|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

September 29, 2003

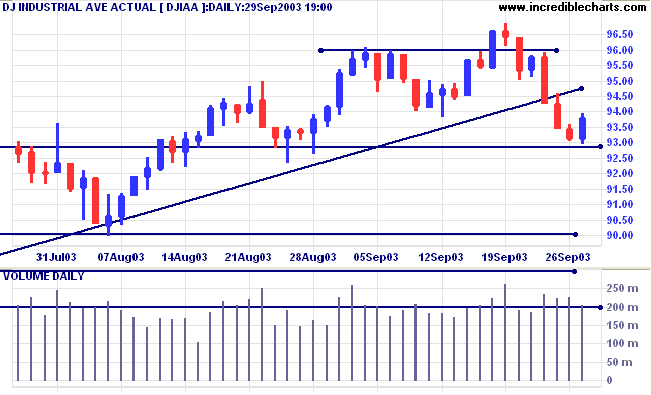

The intermediate trend is weak, with continued low volume.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 9000 will signal reversal.

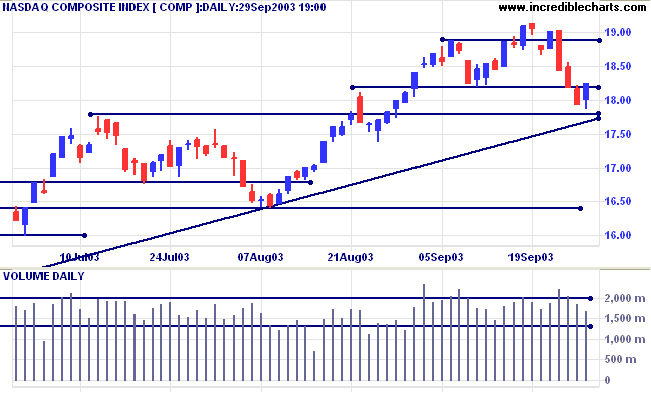

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

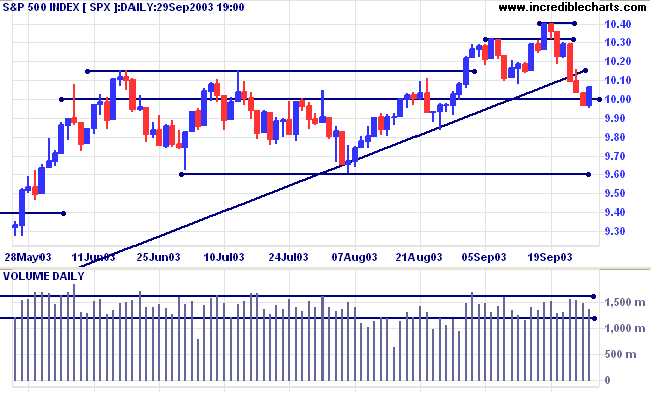

The intermediate trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

Short-term: Bullish if the S&P500 is above 1008. Bearish below 995.

Intermediate: Bullish above 1008.

Long-term: Bullish above 1008.

Fuelled by mortgage refinancing, August consumer spending rose by 0.8%, while personal incomes increased by 0.2%. (more)

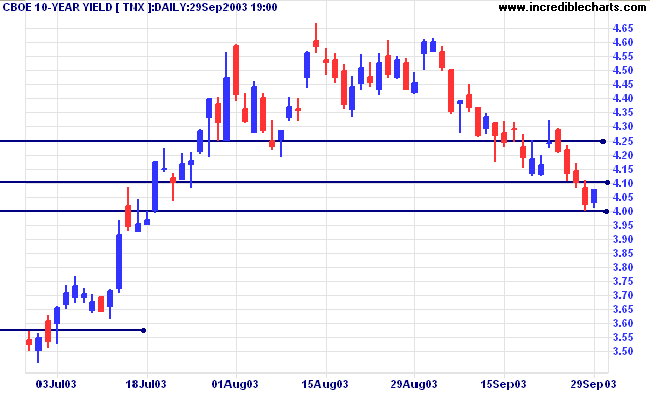

The yield on 10-year treasury notes formed an inside day with a close at 4.08%, after testing support at 4.00%.

The intermediate trend is down.

The primary trend is up. A close below 4.00% will signal weakness.

New York (16:53): Spot gold tested 379 before recovering to 381.80.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

The primary trend is up. A fall below 3000 will signal reversal.

