|

ETOs and Warrants We have not forgotten about ETOs and warrants. We just had to make a detour first: we encountered problems with the larger menu sizes and had to re-build the securities and watchlist menus to cope. This has now been completed, with version 4.0.2.500, and we hope to have news for you shortly. I have learnt that the words "this will not take more than a week" should not be taken literally when developing software. |

Trading Diary

September 17, 2003

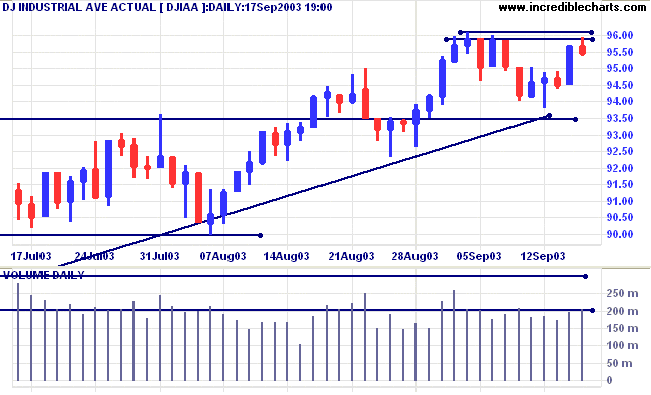

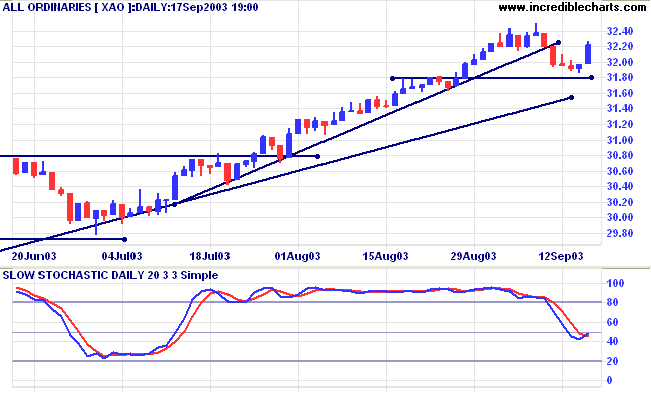

The intermediate trend is up. Continued low volume signals weakness.

The primary trend is up.

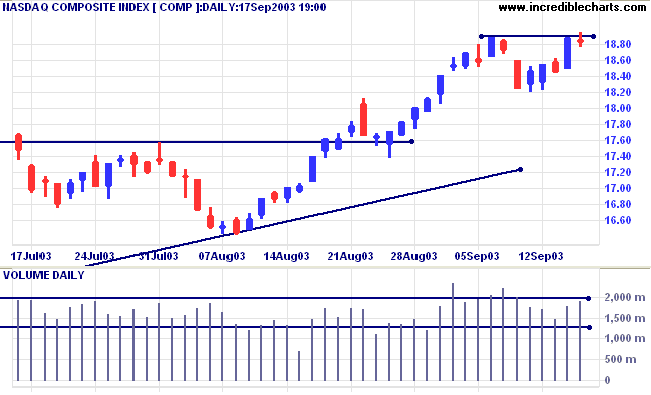

The intermediate trend is up.

The primary trend is up.

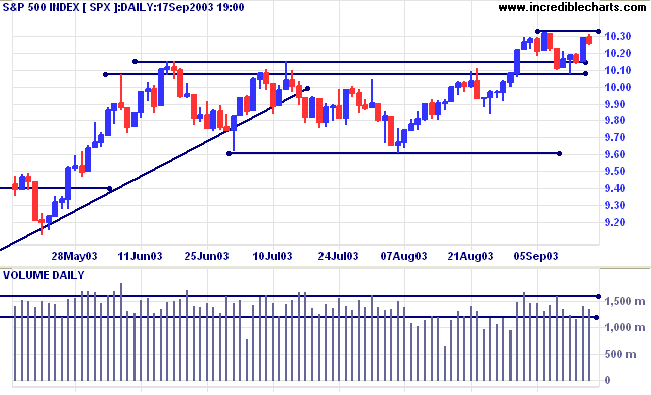

The intermediate trend is up.

The primary trend is up.

Short-term: Long if the S&P500 is above 1032.

Intermediate: Long if S&P 500 is above 1032.

Long-term: Long is the index is above 960.

The US budget deficit passes $400 billion for the first time. (more)

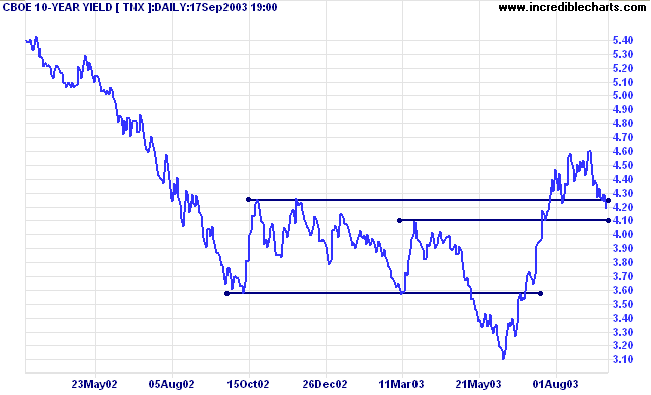

The yield on 10-year treasury notes closed down at 4.19%, below support at 4.20%.

