|

Searching for ETOs and Warrants

(Premium Members) Important: Ensure that you have Time Periods >> Chart Complete Data selected. You will need to upload the menu before doing a search: (1) select Securities >> ASX ETOS & WARRANTS >> Upload ASX ETOS & WARRANTS Menu; and (2) click Yes if you want the menu to update at the start of each session. |

Trading Diary

October 17, 2003

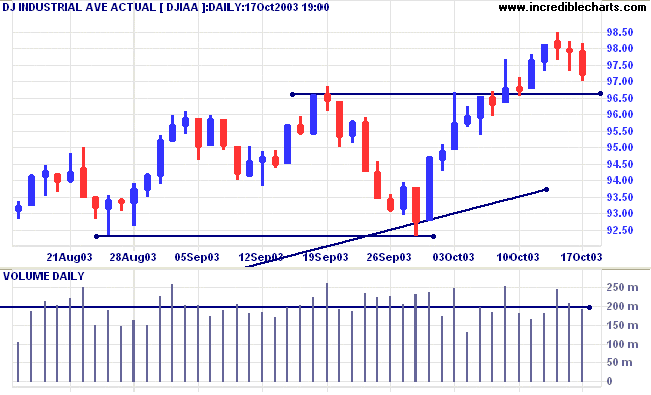

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

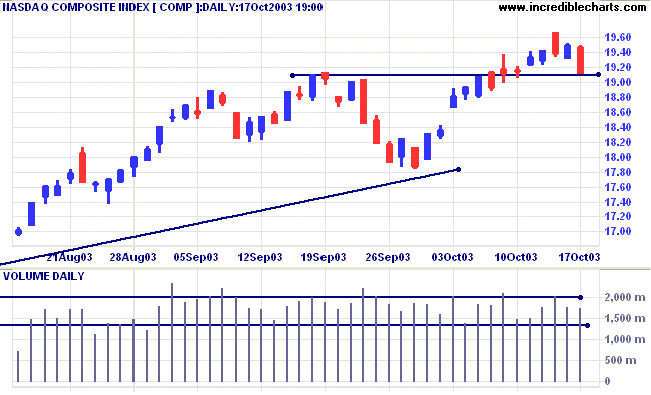

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal.

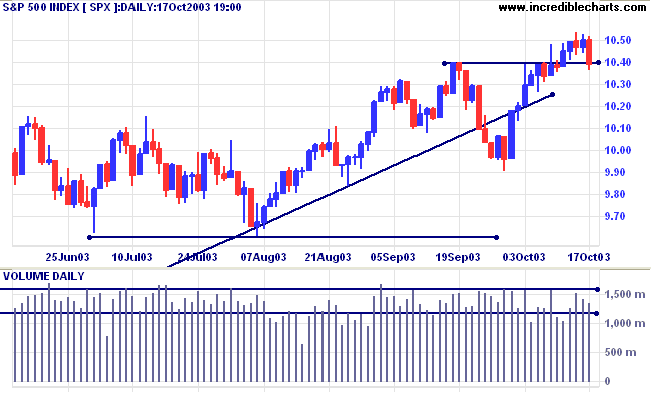

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Preliminary readings for the University of Michigan index of consumer sentiment indicate a rise to 89.4; up from September but only marginally above the August reading. (more)

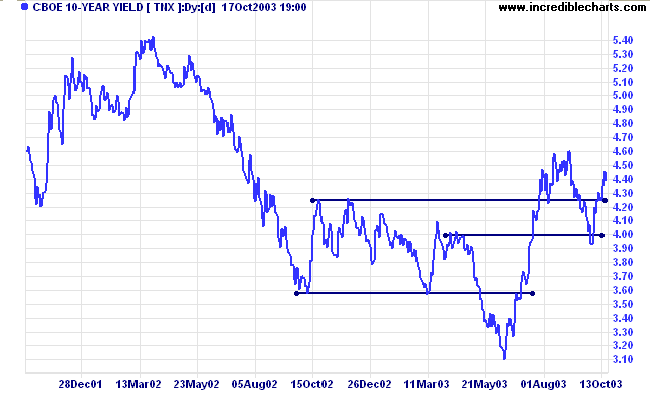

The yield on 10-year treasury notes closed the week at 4.39%.

The intermediate trend is up. Expect resistance at 4.60%.

The primary trend is up.

