|

Incredible Charts version 4.0.2.400 (a minor revision) is now available

Check Help >> About to ensure that your version has automatically updated. (1) The new version remembers the last active watchlist that you used, on opening; and (2) It fixes a watchlist scrolling problem reported by some users. See What's New for details. |

Trading Diary

August 29, 2003

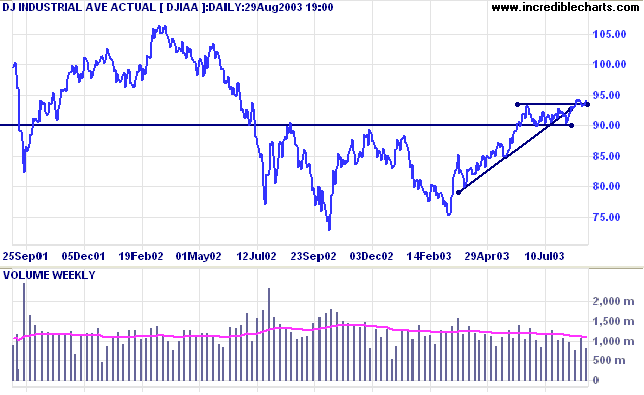

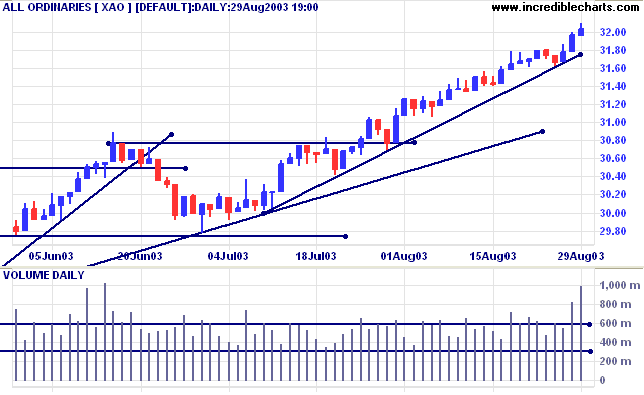

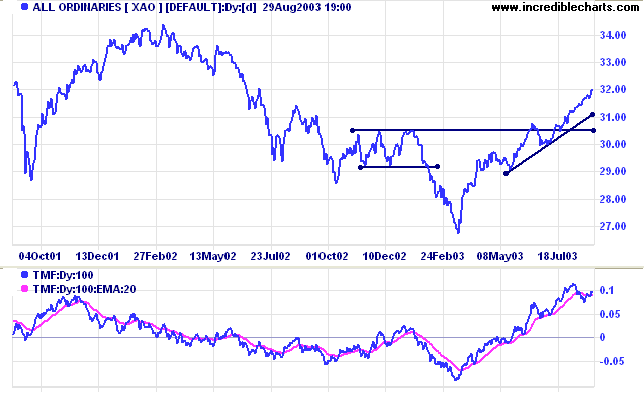

The intermediate trend is up.

The primary trend is up.

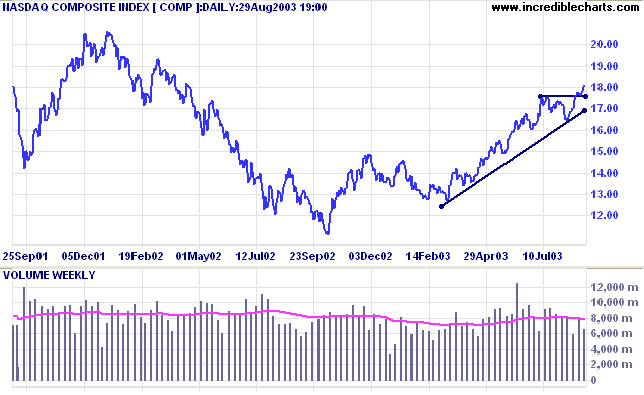

The intermediate trend is up.

The primary trend is up.

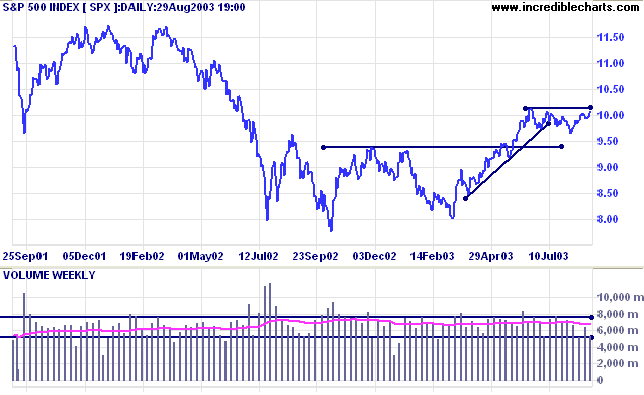

The intermediate trend is down. A rise above 1011 will signal a reversal.

