|

ETOs and

Warrants ETOs and warrants will be made available to Premium members. The introduction may be delayed until Monday. US stocks will follow. |

Trading Diary

October 10, 2003

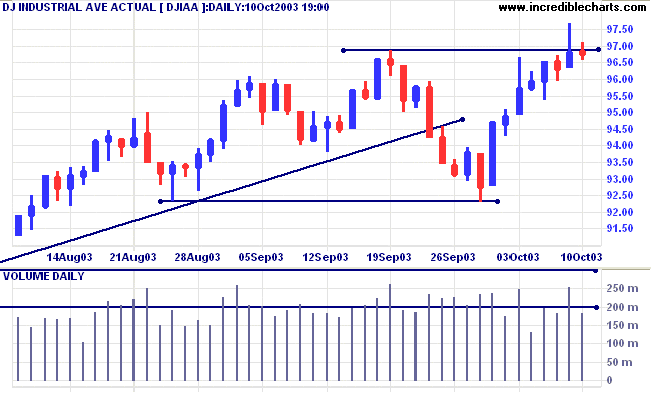

The intermediate trend is uncertain. A rise above 9686 will signal an up-trend.

The primary trend is up. A fall below 9000 will signal reversal.

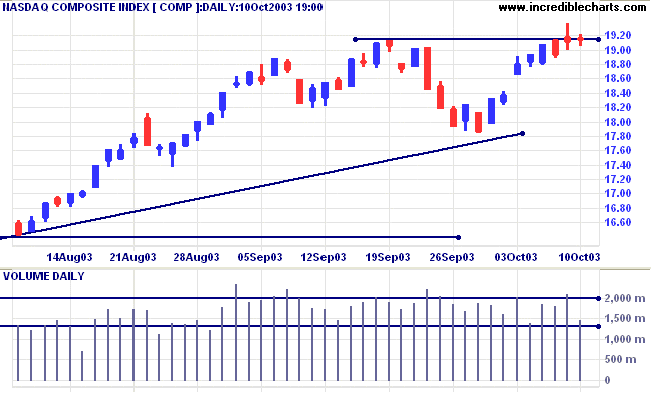

The intermediate trend uncertain. The rise above 1914 is unconvincing.

The primary trend is up. A fall below 1640 will signal reversal.

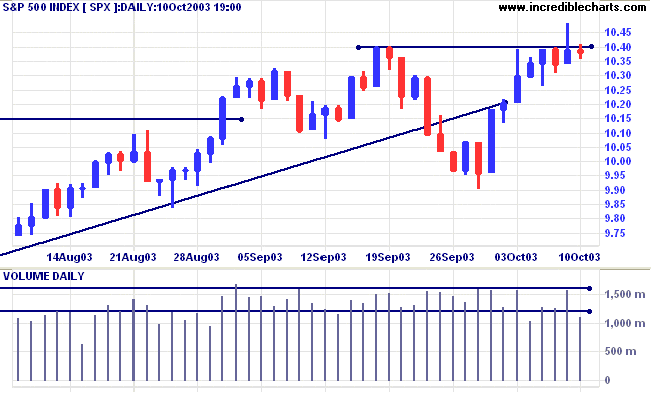

The intermediate trend is uncertain. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1026.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

General Electric lowers earnings expectations for the third time - a sign that all is not right with the US economy. (more)

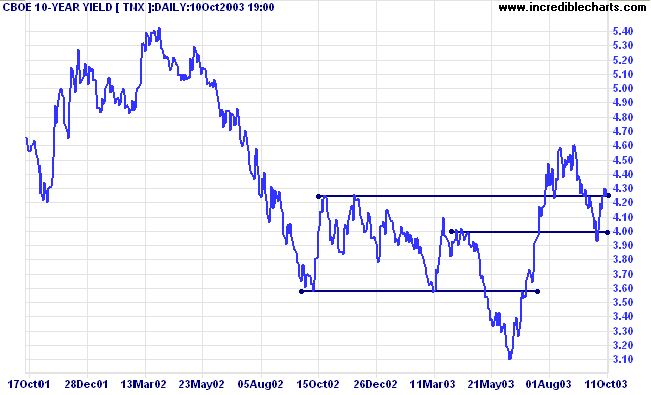

The yield on 10-year treasury notes ended the week at 4.25%, after testing support at 4.00%.

The intermediate down-trend appears weak.

The primary trend is up.

New York (13.30): Spot gold recovered slightly to $373.20.

The intermediate trend has turned down.

The primary trend is up. Support is at 343 to 350.

