|

ETOs and

Warrants We are on target to introduce ETOs and warrants this week. US stocks to follow. |

Trading Diary

October 9, 2003

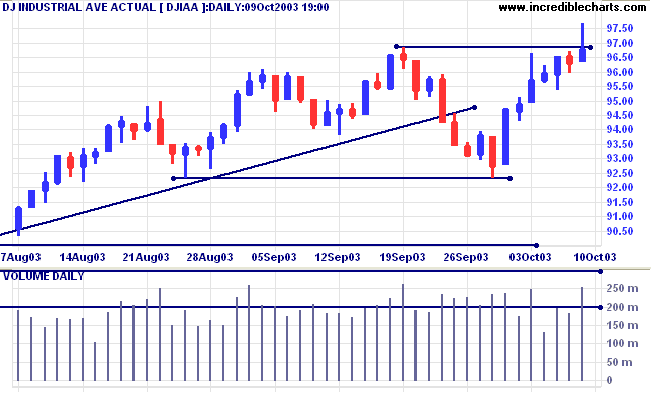

The intermediate trend is uncertain. A rise above resistance at 9686 will signal an up-trend.

The primary trend is up. A fall below 9000 will signal reversal.

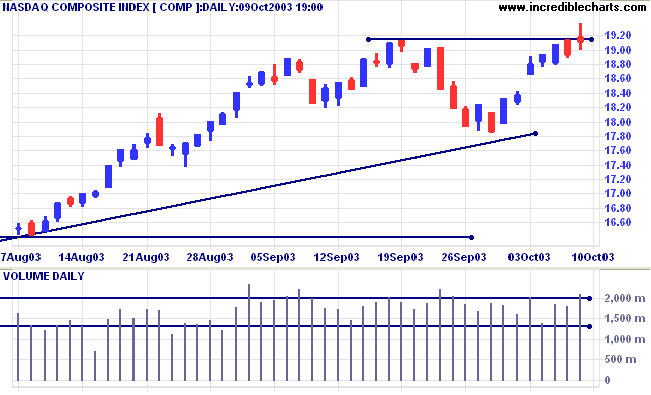

The intermediate trend is uncertain. A rise above resistance at 1914 will signal an up-trend.

The primary trend is up. A fall below 1640 will signal reversal.

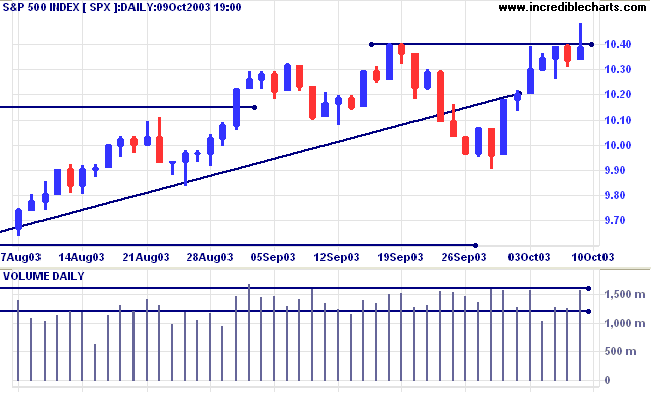

The intermediate trend is uncertain. A rise above resistance at 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1026.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

New unemployment claims fell to 382,000 last week, from a revised 405,000 the week before. (more)

The yield on 10-year treasury notes rallied to 4.30%.

The intermediate down-trend is weak.

The primary trend is up.

New York (20:15): Spot gold fell sharply to $370.60.

The intermediate trend is down.

The primary trend is up. There is a band of support at 343 to 350. A fall below the lower level would signal reversal.

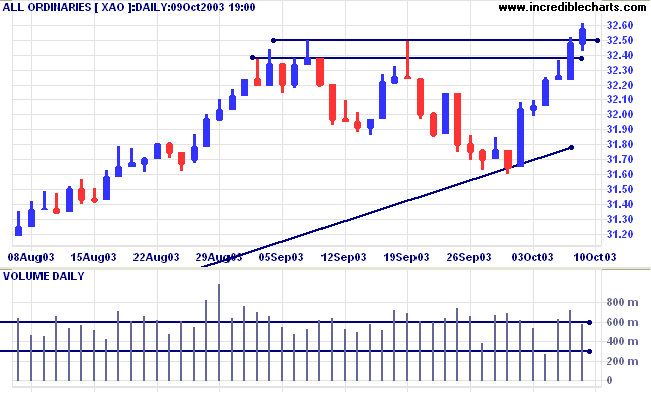

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow (21) has turned up, threatening to cross above the zero line.

Short-term: Bullish if the All Ords is above 3250.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

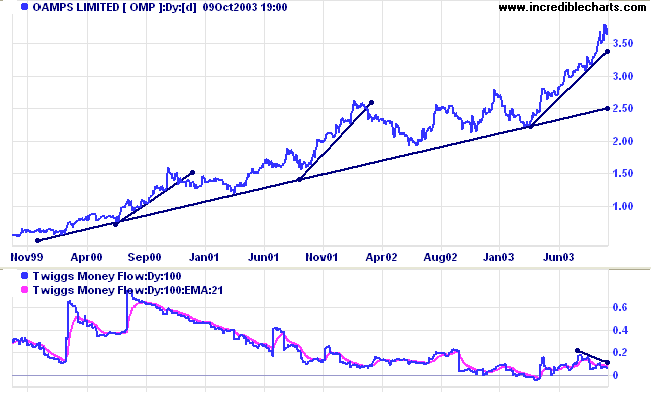

OMP is in a primary up-trend which has lasted more than 4 years; an exceptional performance.

