|

Next update One advantage of subscribing to Incredible Charts is that you will never have to purchase a software upgrade: your software is upgraded automatically with each live update. The next update will be available in the next few days. The new version offers further improvements to the watchlist menu, powerful new scrolling features and enables members to use Large Font settings on their laptop (or desktop) computers. |

Trading Diary

September 3, 2003

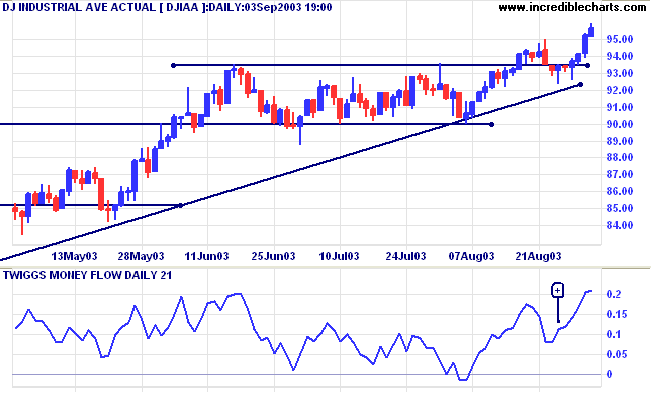

The intermediate trend is up.

The primary trend is up.

Twiggs Money Flow and MACD are both bullish.

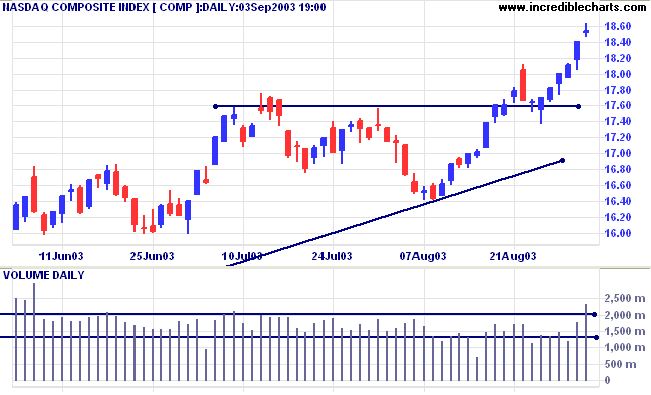

The intermediate trend is up.

The primary trend is up.

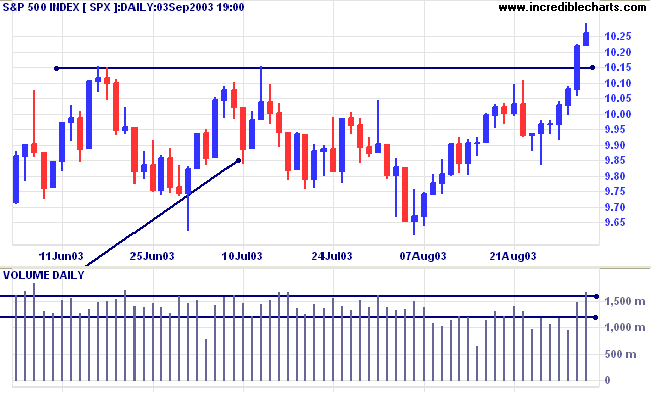

The intermediate trend is up.

The primary trend is up.

Short-term: Long above 1022.

Intermediate: Long if the index is above 1015.

Long-term: Long if the index is above 960.

Domestic vehicle sales are well above forecasts, a healthy sign for a recovery. (more)

After consolidating above its new support level, the 10-year treasury note yield held at 4.60%.

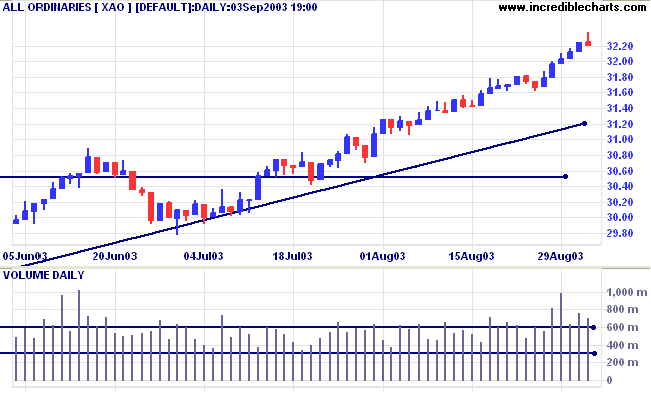

The intermediate and primary trends are both up.

