|

Incredible Charts version 4.0.2.300 is now available Check Help >> About to ensure that your version has automatically updated. To scroll through a watchlist: (1) Open the Watchlist menu; (2) Set the Active Watchlist; (3) Scroll through the watchlist using the up/down arrows on the toolbar. To select a stock from the Active Watchlist: (1) Open the Watchlist menu; (2) Place your mouse over the Active Watchlist at the bottom of the menu; (3) Select a security from the pop-up list. See Watchlists for further details. |

Trading Diary

August 25, 2003

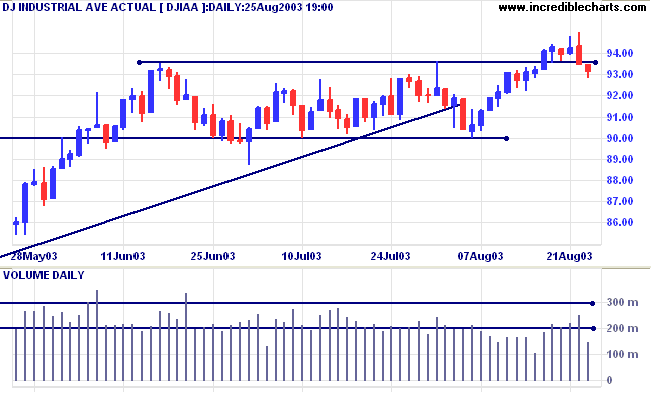

The intermediate trend is up.

The primary trend is up.

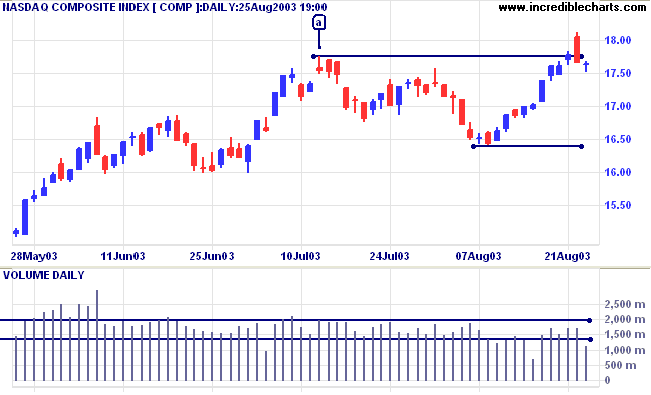

Equal highs in an up-trend are not particularly bearish - unless the index falls below the intervening low of 1640.

The intermediate trend is up.

The primary trend is up.

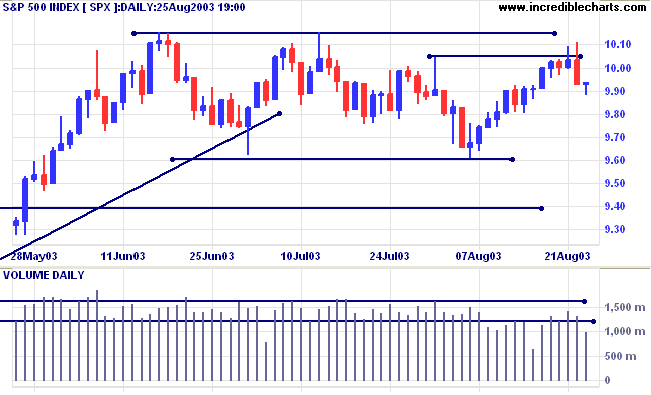

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1011. Short if below 988.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long is the index is above 960.

The Nikkei's rise to a one year high is fuelling a switch from dollars to yen. (more)

The yield on 10-year treasury notes closed up at 4.53%, ranging in a narrow band.

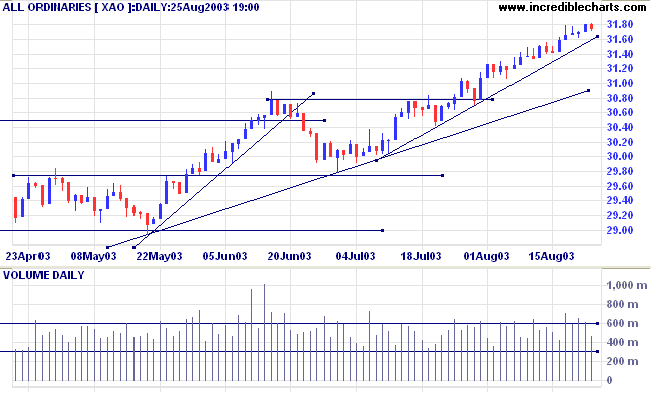

The intermediate and primary trends are both up.