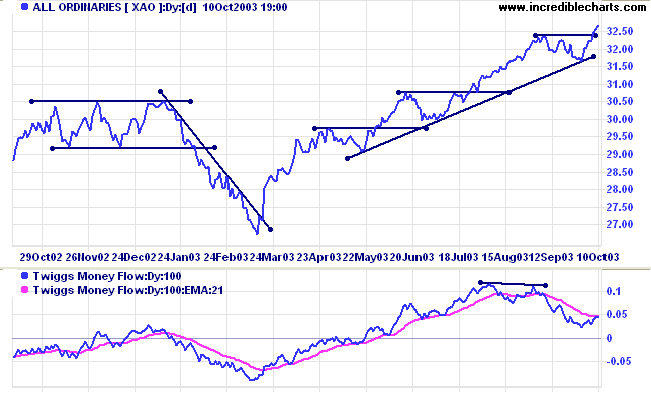

The primary trend is up. A fall below 3000 will signal reversal.

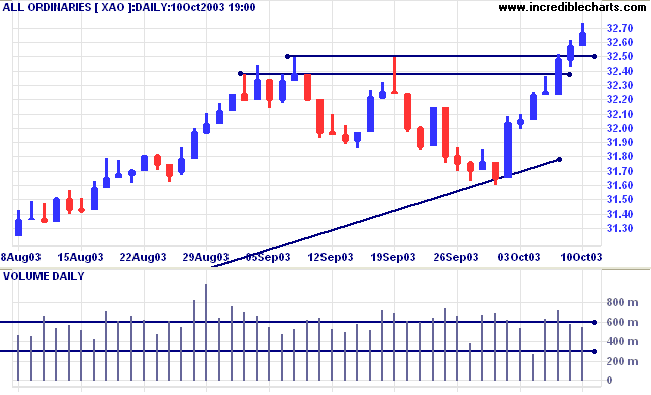

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (100) displays a bearish divergence.

Short-term: Bullish if the All Ords is above 3250.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

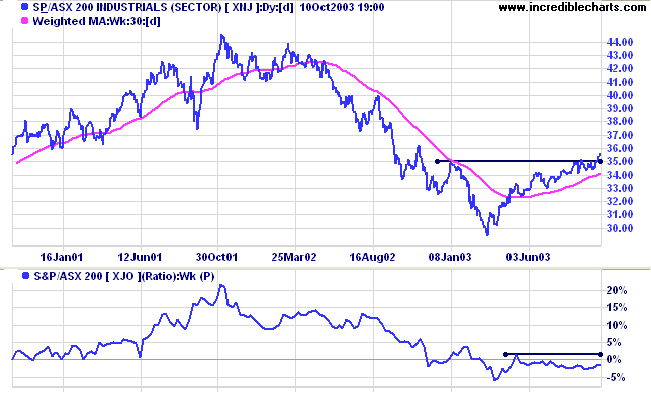

- Industrials [XNJ] - stage 2 (RS is level). An unstable V-bottom.

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

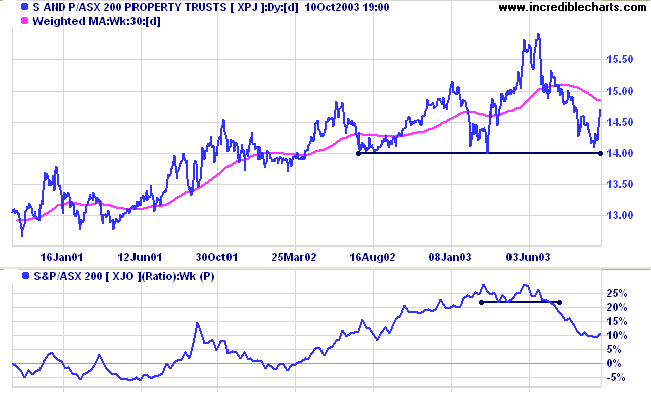

- Property Trusts [XPJ] - stage 3 (RS is falling)

- Financial excl. Property [XXJ] - stage 2 (RS is level)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is rising).

- Utilities [XUJ] - stage 3 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) rose to 58 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Oil & Gas Exploration & Production (5)

- Diversified Metals & Mining (4)

- Broadcasting & Cable TV (4)

- Gold (3)

- Casinos & Gaming (3)

- Publishing (3)

Stocks analyzed during the week were:

- Timbercorp - TIM

- Mincor - MCR

- Telstra - TLS

- CSL Limited - CSL

- Mosaic Oil - MOS

- Patrick - PRK

- Peptech - PTD

- Australian Growth Properties - AGH

- OAMPS Limited - OMP

- Orbital Engine - OEC

you have neutralize your expectations about what the market will or will not do

at any given moment or in any given situation.....(think in terms of probabilities).

~ Mark Douglas: Trading in the Zone.

for only

$270

and the Daily Trading Diary (click here for a free sample).

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.