|

Incredible Charts version 4.0.2.400 (a minor revision) is now available

Check Help >> About to ensure that your version has automatically updated. (1) The new version remembers the last active watchlist that you used, on opening; and (2) It fixes a watchlist scrolling problem reported by some users. See What's New for details. |

Trading Diary

August 26, 2003

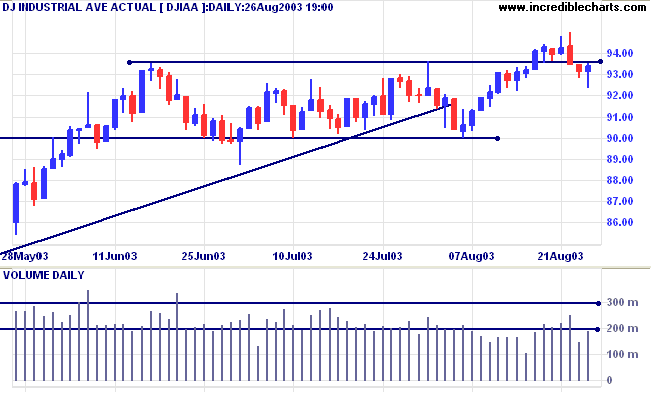

The intermediate trend is up.

The primary trend is up.

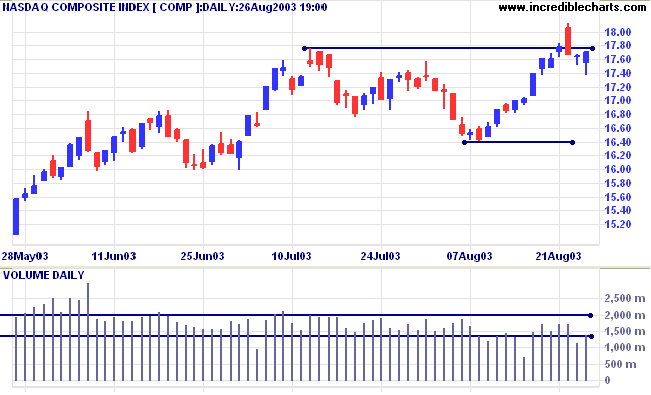

Equal highs in an up-trend are not particularly bearish - unless the index falls below the intervening low (1640).

The intermediate trend is up.

The primary trend is up.

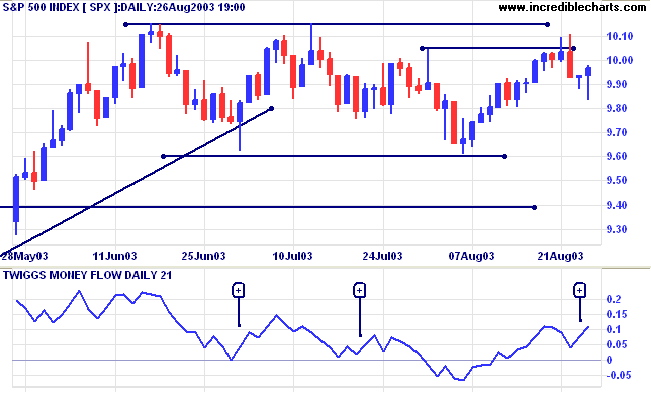

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 984.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long is the index is above 960.

Led by a surge in car sales, demand for durable goods increased by roughly 1 per cent, while inventories fell by a similar amount. (more)

The Conference Board index of consumer confidence increased to 81.3, from a revised 77 in July. (more)

The yield on 10-year treasury notes closed at 4.49%.

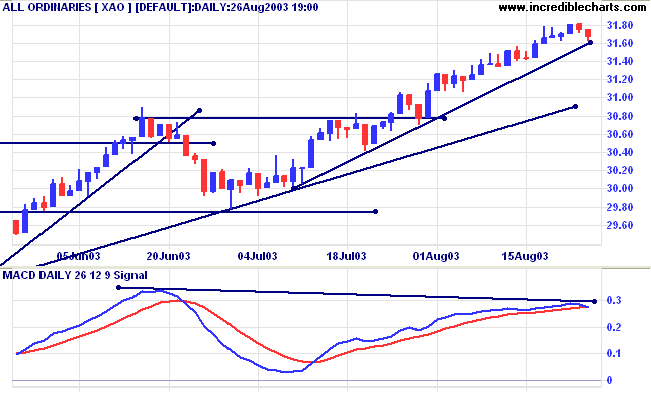

The intermediate and primary trends are both up.

