|

US Charts With ETOs and warrants available, we can now focus on the US market: NYSE, Nasdaq and Amex exchanges. Our target is next Friday. |

Trading Diary

October 29, 2003

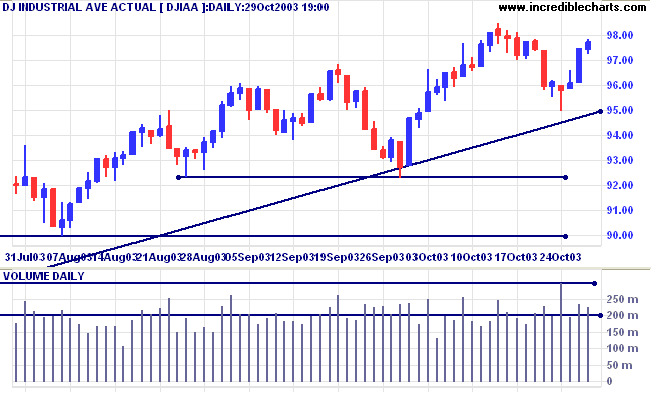

The intermediate down-trend is weak.

The primary trend is up. A fall below 9000 will signal reversal.

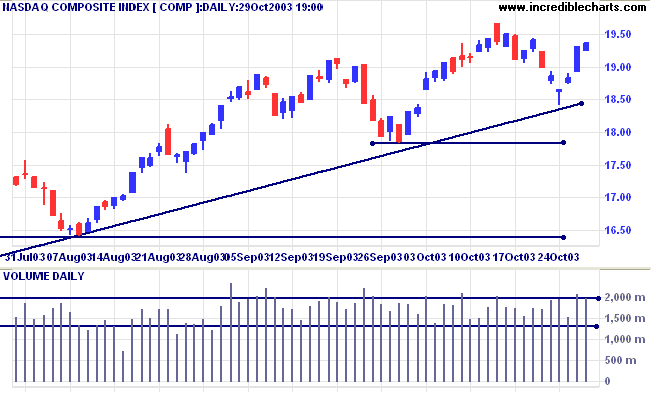

The intermediate down-trend appears weak.

The primary trend is up. A fall below 1640 will signal reversal.

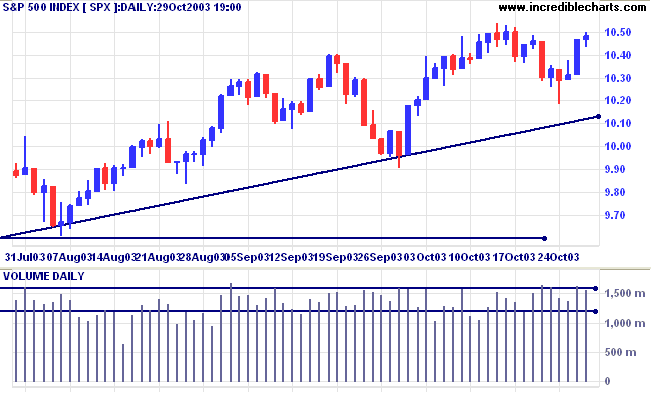

The intermediate down-trend is weak.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054. Bearish below 1026.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

The yield on 10-year treasury notes recovered to close at 4.28%.

The intermediate trend is down.

The primary trend is up.

New York (20.08): Spot gold rebounded to $385.80.

The intermediate trend is up.

The primary trend is up. Expect resistance at 400 to 415.

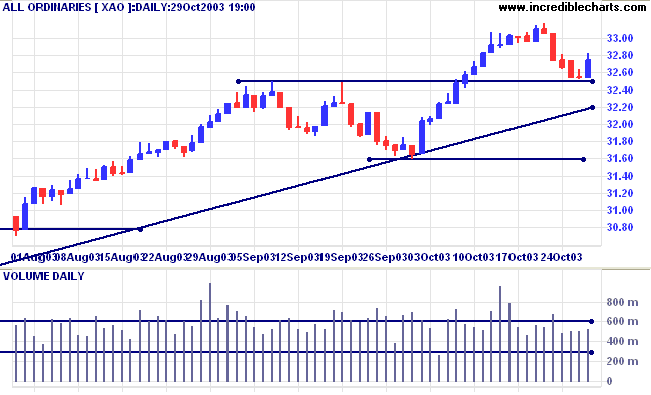

Initial support is at 3238 to 3250; resistance at 3317.

The primary trend is up. The rally is extended and the probability of a reversal increases with each successive primary trend movement.

A fall below 3160 will signal reversal.