There is a further band of support below, at 4.00 to 4.10, so I do not yet expect a re-test of the previous lows.

The intermediate and primary trends are both up.

New York (21.30): Spot gold has rallied to $376.90.

The primary trend is up.

Price has broken above a symmetrical triangle formed since the start of the year. If gold rises above resistance at 382, the target is the 10-year high of 420.

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow has crossed back above zero, after a bearish divergence.

Short-term: Long above 3202.

Intermediate: Long if the index is above 3180.

Long-term: Long if the index is above 2978 .

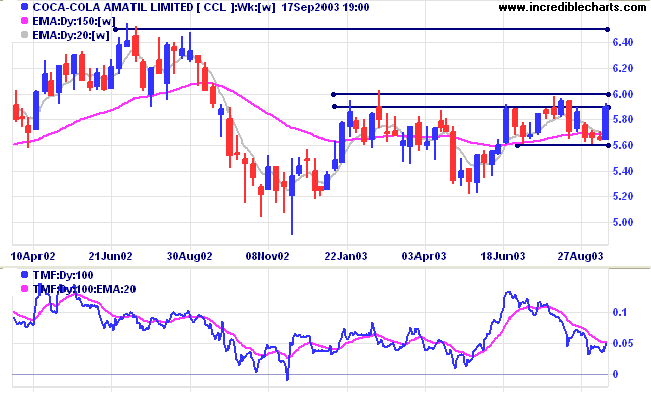

CCL formed a narrow inverted head and shoulders reversal at the end of 2002 before rallying to 6.00. Price then corrected back to re-test support (note that support formed at the level of the right shoulder) before again rallying to test 6.00. The stock is now consolidating between 5.60 and 6.00.

Twiggs Money Flow (100) signals accumulation, while the 21-day indicator has crossed above its downward trendline, a bullish sign.

MACD is neutral, crossing above its signal line while below zero.

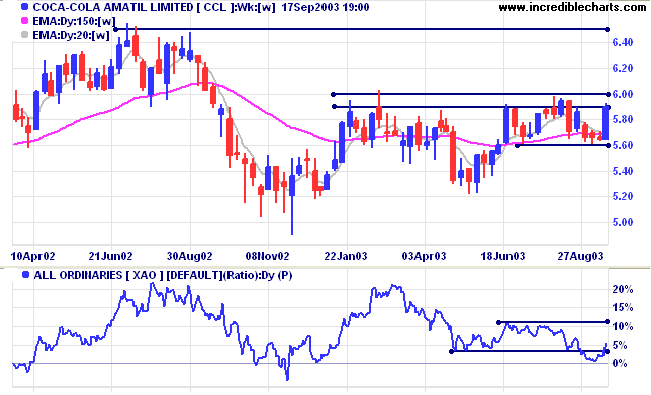

The indicator has now crossed back above support. A higher low will be a bullish sign, while a 3-month high will be a stronger signal.

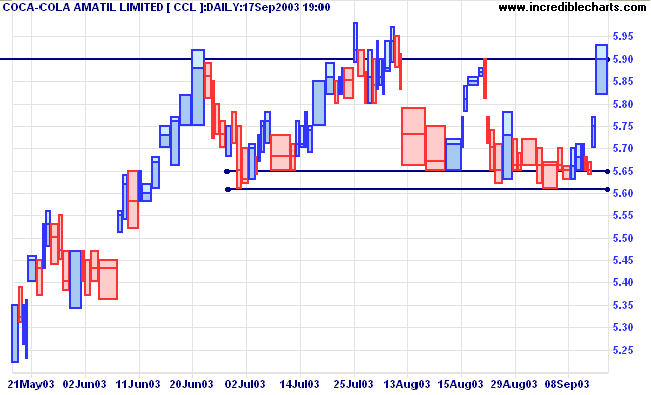

Tests of resistance have so far lacked commitment, evidenced by thin volume. The latest gap up is also likely to exhaust momentum.

Heavy volumes confirm the strength of the support level at 5.62/5.65.

A fall below 5.62 would be bearish.

To go long, place a buy-stop just above 6.00, with a stop-loss just below 5.90.

To go short, place a sell-stop below 5.62, with a stop-loss just above 5.65.

it will instantly disappear and be replaced by something even more bizarre and inexplicable.

There is another theory which states that this has already happened.

~ Douglas Noel Adams: Hitchhiker's Guide to the Galaxy.

|

To display partially completed weeks or months on the price

chart and to show weekly or monthly indicator values for an

incomplete period: select File >> Advanced Features >> Display Part-Periods. See Display Part Periods for further details. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.