New York (20.27): Spot gold eased a dollar to $361.60.

The primary trend is up.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above;

Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3182. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3182.

Long-term: Long positions if the index is above 2978 .

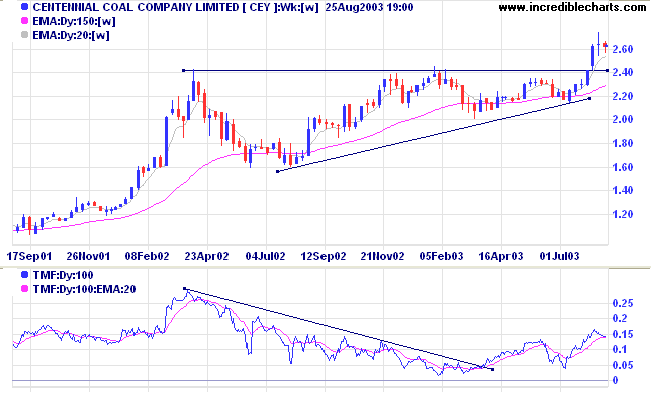

Stocks in this sector have recently featured strongly in the weekly stock screen that I do on % Price Move (1 month).

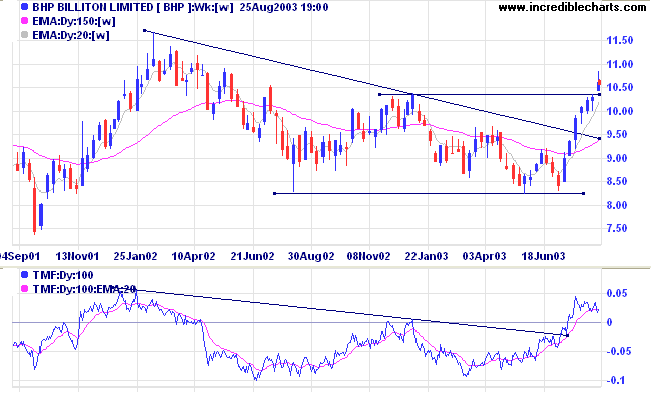

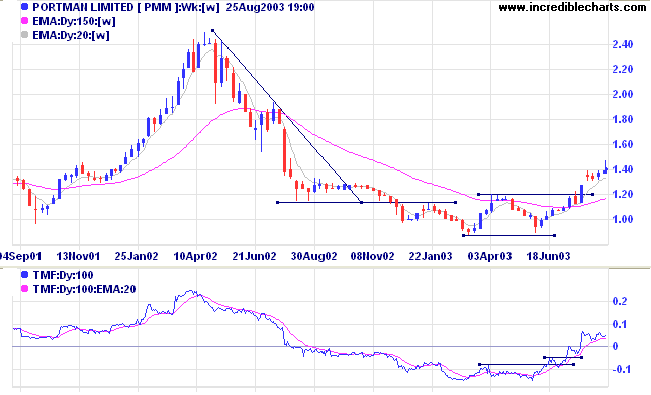

Twiggs Money Flow (100) has risen above zero, to signal accumulation, after breaking its downward trendline.

Relative Strength threatens to make a new 2-year high, while MACD is bullish.

Relative Strength has made a new 2-year high.

Traders should be alert for a pull-back to the new support level at 2.40 which may present entry opportunities.

