|

ETOs and

Warrants ETOs and warrants will be available shortly. US stocks will follow. |

Trading Diary

September 24, 2003

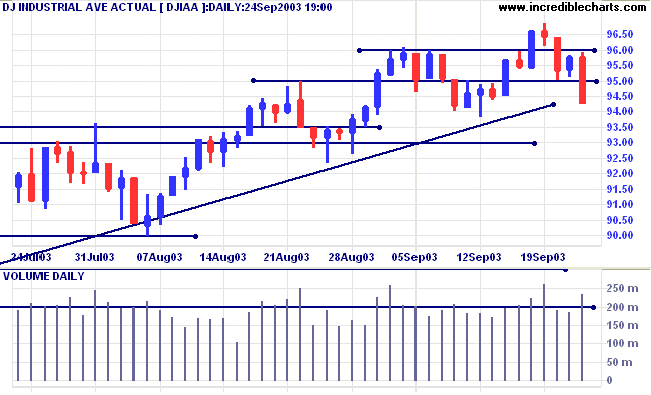

The intermediate trend is up. Low volume in the past month signals weakness. A fall below 9381 will be a further bear signal.

The primary trend is up.

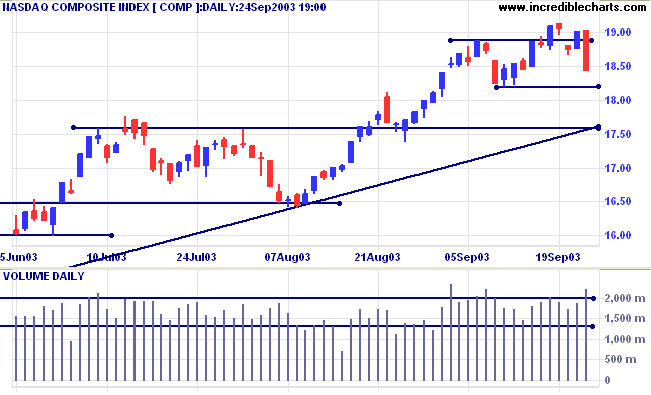

The intermediate trend has turned down and we may see a re-test of the long-term supporting trendline.

The primary trend is up.

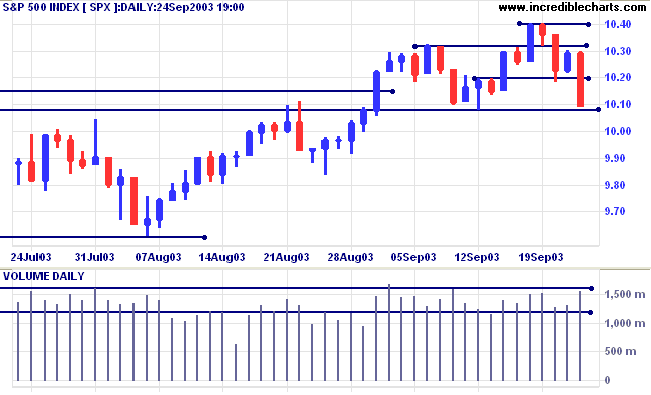

The intermediate trend is up. A fall below 1008 will be bearish, while a fall below 1000 will be a stronger signal.

The primary trend is up.

Short-term: Long if the S&P500 is above 1030. Short if below 1000.

Intermediate: Long if S&P 500 is above 1030.

Long-term: Long if the index is above 1008.

OPEC countries agree to cut production, causing a jump in oil prices. (more)

The FTC is being challenged in the courts in its attempt to set up a national do-not-call list, preventing tele-marketers from making calls to listed private numbers. (more)

An idea that should be considered in Australia.

The yield on 10-year treasury notes closed down at 4.13%.

The intermediate trend has turned down, headed for a test of support at 4.10% to 4.00%.

The primary trend is up.

New York (19:35) Spot Gold has retreated to $388.20, after reaching 389.20.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321) but expect heavy resistance between 400 and 415 (the 10-year high).

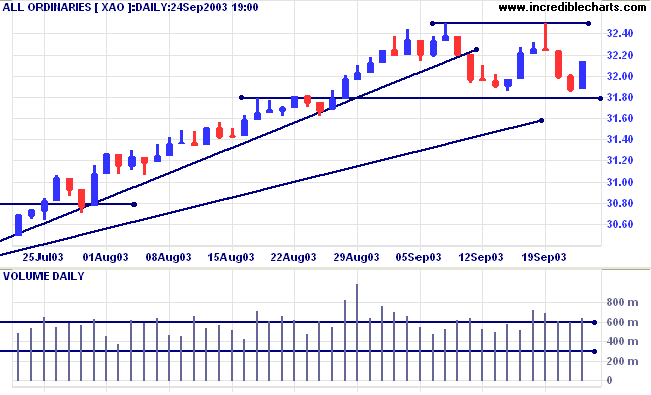

A fall below 3180 would signal a reversal.

