|

ASX hourly updates Our data suppliers had problems with their servers in the US, causing us to miss the first two hourly updates on Thursday. Closing prices for the 17th were also briefly affected when the service was switched to a backup server. The normal service has resumed and we will continue to monitor the situation. |

Trading Diary

September 18, 2003

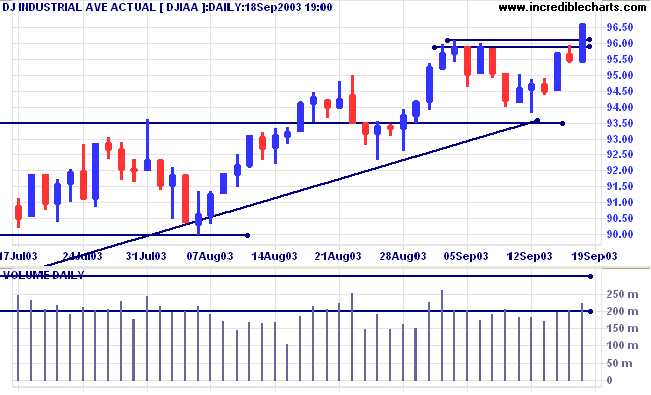

The intermediate trend is up. Continued low volume signals weakness.

The primary trend is up.

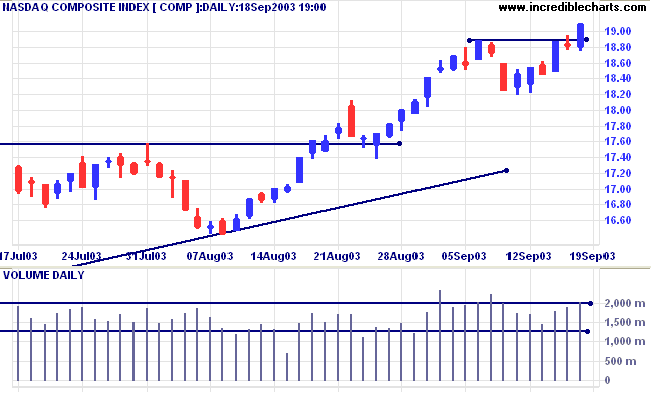

The intermediate trend is up.

The primary trend is up.

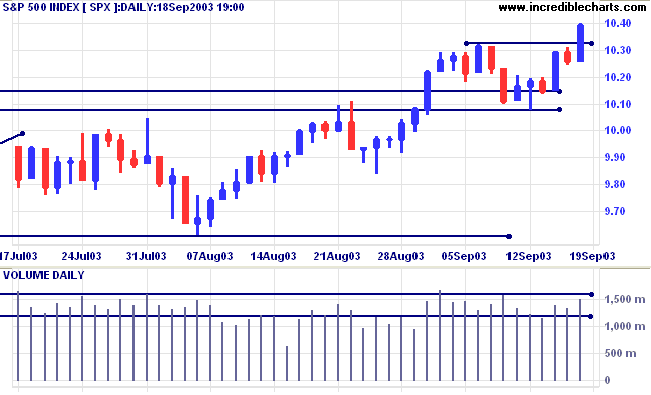

The intermediate trend is up.

The primary trend is up.

Short-term: Long if the S&P500 is above 1032.

Intermediate: Long if S&P 500 is above 1032.

Long-term: Long if the index is above 1015.

New unemployment claims fell to 399,000 for last week. (more)

The yield on 10-year treasury notes closed lower at 4.18%, below support at 4.20%.

There is a further band of support below, at 4.00 to 4.10, so I do not yet expect a re-test of the previous lows.

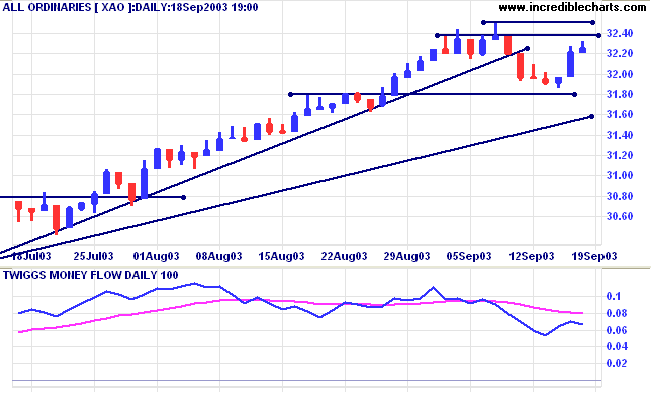

The intermediate and primary trends are both up.