Twiggs Money Flow (100) and (21) show bearish divergences. Relative Strength (price ratio: xao) is rising strongly.

Now would not be a good time to increase (intermediate or long-term) positions, with the secondary rally extended a long way above the primary trendline.

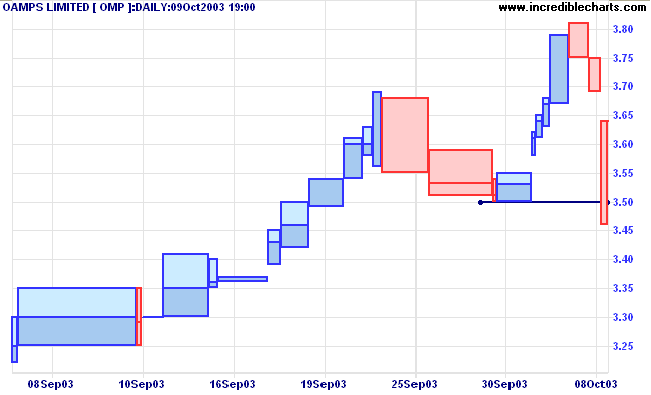

A close below 3.50 would be a bear signal.

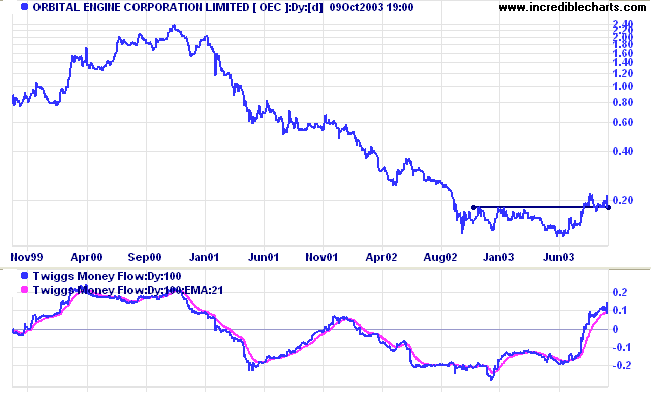

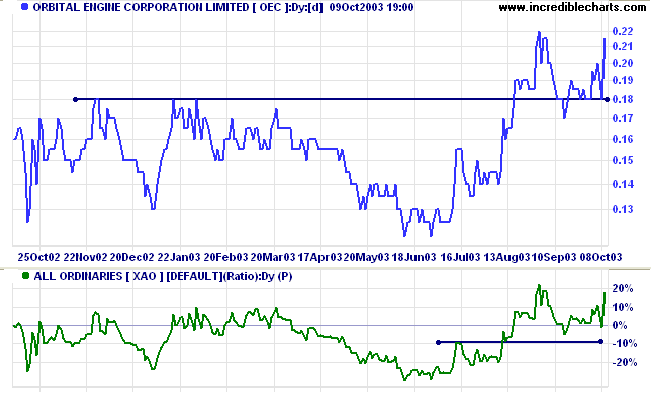

I had to use a log scale with OEC because of the massive fall over the last 3 years; from 2.40 down to 0.20.

Price has formed a base over the last 9 months and has lately broken above resistance before pulling back to test the new support level.

Twiggs Money Flow (100) has surged upwards.

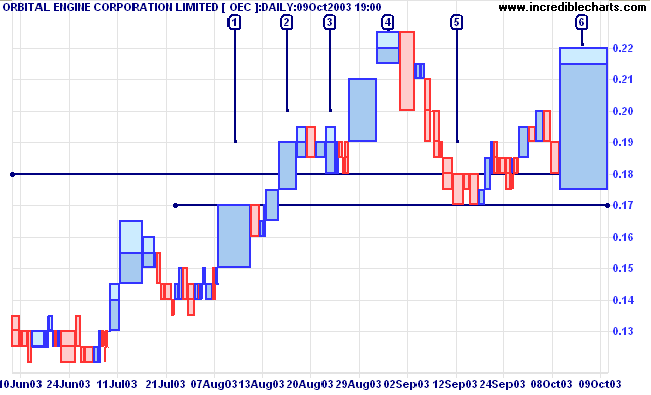

Resistance appeared to have formed at 0.18.

A rise above the high of [4] will be a strong bull signal. A fall below 0.17 will be bearish.

Conservative traders may wait for the next correction so that they can enter nearer the low, allowing tighter stops.

But make allowance for their doubting too.

Rudyard Kipling: If

|

Use the File >>

Export Files command to back up your watchlists (.viz)

and project files (.ini) to a removable disk. Ignore the sub-folders in your directory. These are merely used for the Undo/Redo command. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.