New York (20.21): Spot gold is 3 dollars up at $374.20.

The primary trend is up.

Price has broken above a symmetrical triangle, with a target of 420. There is still some resistance at 382.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has swung below its signal line;

Twiggs Money Flow signals accumulation.

Short-term: Long if the XAO is above 3237.

Intermediate: Long if the index is above 3162.

Long-term: Long if the index is above 2978 .

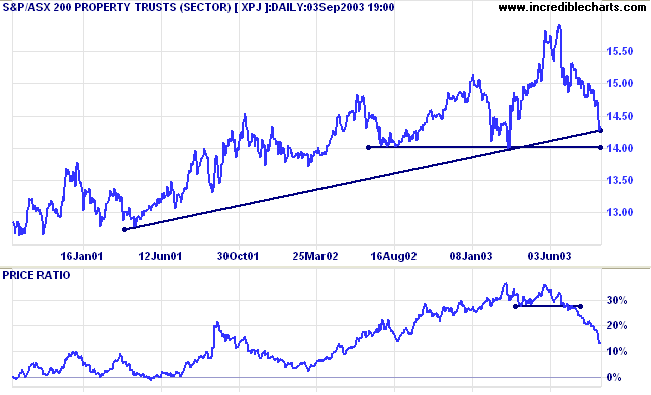

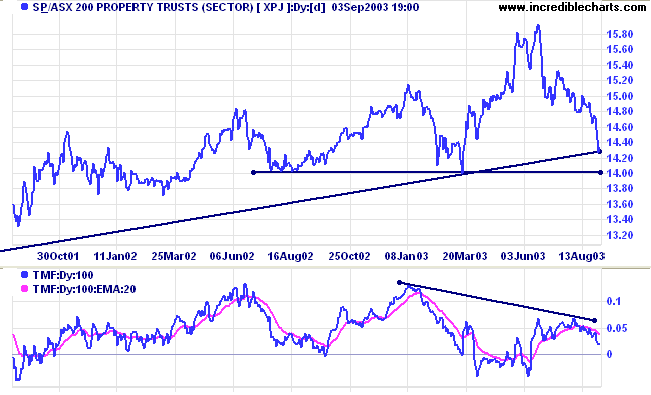

The Property index [XPJ] threatens to break below its long-term upward trendline. The trendline is only a momentum indicator and a reversal to a stage 4 down-trend will only take place when price breaks through support at 1400.

Relative Strength has fallen to a new 1-year low.

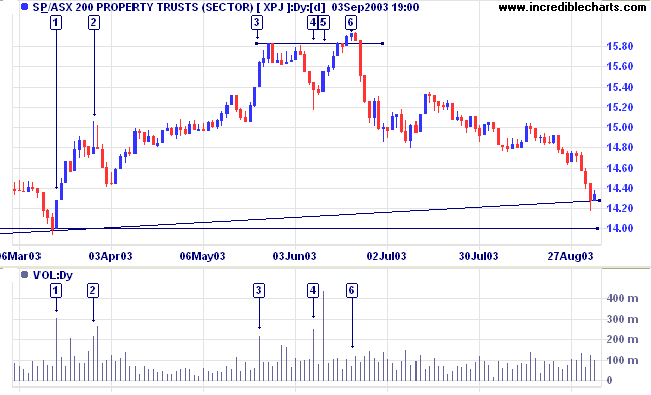

The fast rally at [3] is accompanied by strong volume.

After a failed attempt to break above the previous high, price retreats to [4]. The weak close and high volume signal accumulation at the 1532 support level.

The next rally starts with heavy volume at [5] but fades to low volume at [6]; a false break above the previous high.

Price has since retreated on light volume, falling through several support levels, before pausing briefly at the long-term trendline. Volume has given no sign of a reversal.

The true test will come at 1400.

You are right because your data and reasoning are right.

~ Warren Buffet

|

The quickest way to set up a watchlist is to use the

Stock Screen menu. To create a watchlist of the ASX 50:

You will now have a watchlist of the ASX 50. You can

add and delete individual stocks as you please.

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.