Trading Diary

November 14, 2003

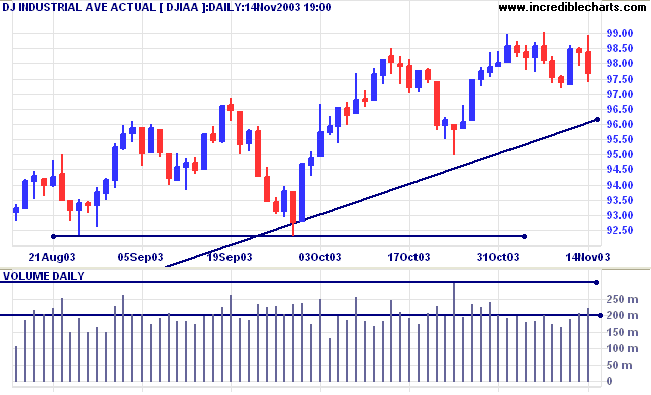

The intermediate trend is down.

The primary trend is up. A fall below 9000 will signal reversal.

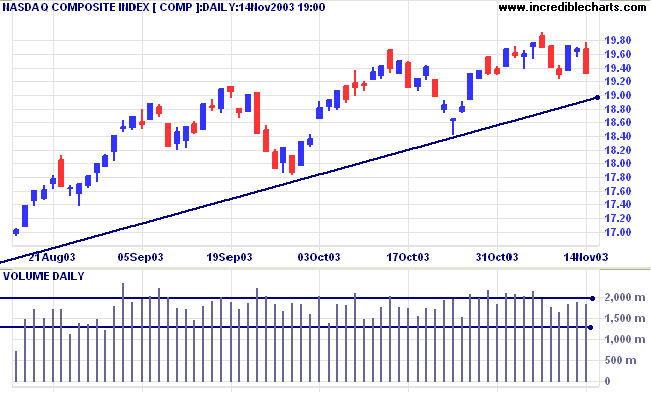

The intermediate trend is up. Expect resistance at 2000 and 2100, the January 2002 high.

The primary trend is up. A fall below 1640 will signal reversal.

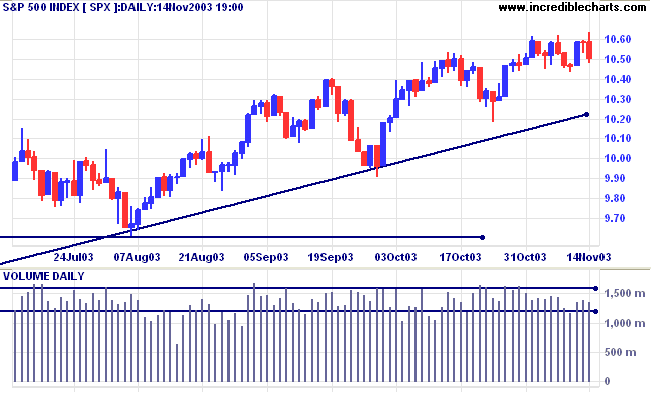

The intermediate trend is up. Expect further resistance at 1100 (a former 2002 support level).

Short-term: Bullish if the S&P500 is above 1062. Bearish below 1043 (Tuesday's low).

Twiggs Money Flow (100) continues to signal accumulation.

Intermediate: Bullish above 1062.

Long-term: Bullish above 960.

A 3-box reversal would signal a bear alert.

Retail sales fell 0.3% in October, after a 0.4% fall in September, while consumer confidence rises. (more)

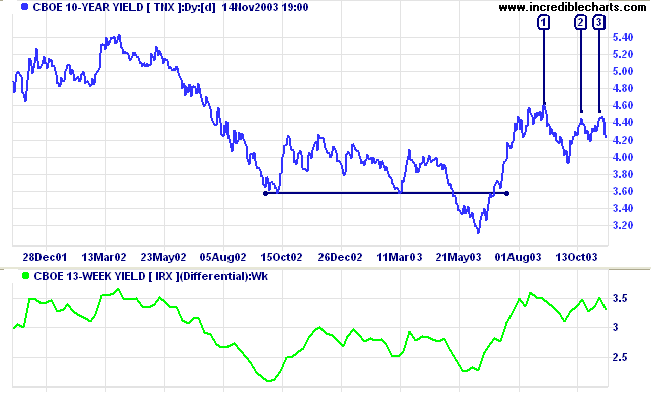

The yield on 10-year treasury notes has fallen to 4.23%.

The intermediate trend is up but equal highs, [2] and [3], below a higher peak [1] are a bear signal.

The primary trend is up.

New York (13.30): Spot gold rallied to close the week at $397.30.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed above.