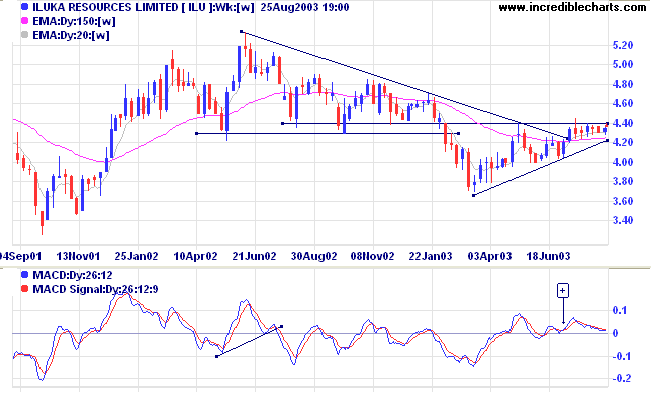

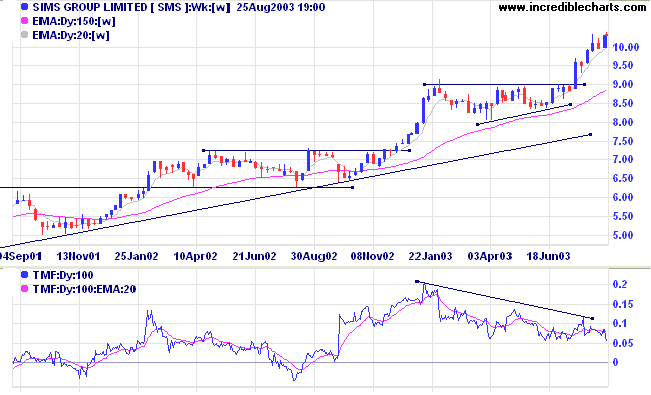

Relative strength appears to be moving sideways, forming a base, while Twiggs Money Flow (100) has crossed to above zero and then pulled back to the zero line. MACD shows a bullish trough [+] above the zero line.

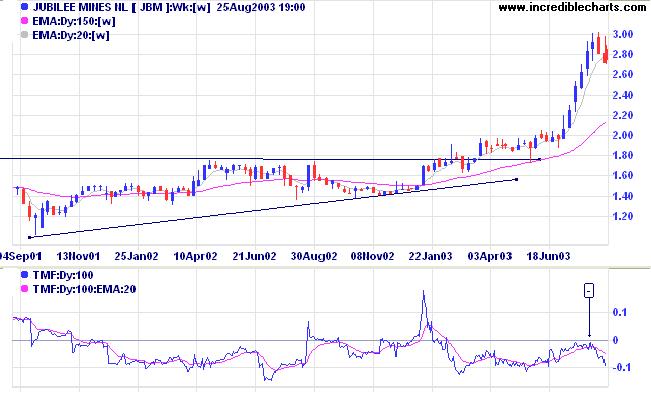

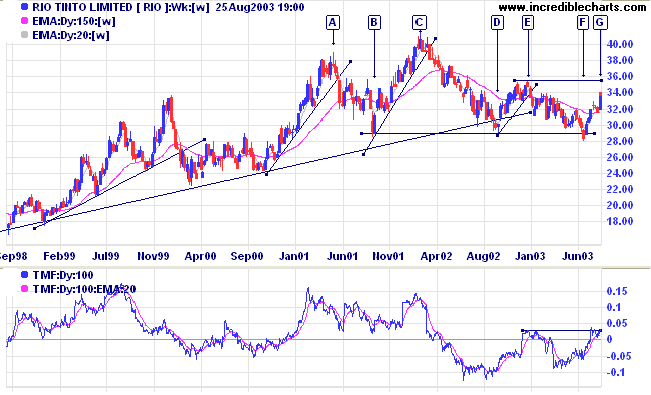

The up-trend has now rolled over into what promises to be a sharp correction, judging from the strong bearish divergence [-] on Twiggs Money Flow (100).

MACD and Relative Strength have both turned down after a large spike.

Relative Strength and Twiggs Money Flow (100) are rising, while MACD is also bullish.

Twiggs Money Flow and Relative Strength appear to contradict this, making new 3-month highs, while MACD formed a bullish trough above zero; so we shall have to adopt a wait-and-see attitude until price reaches 35.00.

Relative Strength has made a new 3-month high while MACD is bullish.

Twiggs Money Flow, however, shows a bearish divergence; so we need to be on the alert for a secondary correction.

Every organism has one and only one central

need in life, to fulfill its own potentialities.

~ Rollo May: Man's Search For Himself.

(1) Open your Default Project (using File >> Open Project);

(2) Open the security that you want as a default;

(3) Select Securities >> Make the Current Security the Project Default.

Separate default securities can be set for each project. There is also an option to clear the project default.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.