|

US stocks Our target is to have NYSE, Nasdaq and Amex charts available by Friday. |

Trading Diary

November 3, 2003

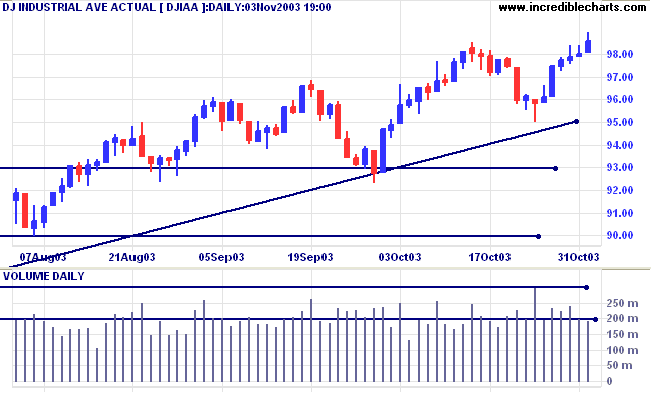

The intermediate trend has turned up.

The primary trend is up. A fall below 9000 will signal reversal.

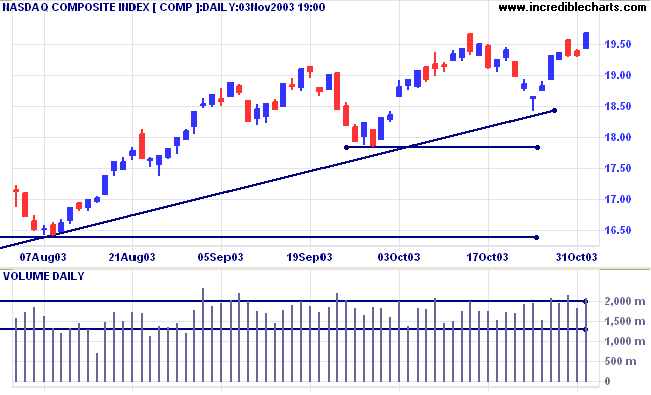

The intermediate trend has turned up.

The primary trend is up. A fall below 1640 will signal reversal.

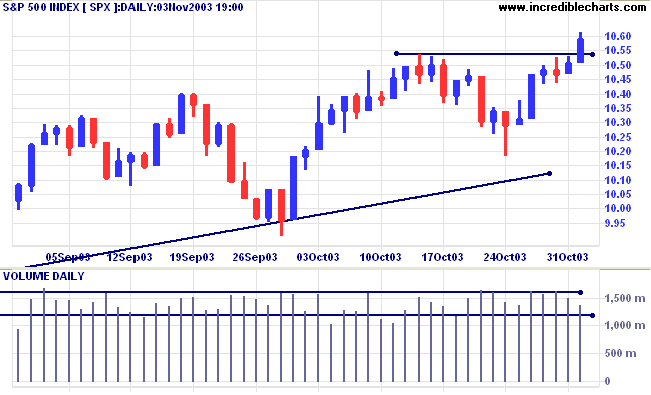

The intermediate trend has turned up.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

The ISM manufacturing index jumped to 57 in October, from 53.7 in September. (more)

The yield on 10-year treasury notes increased to 4.37%.

The intermediate down-trend is weak.

The primary trend is up.

New York (16:21): Spot gold plunged to $377.00.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

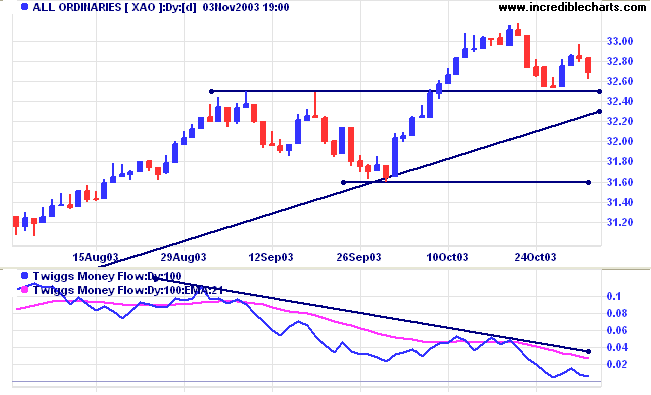

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3250.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