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow has turned up, below zero, after a bearish divergence.

Short-term: Long above 3201. Short if below 3180.

Intermediate: Long if the index is above 3201.

Long-term: Long if the index is above 3180.

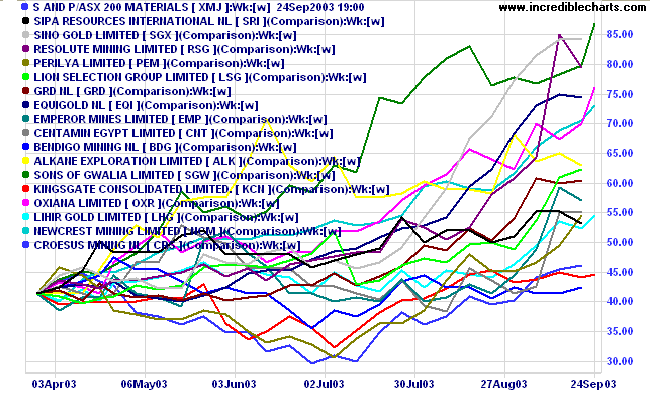

Of twenty ASX 300 stocks with the highest relative strength for the last month, 8 are gold stocks. The 6-month comparison chart shows a similar bullish picture.

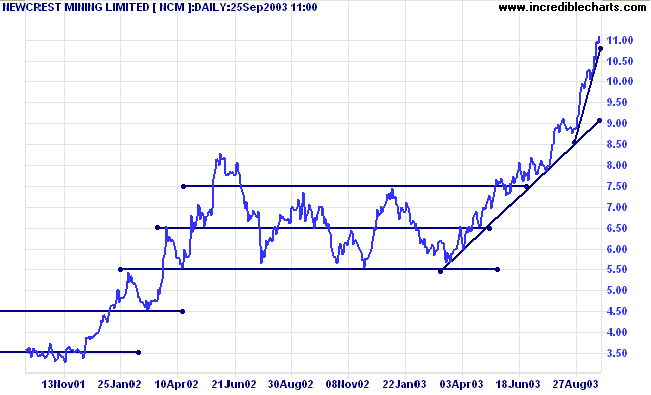

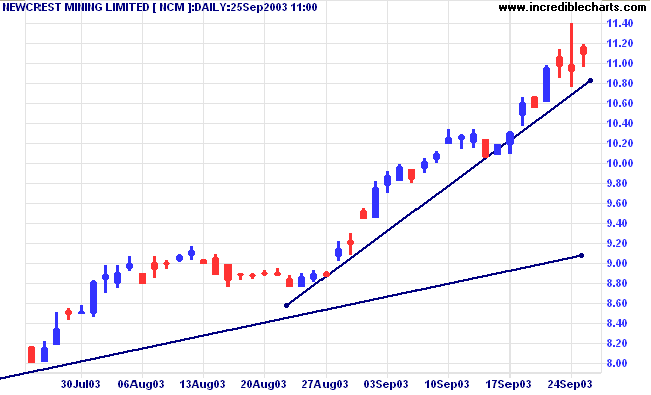

Price has accelerated from a fast trend towards a blow-off spike. This a self-reinforcing cycle where the higher price rises, the more investors are convinced that prices will go higher. There is only one outcome: an eventual sharp correction back to the longer-term trendline, when fear overcomes euphoria.

In the final phase of a blow-off, I prefer to switch to a trailing percentage stop of 6% or 8%, depending on the volatility of the stock. It is important to calculate the trailing stop on intra-day highs and not merely on closing price as many brokers do.

and is not governed by conditions but by fears,

takes the easiest way - he stops thinking that there must be a limit to the advances.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

|

Stock Screening: Relative

Strength To screen for Relative Strength, I use the % Price Move filter. For example, to find the relative strength of securities over a 1-month time frame: (1) select the ASX 200 or ASX 300 under Indexes & Watchlists; (2) open % Price Move; (3) enter 9999 as the 1-month Maximum; (4) Submit; and (5) sort the results by clicking at the top of the %M(1M) column. To screen for RS over 1 year, simply enter 9999 as the 1-year Maximum instead. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.