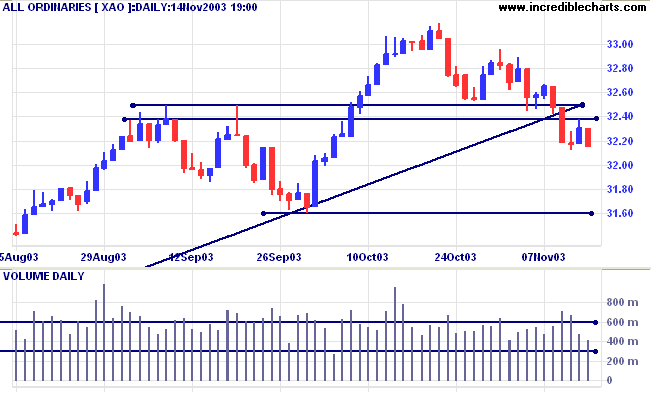

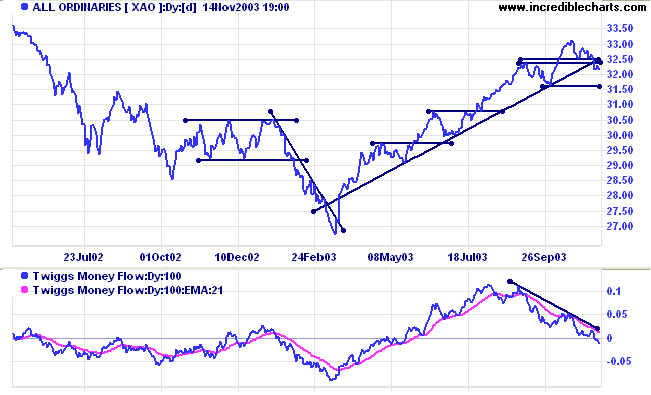

Short-term: Bullish if the All Ords crosses back above 3250. Bearish below 3238.

Twiggs Money Flow (100) has crossed below zero after a bearish triple divergence, signaling distribution.

Intermediate term: Bullish above 3250. Bearish below 3160.

Long-term: Bearish below 3160.

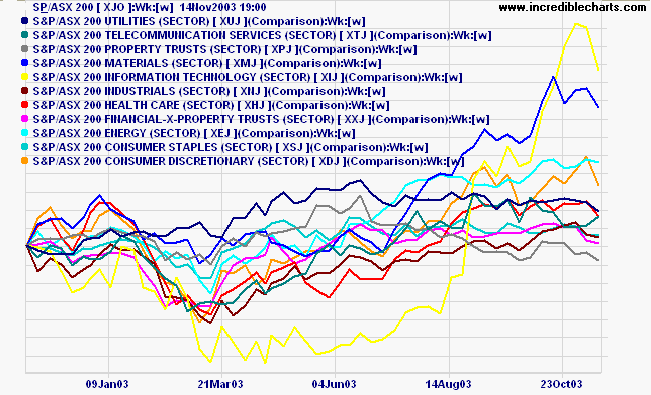

Materials, Consumer Discretionary and Information Technology are the most promising, with rising Relative Strength (xjo).

- Energy [XEJ] - stage 2 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 2 (RS is level)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is level)

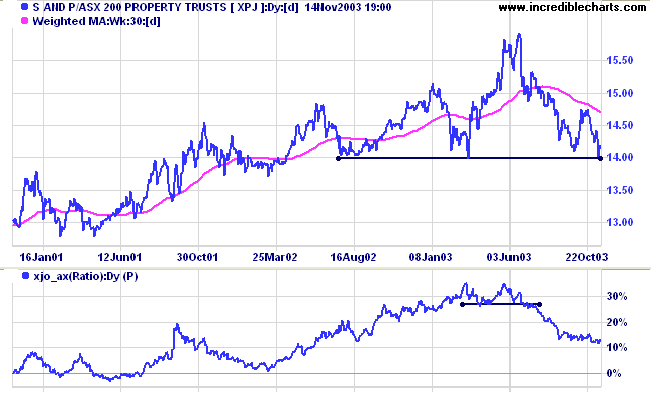

- Property Trusts [XPJ] - stage 3 (RS is falling). A fall below 1400 will signal the start of stage 4.

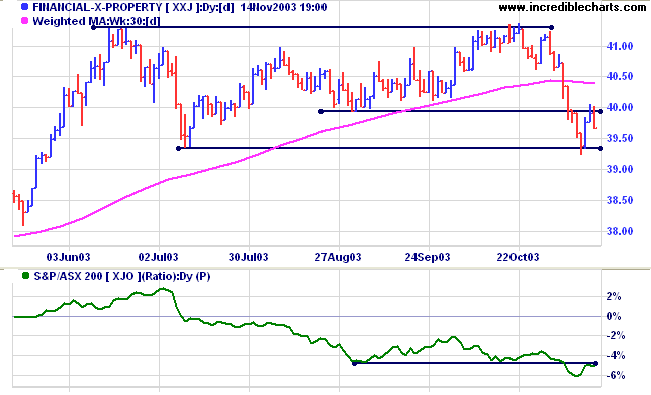

- Financial excl. Property [XXJ] - stage 3 (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - uncertain (RS is falling)

- Utilities [XUJ] - stage 3 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) fell sharply to 26 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Gold (3)

- Construction & Engineering (3)

Stocks analyzed during the week were:

- Westpac -WBC

- ANZ Bank - ANZ

- St George - SGB

- Bank of Queensland - BOQ

- Australian Stock Exchange - ASX

- Perpetual - PPT

- Sydney Futures Exchange - SFE

- Macquarie Bank - MBL

- Insurance Australia - IAG

- QBE Insurance - QBE

- Oxiana - OXR

- Resolute Mining - RSG

- Lihir - LHG

- Croesus - CRS

.......The more we are aware of our basic paradigms, maps, or assumptions,

and the extent we have been influenced by our experience,

the more we can take responsibility for those paradigms,

examine them, test them against reality,

listen to others and be open to their perceptions,

thereby getting a larger picture and a far more objective view.

~ Stephen Covey: The Seven Habits of Highly Effective People.

Incredible Charts Premium version with adjusted data and hourly updates

and the Daily Trading Diary.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.