New York (19.12): Spot gold jumped 3 dollars in the morning session to $364.20.

The primary trend is up.

Slow Stochastic (20,3,3) and MACD (26,12,9) have crossed to below their signal lines; MACD and Twiggs Money Flow (21) display bearish divergences.

Short-term: Long if the All Ords is above 3182. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3182.

Long-term: Long if the index is above 2978 .

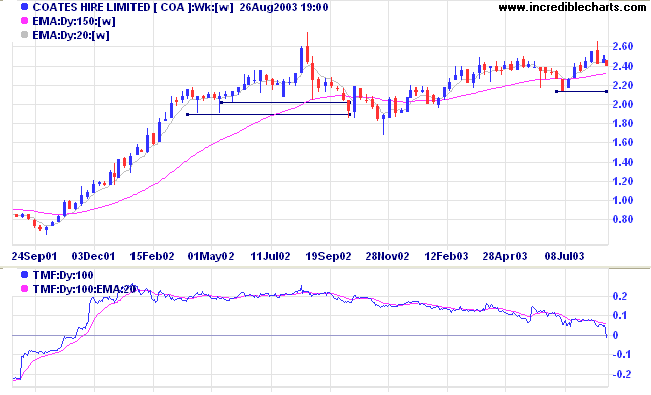

This normally quiet industry has also popped up in my weekly stock screens.

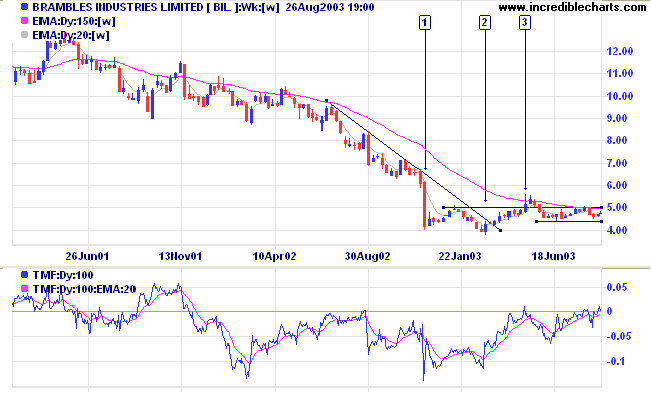

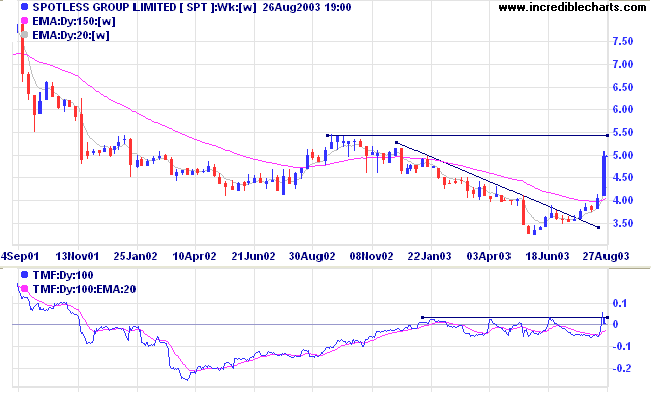

Price broke out of the base at [3] but then retreated to range in a narrow band below resistance at 5.00, a bullish sign.

Twiggs Money Flow (100) signaled strong distribution for the past year but now shows a bullish divergence and threatens to rise above zero, an even stronger signal.

Relative Strength is still fairly weak, while MACD is neutral.

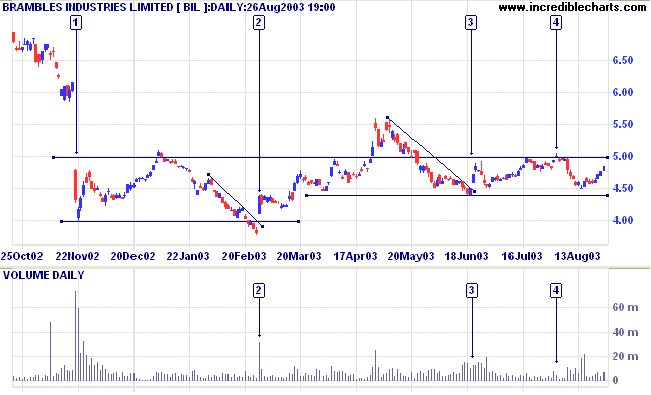

- The cathartic sell-off at [1] which signaled the start of the stage 1 base;

- A marginal break of the previous low, followed by a gap above the trendline at [2], a strong intermediate bull signal;

- A repeat of the same pattern at [3], establishing another support level; and

- Repeated tests of resistance at 5.00, so far on low volume [4].