The primary trend is up.

Short-term: Long if the S&P500 is above 1012. Short if below 1000.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long if the index is above 960.

The economy has shed 2.7 million jobs since March 2001, slowing wage gains for the employed as well . (more)

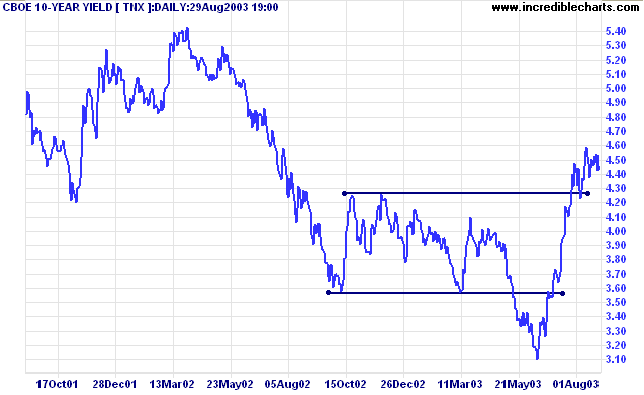

The yield on 10-year treasury notes is almost unchanged from last week at 4.45%.

The intermediate and primary trends are both up.

New York (13.30): Spot gold rose sharply, to end the week more than 12 dollars higher at $375.30.

The primary trend is up.

Price has broken above a symmetrical triangle formed since the start of the year (a slight change since the ascending triangle identified earlier this week). If gold rises above overhead resistance at 382, the target is resistance at the 10-year high of 420. The calculated target is 426 (365 + 382 - 321).

MACD (26,12,9) whipsawed above its signal line; Slow Stochastic (20,3,3) is above;

Twiggs Money Flow signals strong accumulation, but stay on the alert for a bearish divergence.

Short-term: Long if the All Ords is above 3197. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3160.

Long-term: Long if the index is above 2978 .

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 1 (RS is level)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

- Property Trusts [XPJ] - stage 2 (RS is falling)

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is falling).

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is rising).

- Utilities [XUJ] - stage 2 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) declined to 71 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Diversified Commercial (5)

- Diversified Metals & Mining (4)

- Diversified Financial (4)

- Gold (3)

- Health Care Facilities (3)

- Banks (3)

- Construction & Engineering (3)

Stocks analyzed during the week were:

- BHP Billiton - BHP

- Centennial - CEY

- Iluka - ILU

- Jubilee- JBM

- Portman - PMM

- Rio Tinto - RIO

- Sims Metal - SMS

- Brambles - BIL

- Collection House - CLH

- Coates - COA

- Spotless - SPT

- Tempo - TEM

- Transfield TSE

- Croesus - CRS

- Kingsgate - KCN

- Lihir - LHG

- Newcrest - NCM

- Oxiana - OXR

- Sons of Gwalia - SGW

One structural property common to all more

highly integrated systems is that of regulation by so-called

feedback cycles or homeostases. In order to understand their

action we must imagine a working structure consisting of a

number of systems supporting each other functionally in such a

way that system A sustains the action of B, B that of C, and so

on, until finally Z supports the function of A. Such a cycle of

'positive feedback' is, at best in a state of unstable

equilibrium; the smallest increase of a single action will lead

to snowballing of all the system functions, and, conversely,

the slightest decrease to the ebbing of all activity. As

technology has long known, such an unstable system can be

converted to a stable one by introducing into the cycle a

single link whose action on the subsequent one in the chain of

effects decreases in proportion to the increase in strength

exerted by the link preceding it. Thus a regulating cycle is

set up, a homeostasis or 'negative

feedback'.....................In nature, there are countless

regulating cycles. They are so indispensable for the

preservation of life that we can scarcely imagine its origin

without the simultaneous invention of the regulating cycle.

Cycles of positive feedback are hardly ever found in nature,

or, at most, in a rapidly waxing and just as rapidly waning

process such as an avalanche or a prairie fire (Colin: or a

blow-off spike). These phenomena resemble various pathological

disorders of human society.

~ Konrad Lorenz: Civilized Man's Eight Deadly Sins (1973)

(Colin: chart patterns apply not only to financial

markets).

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.