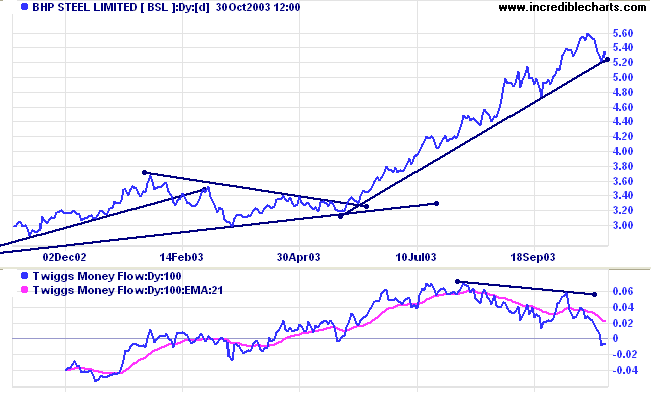

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3238.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

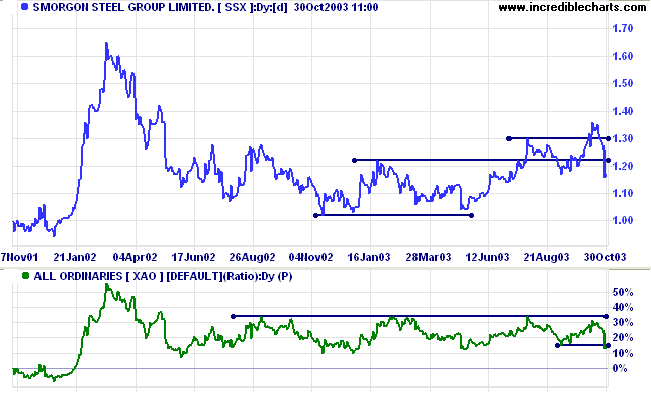

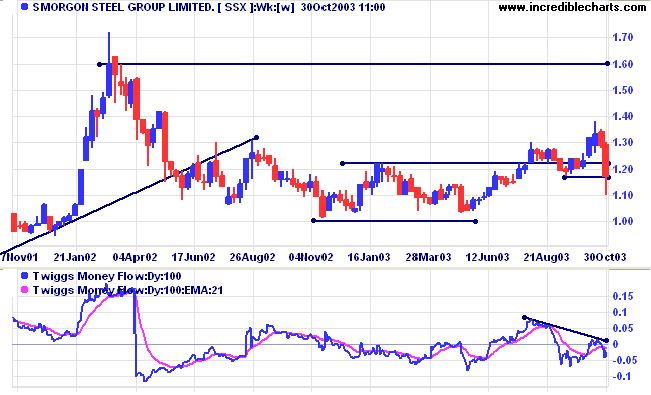

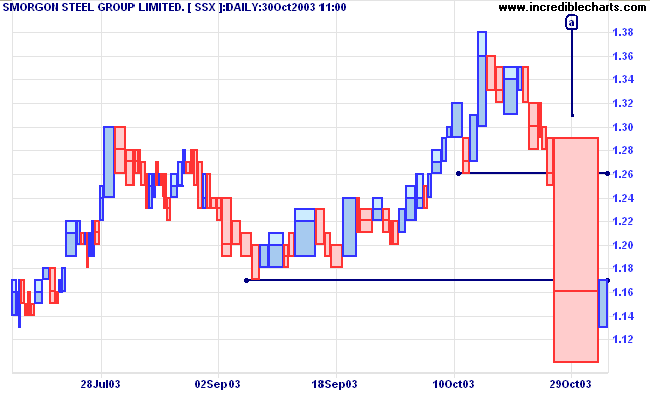

Last covered October 15, 2003. SSX broke out of a broad base above 1.00 but Relative Strength failed to follow, turning down below the resistance level. Price has fallen sharply and RS has made a new low, below the previous trough.

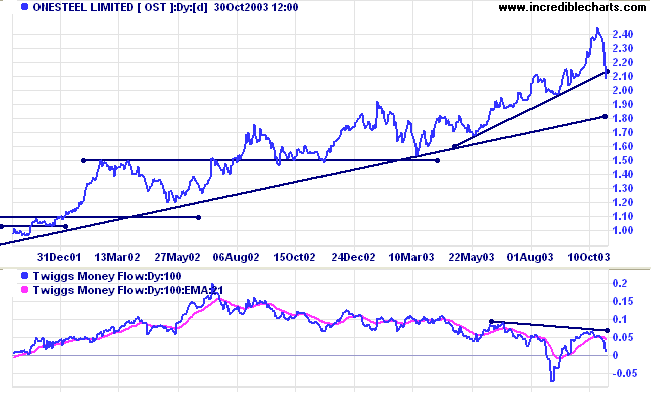

Last Covered August 20, 2002. Onesteel displays a similar bearish divergence on Twiggs Money Flow (100). Relative Strength (xao) appears to be weakening but has yet to make a new low.

Twiggs Money Flow (100) displays a bearish divergence while Relative Strength (xao) has yet to make a new low.

Don't tell me, just show your trading records.

Don't have good records?

Well, that's an answer in itself.

~ Alexander Elder: Come Into My Trading Room

|

To alter the color of captions or

trendlines: (1) select Format Charts >> Colors; (2) click on the color button next to Trendlines or Captions; (3) select a new color from the palette and click OK. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.