New York (13.30): Spot gold has weakened to $371.30.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

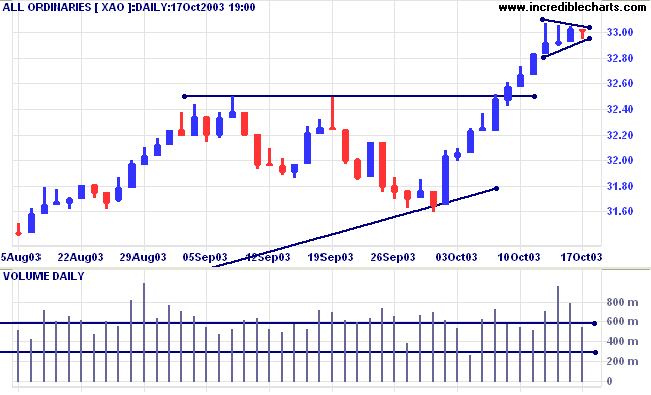

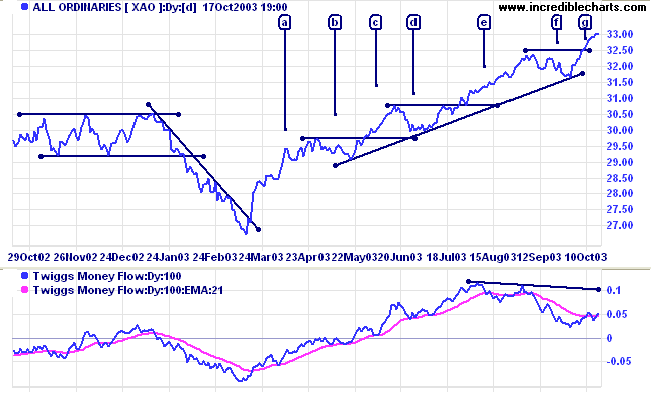

The primary trend is up. The rally is extended, with 4 primary trend movements at [a], [c], [e] and [g]; and 3 secondary corrections at [b], [d] and [f]. The probability of a reversal increases with each primary trend movement. Elliot wave theory maintains that the natural cycle is 5 waves, [a] to [e], while Gann holds that a bull campaign will normally have 3 or 4 advances, [a] to [e] or [g].

A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed back above; Twiggs Money Flow (100) is above its signal line but displays a "triple" bearish divergence.

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 2 (RS is level). An unstable V-bottom.

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

- Property Trusts [XPJ] - stage 3 (RS is falling)

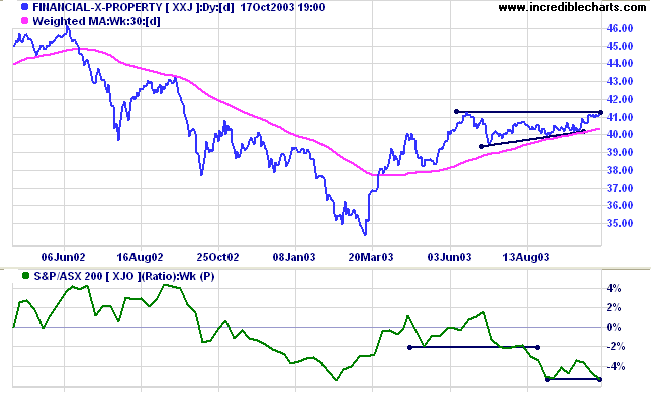

- Financial excl. Property [XXJ] - stage 2 (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is level).

- Utilities [XUJ] - stage 3 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) rose to 63 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Diversified Metals & Mining (5)

- Broadcasting & Cable TV (5)

- Diversified Financial (4)

- Gold (4)

- Publishing (3)

- Construction Materials (3)

- Steel (3)

Stocks analyzed during the week were:

- Publishing & Broadcasting - PBL

- Seven Network - SEV

- Ten Network - TEN

- Prime Television - PRT

- Austereo - AEO

- Southern Cross Broadcasting - SBC

- Macquarie Communications Infrastructure Group - MCG

- Novogen - NRT

- Novus Petroleum - NVS

- Zimbabwe Platinum - ZIM

- Smorgon Steel - SSX

- Lion Selection Group - LSG

- National Australia Bank - NAB

- ANZ Bank - ANZ

- Commonwealth Bank - CBA

- Westpac - WBC

than being an adamant and continuing bear.

...... it is a real danger to look for disaster so constantly

as to miss opportunities.

~ Richard Arms: Trading Without Fear.

The data feed is still beta at this stage - there may be a few bugs that have to be ironed out.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.