| Incredible Charts version 4.0.2.300 |

| The new version will be released next week. Changes include a revised watchlist and securities menu, enabling us to add ETOs, warrants and US stocks, and a new printer module, with greater coverage and functionality. |

Trading Diary

August 8, 2003

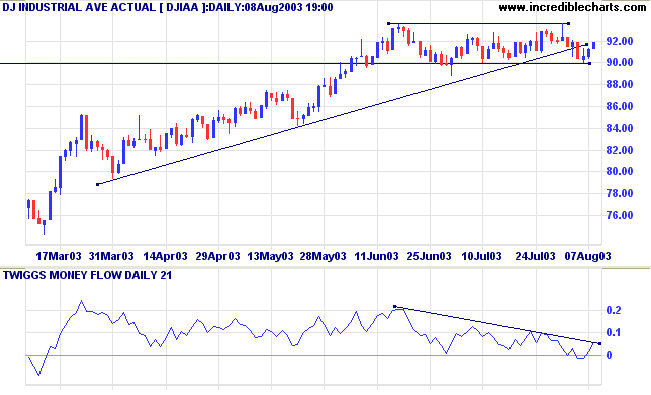

The intermediate trend is up.

The primary trend is up.

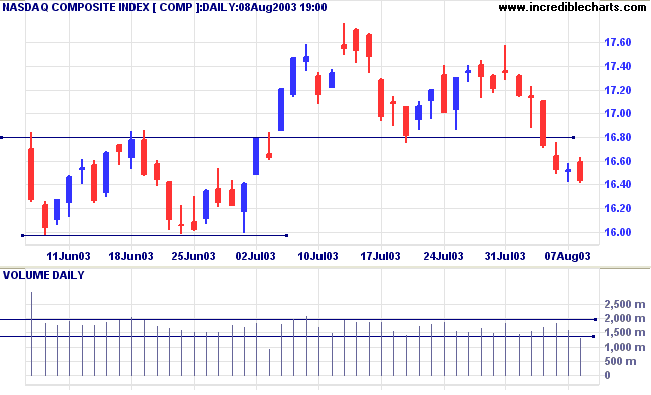

The intermediate trend is down.

The primary trend is up.

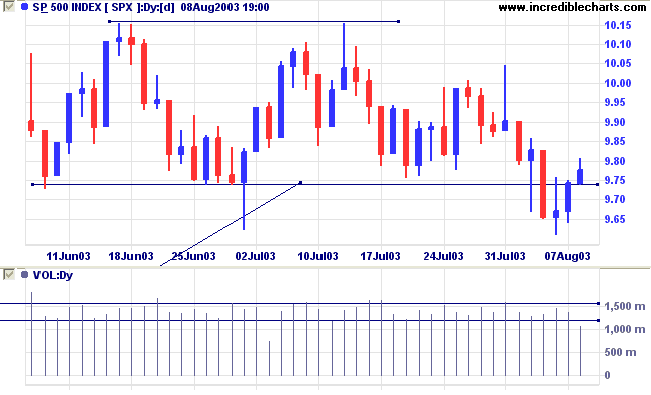

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 974.

Long-term: Long is the index is above 950.

Rising long-term rates may hamper the recovery, but the Fed is unlikely to cut short-term interest rates at its' Tuesday meeting. (more)

The yield on 10-year treasury notes closed at 4.29%, easing slightly from last week's high.

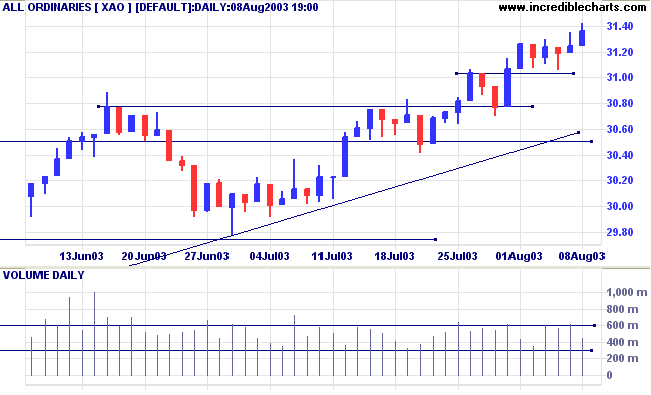

The intermediate and primary trends are both up.

New York (13.30): Spot gold closed up $10.00 for the week, at $356.20.

The primary trend is still upwards.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3127. Short if the index falls below 2978.

Intermediate: Long if the index is above 3127.

Long-term: Long if the index is above 2978 .

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising) This is an unstable V-bottom.

- Materials [XMJ] - stage 2 (RS is level)

- Industrials [XNJ] - stage 1 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is level)

- Property Trusts [XPJ] - stage 2 (RS is falling)

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is level)

- Information Technology [XIJ] - stage 1 (RS is level)

- Telecom Services [XTJ] - stage 2 (RS is rising) Another V-bottom.

- Utilities [XUJ] - stage 2 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) eased to 84 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Diversified Metals & Mining (7)

- Oil & Gas Exploration & Production (7)

- Gold (6)

- Health Care Facilities (4)

- Construction Materials (4)

- Diversified Commercial Services (3)

- Real Estate Management & Development (3)

- Diversified Financial Services (3)

- Steel (3)

- Auto Parts & Equipment (3)

- Broadcasting & Cable TV (3)

- Construction & Engineering (3)

Stocks analyzed during the week were:

- Centennial Coal - CEY

- Computershare - CPU

- Telecom NZ - TEL

- Telstra - TLS

- Healthscope - HSP

- Ramsay Health Care - RHC

- DCA Group - DVC

- Sigma - SIG

- Amity Oil - AYO

- Caltex - CTX

- Oil Search - OSH

Laws Conditional # 6.

In forming an opinion of the market the element of chance

ought not to be omitted.

There is a doctrine of chances - Napoleon in his campaign,

allowed a margin for chances

- for the accidents that come in to destroy or modify

the best calculation.

Calculation must measure the incalculable.

In the "reproof of chance lies the true proof of

men."

~ SA Nelson: The ABC of Stock Speculation (1903).

| Tip of the Week |

| Click on an indicator in the chart legend and a help page opens, with a detailed explanation of the indicator's uses and construction. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.