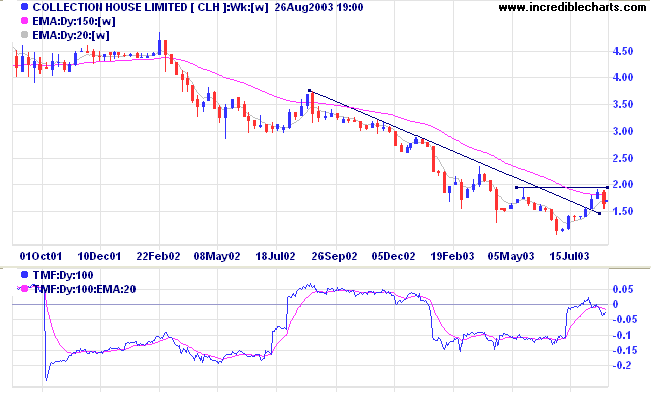

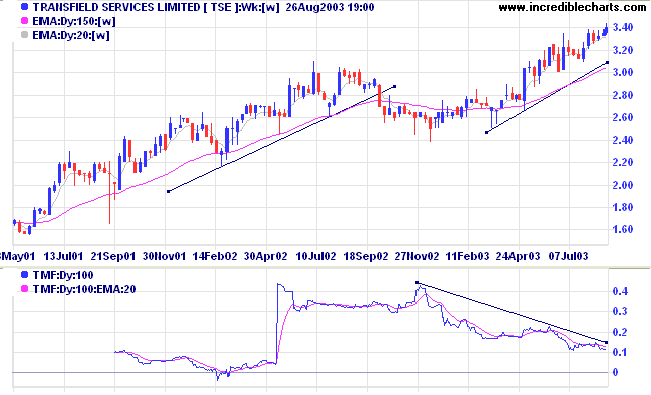

Twiggs Money Flow (100), which has signaled strong accumulation for the past 18 months has fallen below zero after a bearish divergence.

Relative Strength is level while MACD displays a bearish divergence.

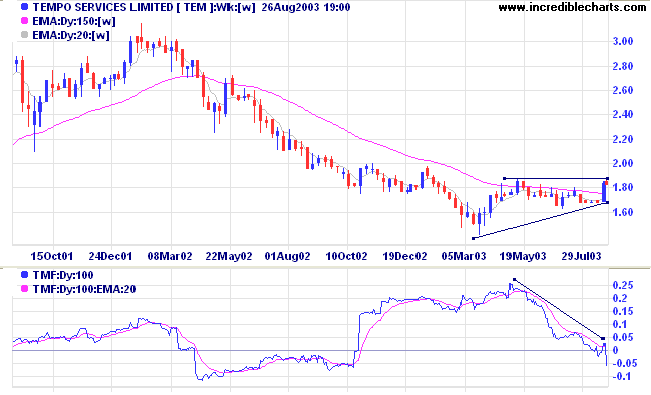

Relative Strength and MACD are rising, while Twiggs Money Flow (100) ranges in a narrow band around zero.

However, Relative Strength is still weak and Twiggs Money Flow (100) shows a strong bearish divergence.

MACD is fairly bullish.

Relative Strength is rising and MACD has completed a bullish trough above zero, but there are some warning signs on the horizon.

MACD displays a bearish divergence, while Twiggs Money Flow shows an even stronger divergence.

Tseng Tzu said: "Each day I examine myself in

three ways:

In doing things for others, have I been disloyal?

In my interactions with friends, have I been

untrustworthy?

Have I not practiced what I have preached?".

~ The Analects of Confucius.

When you select an indicator on the Indicator Panel, it will, wherever practical,

offer a moving average option. The box is positioned at the bottom of the center panel.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.