New York (20.22): Spot gold has rallied to $376.40.

The primary trend is up.

Price has broken above a symmetrical triangle formed since the start of the year. If gold rises above resistance at 382, the target is the 10-year high of 420.

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow is above zero, after a bearish divergence.

Short-term: Long if the All Ords is above 3232.

Intermediate: Long if the index is above 3232.

Long-term: Long if the index is above 2978 .

Last covered August 5, 2003.

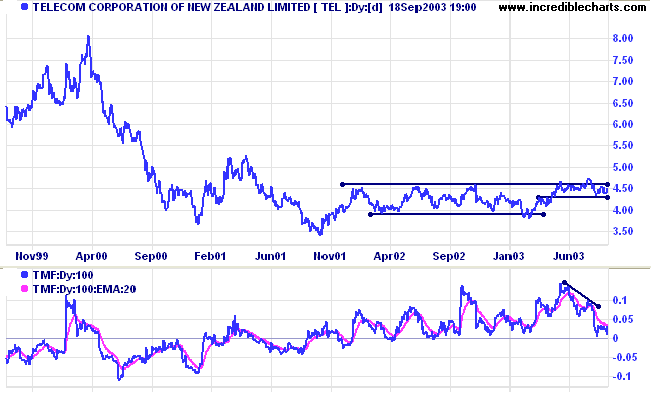

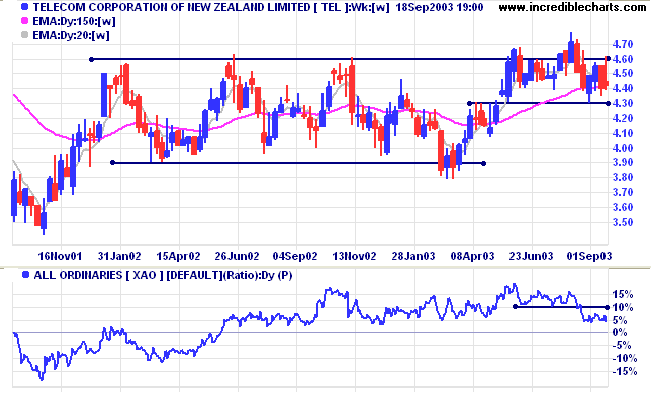

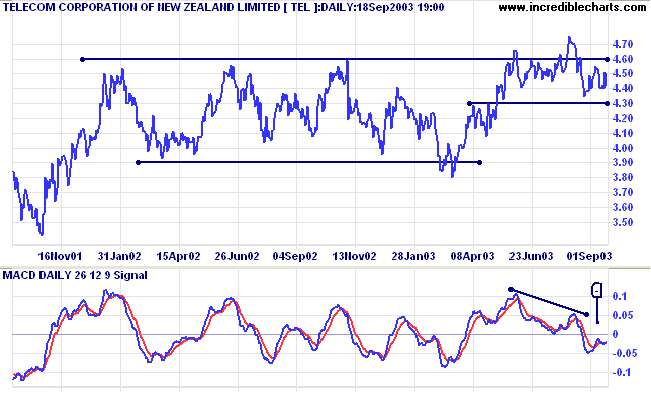

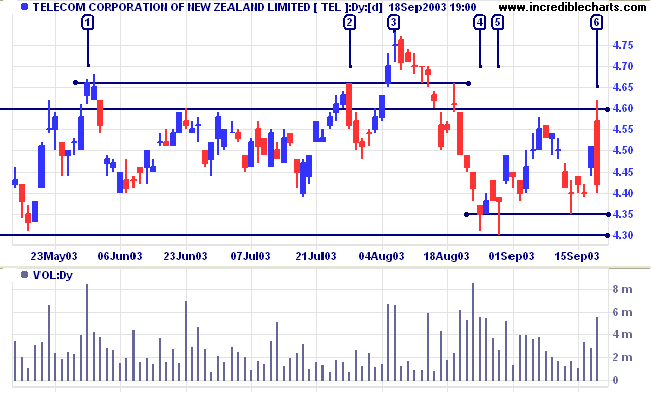

TEL has formed a broad base, with Twiggs Money Flow (100) signaling strong accumulation over the past year. In the last 4 months price has consolidated just below resistance at the upper edge of the base, a bullish sign.

