|

US Data - Monday I may have succeeded in confusing most readers with my message yesterday. We received an update file from our data supplier, despite the market being closed for Labor Day. Most indexes were blank (as one would expect), except for the few that have international input. Apologies to anyone who waited for an update. At least all were aware that there was no index data despite the time stamp showing otherwise. |

Trading Diary

September 2, 2003

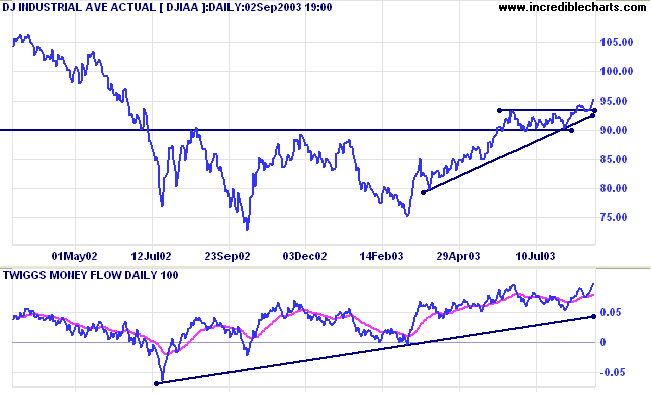

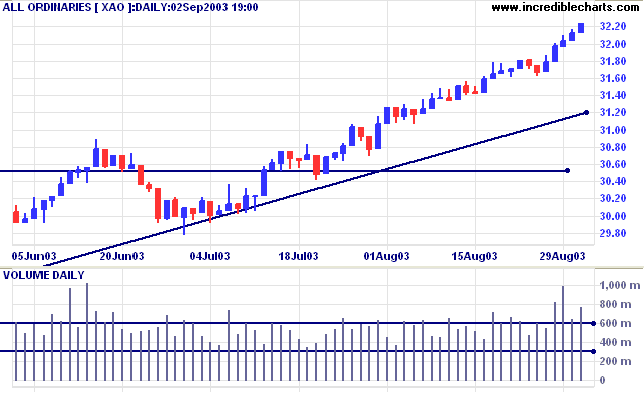

The intermediate trend is up.

The primary trend is up.

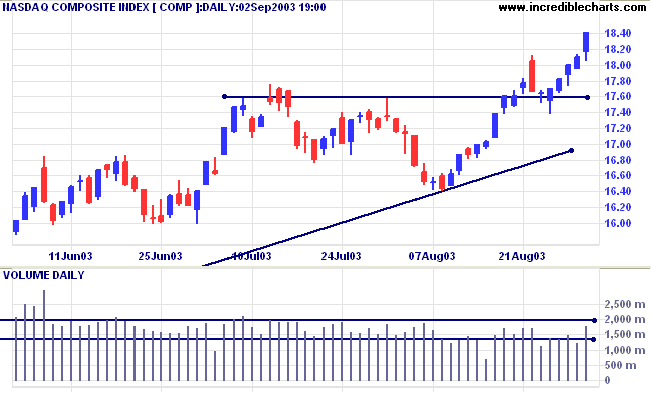

The intermediate trend is up.

The primary trend is up.

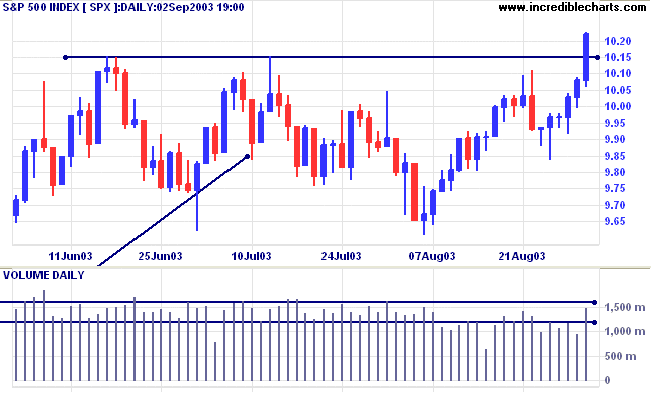

The intermediate trend has reversed up.

The primary trend is up.

Short-term: Long above 1015.

Intermediate: Long if the index is above 1015.

Long-term: Long if the index is above 960.