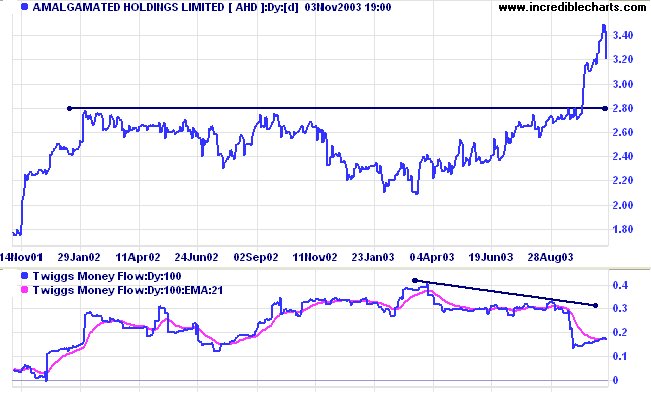

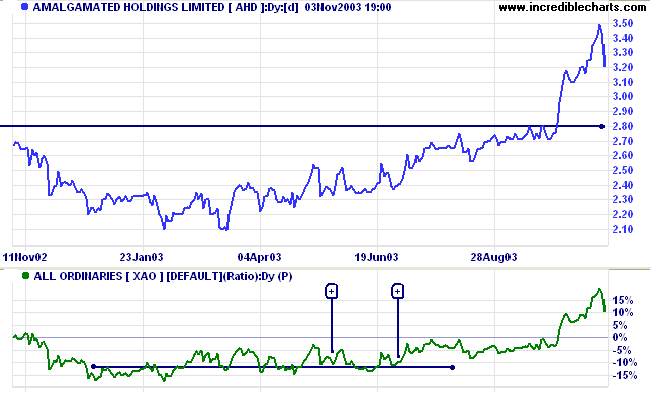

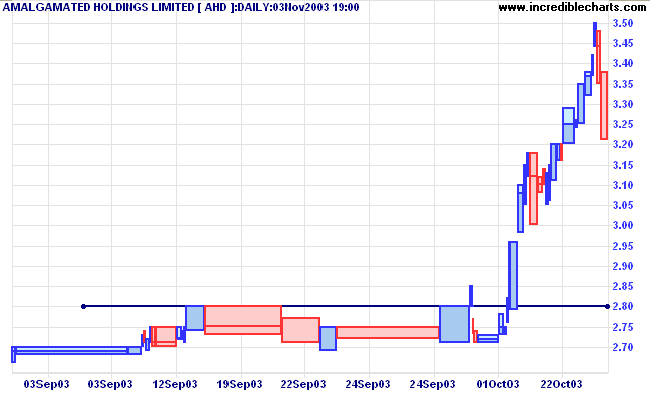

AMH, after a lengthy consolidation, broke above resistance at 2.80 but has corrected sharply in the last 2 days. Twiggs Money Flow (100) signals a bearish divergence.

