ventracor - VCR

- Ansell - ANN

- Billabong - BBG

- Peptech - PTD

- Hardman Resources - HDR

but difficult to look further than you can see.

~ Winston Churchill.

Incredible Charts Premium version with adjusted data and hourly updates

and the Daily Trading Diary.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.