|

ETOs and

Warrants ETOs and warrants are ready and will be introduced next week. US stocks will follow. |

Trading Diary

October 3, 2003

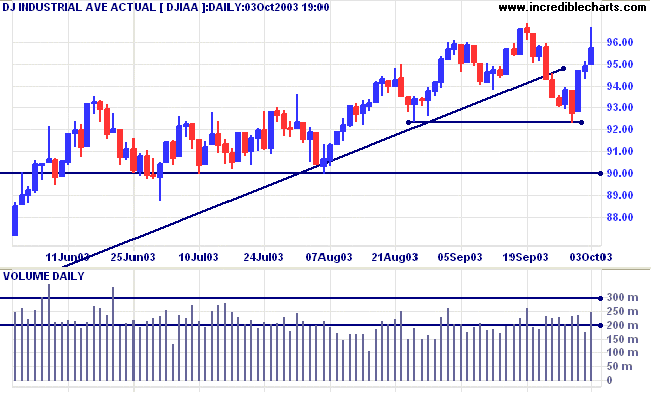

The intermediate trend is down. A rise above 9686 will signal reversal.

The primary trend is up. A fall below 9000 will signal reversal.

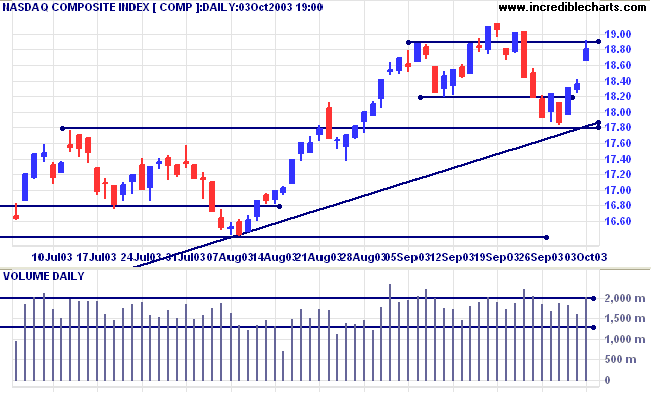

The intermediate trend is down. A rise above 1914 will signal reversal.

The primary trend is up. A fall below 1640 will signal reversal.

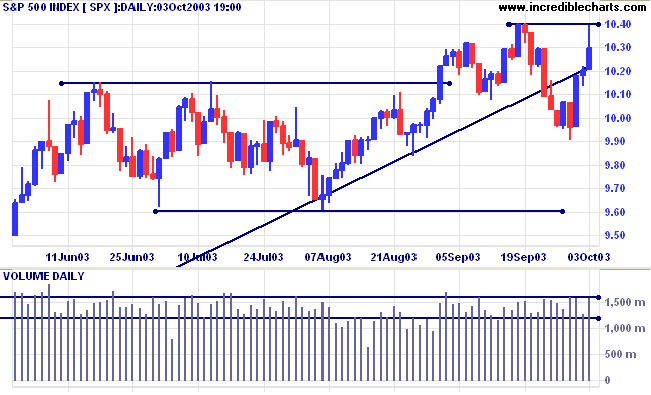

The intermediate trend is weak. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1020. Bearish below 990.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

Non-farm jobs grew by 57,000 in September. The first rise in 8 months. (more)

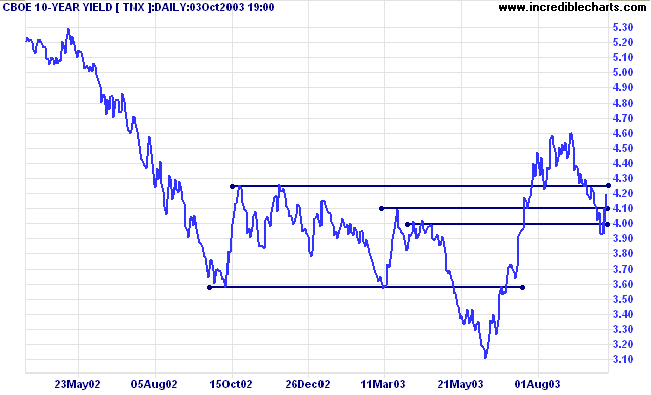

The yield on 10-year treasury jumped sharply to 4.20%, after testing support at 4.00%.

The intermediate down-trend appears weak.

The primary trend is up.

New York (13.30): Spot gold fell sharply to close at $368.70.

The intermediate trend has turned down.

The primary trend is up. A fall below 350 will signal reversal.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

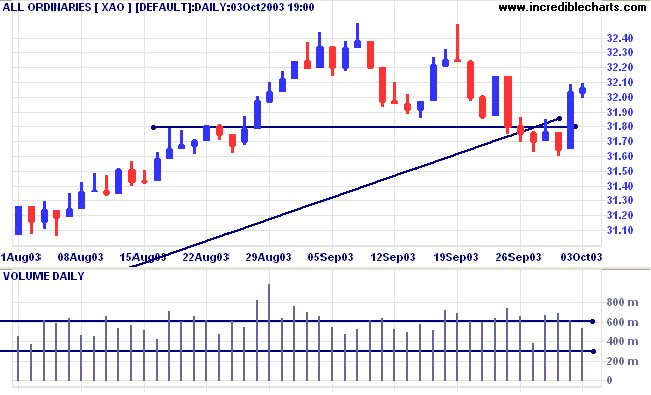

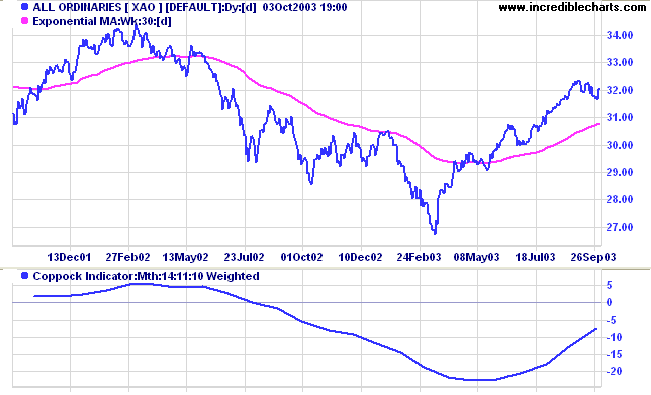

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow signals distribution.

The monthly Coppock Indicator continues to rise below zero, signaling a bull market.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3160.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 1 (RS is level)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

- Property Trusts [XPJ] - stage 3 (RS is falling)

- Financial excl. Property [XXJ] - stage 2 (RS is level)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is rising).

- Utilities [XUJ] - stage 3 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) has fallen to 32 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Gold (5)

- Diversified Metals & Mining (3)

- Oil & Gas Exploration & Production (3)

- Casinos & Gaming (3)

Stocks analyzed during the week were:

- Telstra - TLS

- Aristocrat - ALL

- CSL Limited - CSL

- Newscorp - NCP

- Spotless - SPT

- Foodland - FOA

- Woolworths - WOW

- Consolidated Minerals - CSM

- Primelife - PLF

- Skilled Engineering - SKE

- the experiential, or that which happens to us;

the creative, or that which we bring into existence;

and the attitudinal, or our response in difficult circumstances ....

My own experience with people confirms the point that Frankl makes

- that the highest of the three values is attitudinal ....

In other words, what matters most is how we respond to what we experience in life.

~ Steven Covey: The Seven Habits of Highly Effective People.

for only

$270

and the Daily Trading Diary (click here for a free sample).

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.