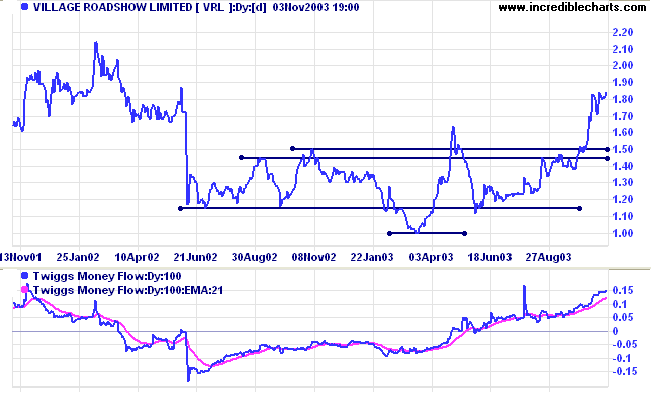

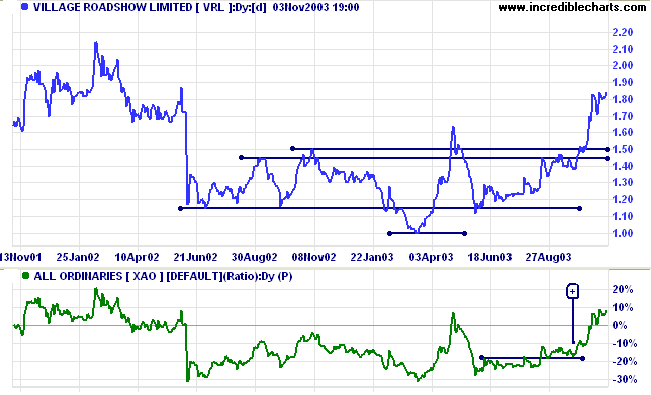

Last covered on June 7, 2002, VRL has recovered, breaking through resistance at 1.45 to 1.50, with Twiggs Money Flow (100) rising steadily.

Price is likely to encounter resistance at 2.00, presenting opportunities to enter if there is a pull-back to re-test support levels.

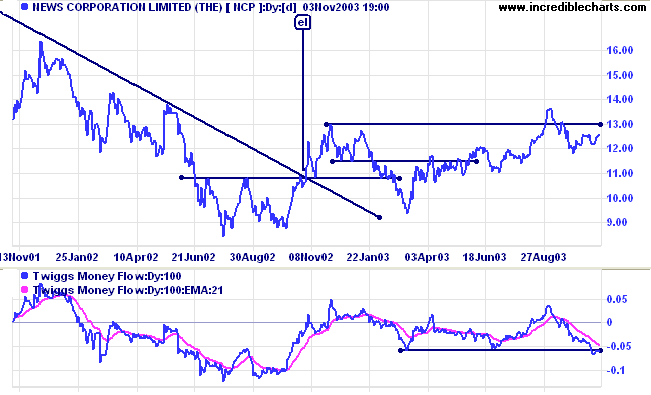

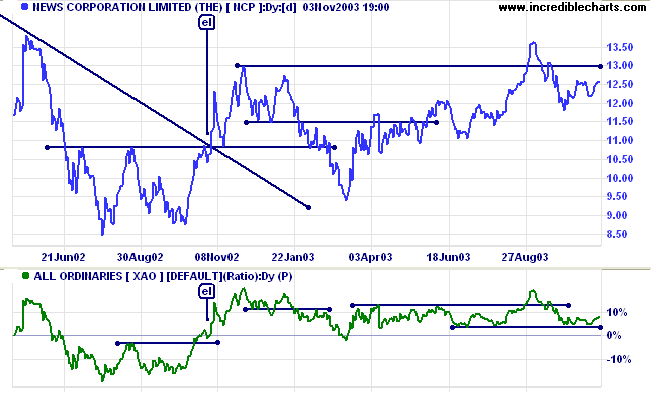

NCP is in a creeping up-trend while Twiggs Money Flow (100) is falling, a bearish sign.

RS subsequently leveled out, providing neither bull or bear signals in the last 6 months.

the recurrence of periods of boom which are followed by periods of depression [recession],

is the unavoidable outcome of the attempts, repeated again and again,

to lower the gross market rate of interest by means of credit expansion.

There is no means of avoiding the final collapse of a boom expansion brought about by credit expansion.

The alternative is only whether the crisis should come sooner

as the result of the voluntary abandonment of further credit expansion,

or later as a final and total catastrophe of the currency system involved.

~ Ludwig von Mises (1881 - 1973)

The Federal Reserve is injecting cash into the US economy to stimulate "the best recovery that money can buy",

in the words of one commentator. This is unsustainable - as reflected by the falling dollar.

|

The easiest way to change indicator

colors is to: (1) display the legend; (2) click the color button next to the indicator; (3) select a new color from the palette and lick OK. You can also use the menu: (1) select Format Charts >> Colors; (2) select the indicator (on the bottom half of the pop-up menu); (3) click the color button and select a new color. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.