Support has formed at 4.30, the high from April.

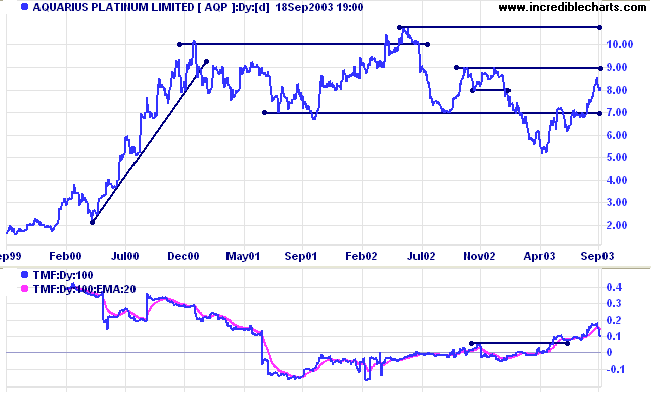

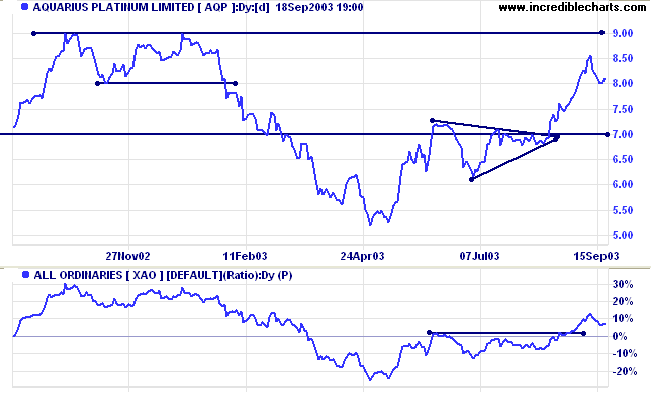

After a marginal new high in mid-2002, AQP corrected back, in two steps, to 5.00. Price immediately rallied, forming an unstable V-bottom. Twiggs Money Flow (100) has risen above zero, to signal accumulation.

Note the narrow double bottom at the end of April, a strong intermediate bull signal. This was followed by consolidation around the 7.00 resistance level in the form of a symmetrical triangle.

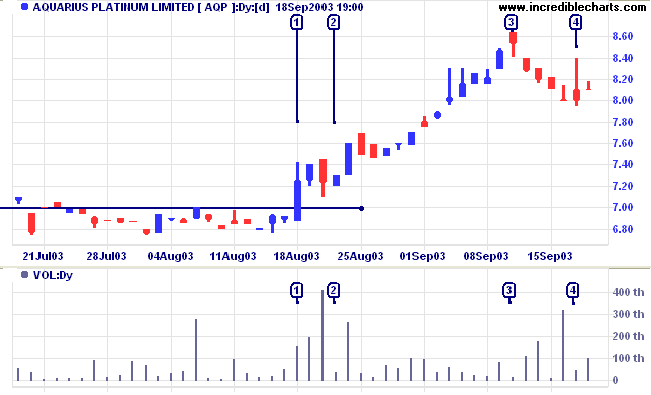

A rather strange signal at [3]: price gapped up at the opening then retreated before again rallying to make a higher close. Volume gives a clue: there are no buyers. The correction takes too long, warning that the trend is changing, while the attempted rally at [4] fades on low volume. Sellers dominate and we may see a second leg down to test support at 7.60.

Longer-term support is at 7.00 and resistance at 9.00.

~ Warren Buffet.

|

You can now search the complete trading diary archives. All

the archives have been edited to include square brackets

around stock codes. Example: to search for BHP enter +"back issues" +[bhp] in the search field. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.