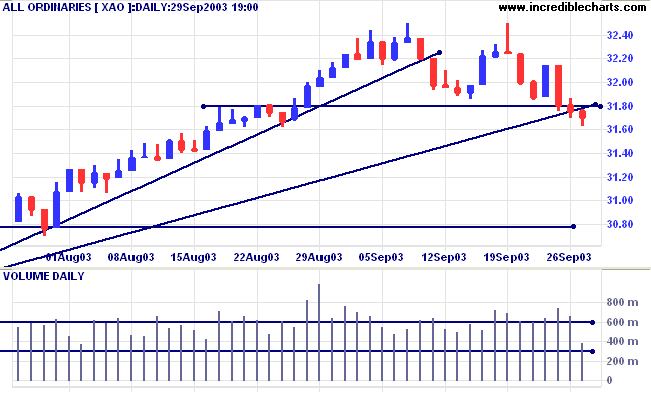

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow (100) displays two bearish peaks below the signal line.

Short-term: Bullish if the All Ords is above 3180. Bearish below 3162.

Intermediate: Bullish above 3180.

Long-term: Bullish above 3180.

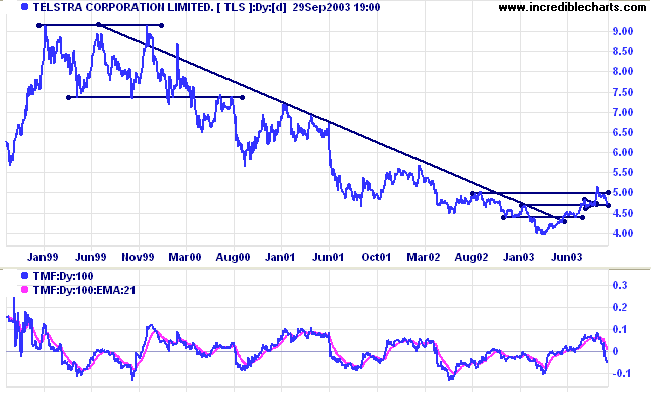

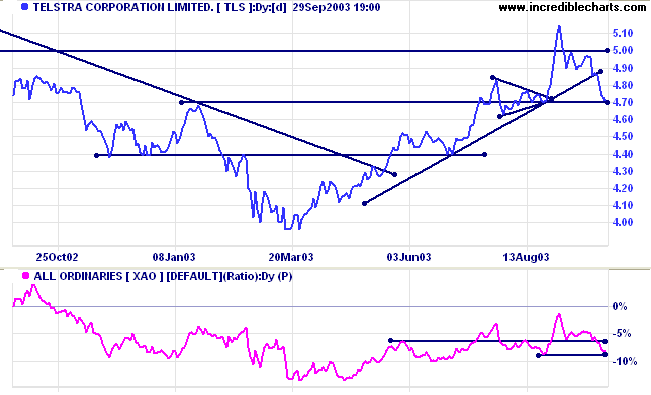

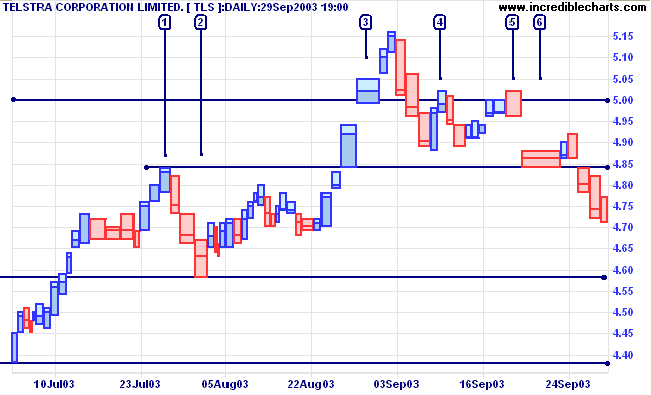

Last covered on August 5, 2003.

TLS formed an unstable V-bottom after a long stage 4 down-trend. Price rallied to test resistance at 5.00 but retreated after making a false (or marginal) break above that level. Twiggs Money Flow (100) has turned down sharply.

After a steady rise, Relative Strength (price ratio: xao) is re-testing support levels. A break below the previous low will be bearish; a new 3-month low will be an even stronger signal.

If you're brave in not being daring, you'll live;

With these two things, in one case there's profit,

in the other there's harm.

The things Heaven hates - who knows why?

The Way is not to fight yet to be good at winning -

Not to speak yet skillfully respond -

No one summons it, yet it comes on its own -

To be at ease yet carefully plan.

~ Lao Tse.

|

Many new members appear to be unaware of

the Screen View buttons to the left of the charts: |

|

|

|

|

|

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.