|

Incredible Charts version

4.0.2.500 The new version is now available. Check Help>>About to ensure that your software has been automatically updated. The update offers further improvements to the watchlist menu, powerful new scrolling features and supports the use of Large Font settings on laptop (and desktop) computers. See What's New? for further details. |

Trading Diary

September 16, 2003

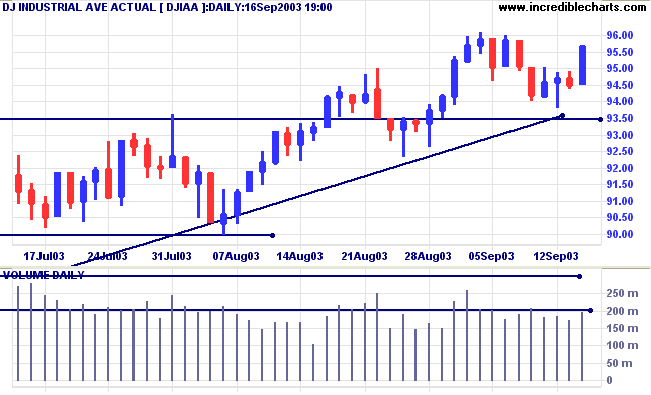

The intermediate trend is up. Continued low volume signals weakness.

The primary trend is up.

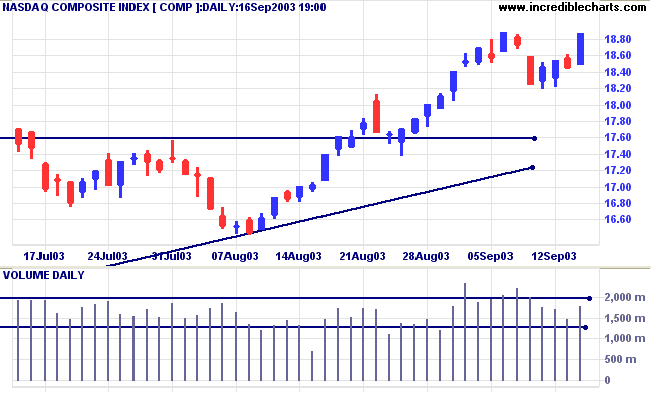

The intermediate trend is up.

The primary trend is up.

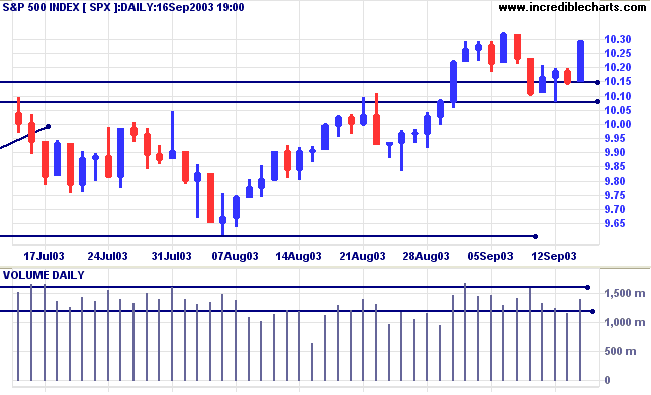

The intermediate trend is up.

The primary trend is up.

Short-term: Long if the S&P500 is above 1023.

Intermediate: Long if S&P 500 is above 1023.

Long-term: Long is the index is above 960.

The Fed left rates unchanged and appears prepared to keep them low for some time. (more)

The yield on 10-year treasury notes closed at 4.29%, above support at 4.20%.

The intermediate and primary trends are both up.

New York (21.11): Spot gold eased to $372.90.

The primary trend is up.

Price has broken above a symmetrical triangle formed since the start of the year. If gold rises above resistance at 382, the target is the 10-year high of 420.

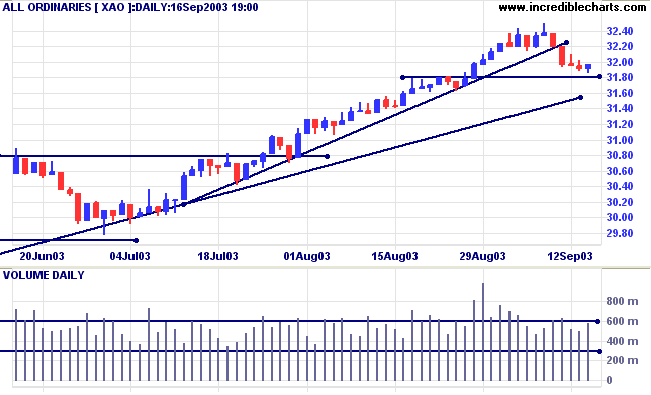

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow has crossed back above zero, after a bearish divergence.