The recovery faces several obstacles: persistently high unemployment; rising long-term interest rates; huge budget and current account deficits; security threats; and high energy costs. (more)

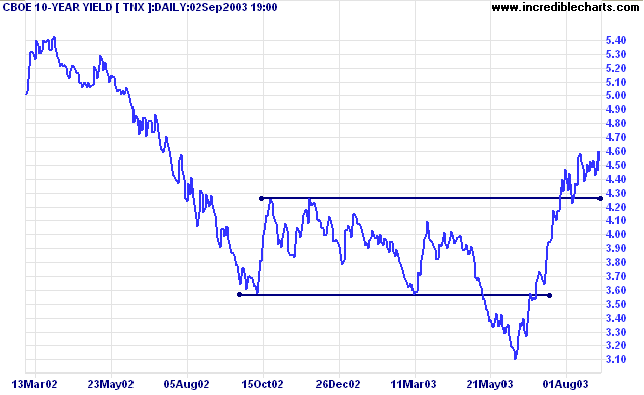

After consolidating above its new support level, 10-year treasury note yield has rallied to a 1-year high of 4.60%.

The intermediate and primary trends are both up.

New York (17.57): After flirting with 379, spot gold retreated to test the new support level at 371, and is currently trading at $371.20.

The primary trend is up.

Price has broken above a symmetrical triangle, with a target of 420. There is still some resistance at 382.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is above;

Twiggs Money Flow signals accumulation.

Short-term: Long above 3212. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3160.

Long-term: Long if the index is above 2978 .

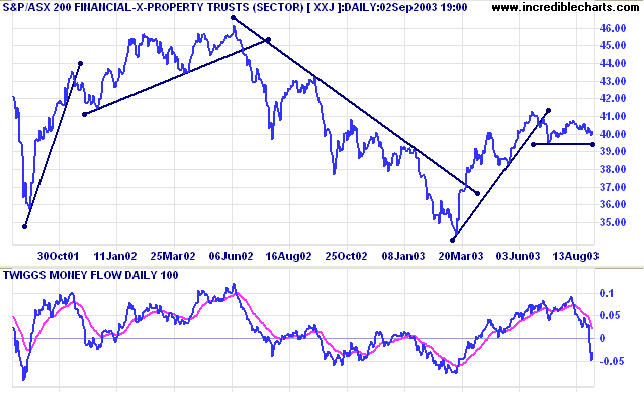

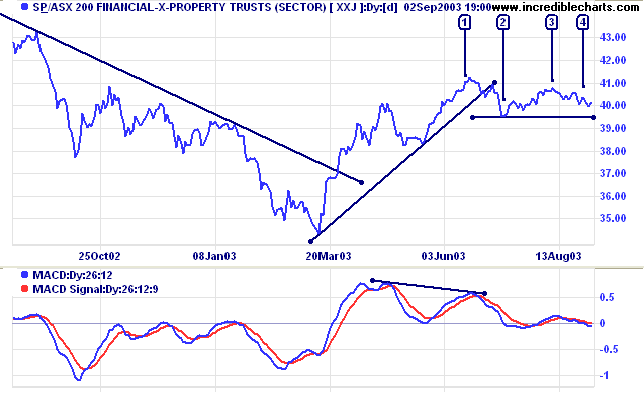

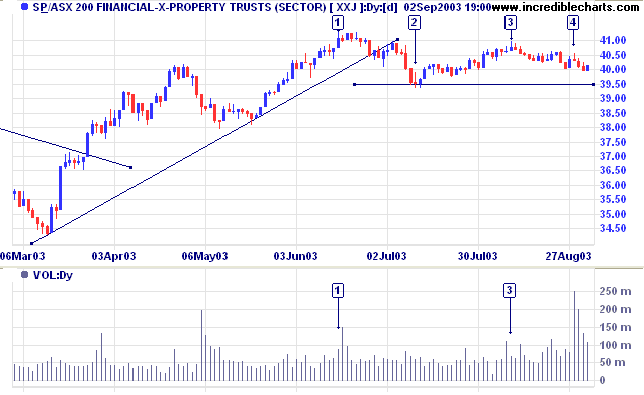

The Financial-X-Property index has broken its upward trendline after completing an inverted head and shoulders pattern. The head was quite elongated and, on reflection, may be taken as an unstable V-bottom.

Relative Strength threatens to make a new 1-year low and Twiggs Money Flow (100) has fallen sharply, signaling distribution.

A close below 39.50 will signal a primary trend reversal, with a likely re-test of support levels at 38.00 and 34.50; a classic V-bottom scenario.

~ Warren Buffet

|

To search for a stock in the Trading Diary archives,

use the normal Search function at the top of the

website page.

Example: To search for Newscorp entries in the current

year, enter +[ncp] +"back issues" in the

search field.

|

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.