Short-term: Long above 3202.

Intermediate: Long if the index is above 3160.

Long-term: Long if the index is above 2978 .

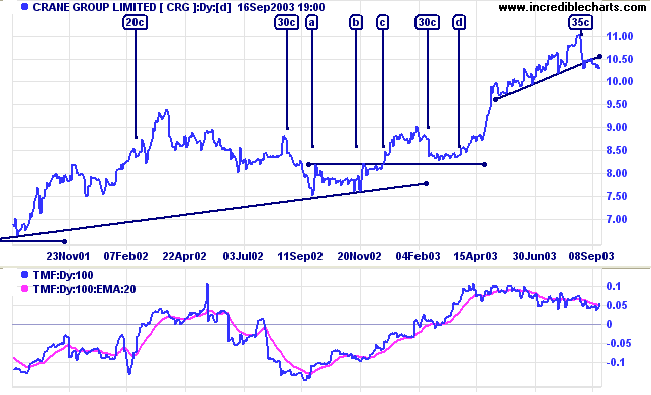

This industrial machinery stock staged a strong rally in 2001/2002 before entering a lengthy consolidation which ended with a breakout at [c]. The dividend ex-dates are shown as [20c], [30c], etc.

Price formed a rectangle at [a] to [b], with equal highs and equal lows, before consolidating just below resistance, between [b] and [c], a bullish sign. Price then broke through resistance at [c], rallying to 9.00.

The stock then went ex on a 30 cent dividend, giving the appearance of a pull-back on the chart. In fact this was a sideways consolidation, another bullish signal, with a breakout at [d].

Twiggs Money Flow (100) has by this stage crossed above zero to add further weight to the bull signal.

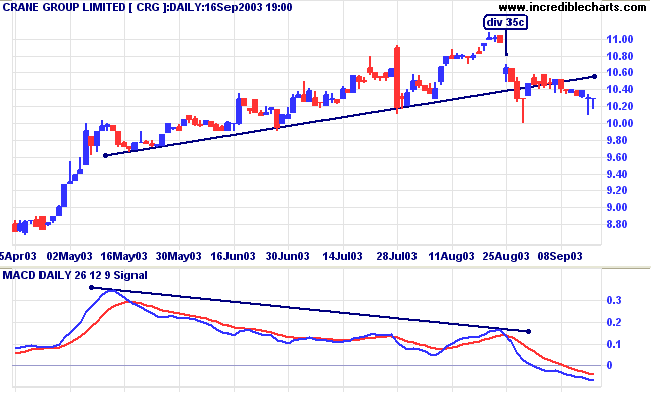

Another dividend ex-date on August 25 causes an artificial break of the trendline.

MACD shows a bearish divergence and Relative Strength shows an artificial fall.

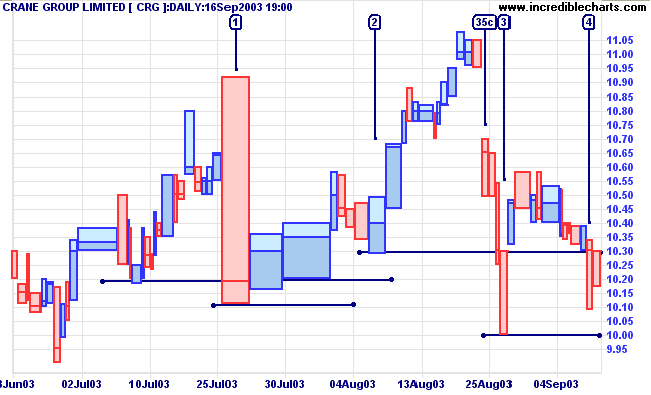

In fact, strong support is evident above that, at 10.30/10.00, with very weak closes at [3] and [4].

A fall below 10.00 would be bearish.

- Adjust past price history, the same as you would for any

other dilution factor.

This method is applied by yahoo on their charts. - Add the dividend to the price, as is done with an accumulation index.

- Make no adjustment, just disclose the dividend by way of note or caption.

But first, we have to obtain a reliable source of dividend history.

The shadow is what we think of it; the tree is the real thing.

~ Abraham Lincoln.

|

If you use Microsoft Outlook, rather than Outlook Express,

as your default email client: select File >> Advanced Features >> Send Email with Outlook. See Help: Email Charts for further details. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.