| ETOs and Warrants |

| Introducing ETOs has proved very time-consuming, with significant adjustments required to menus, stock screens and watchlists. We hope to have the new version available shortly. |

Trading Diary

July 25, 2003

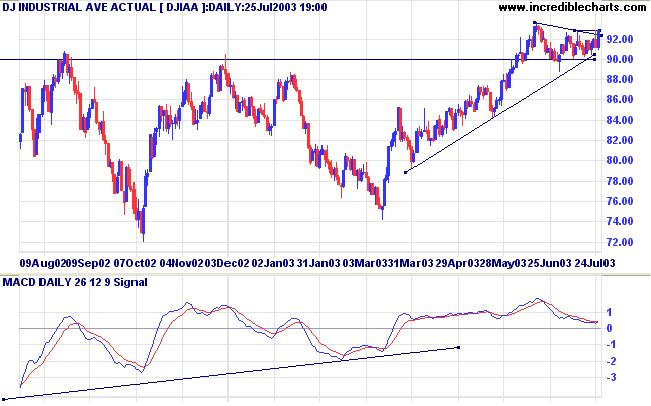

The intermediate trend is up. The index has formed a symmetrical triangle. MACD continues to respect the zero line.

The primary trend is up.

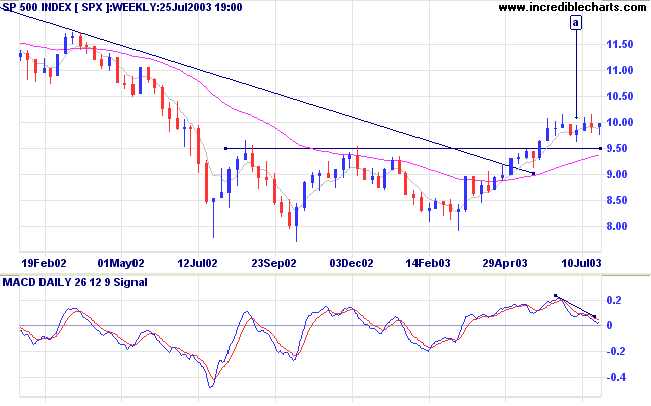

The intermediate is down, with MACD showing a bearish divergence. However, the index has formed an ascending triangle above the 950 support level.

The primary trend is up.

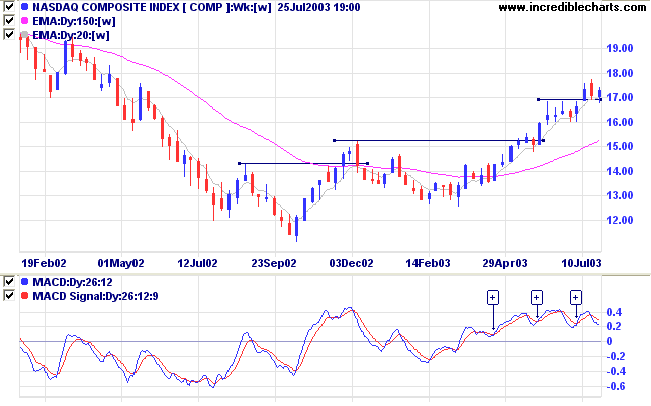

The intermediate trend is up. Price has respected support at 1680, signaling trend strength.

The primary trend is up.

Short-term: Long if the S&P500 is above 1015. Short if below 976.

Intermediate: Long if S&P 500 is above 1015. Short if below 962.

Long-term: Long.

Durable goods orders up

Orders for manufactured goods surged a healthy 2.1% in June.

(more)

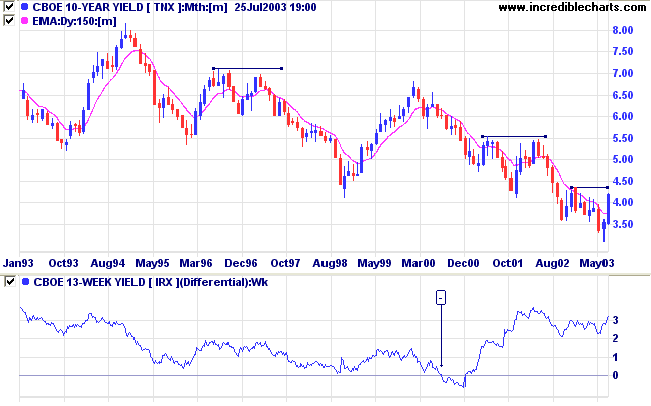

The yield on 10-year notes [TNX] closed the week up 0.21% at 4.18%.

The intermediate trend is up; the primary trend is down.

New York (13.30): Spot gold closed the week more than 15 dollars higher at $362.70.

The primary trend is up.

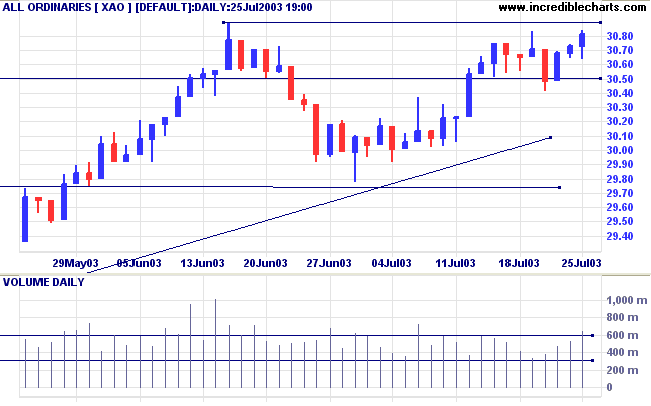

The intermediate trend is up. The index has formed an ascending triangle with overhead resistance at 3089.

The primary trend is up (marginally).

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3089. Short if the index falls below 3050.

Intermediate: Long if the index is above 3089; short if below 2979.

Long-term: Long if above 2979.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising). This is an unstable V-bottom.

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 1 (RS is level)

- Consumer Discretionary [XDJ] - stage 1 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is falling)

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is level)

- Information Technology [XIJ] - stage 1 (RS is level)

- Telecom Services [XTJ] - stage 2 (RS is rising). Another V-bottom.

- Utilities [XUJ] - stage 2 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) climbed to 80 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Oil & Gas Exploration & Production (7)

- Diversified Metals & Mining (6)

- Gold (5)

- REITs (4)

- Diversified Financial Services (3)

- Auto Parts & Equipment (3)

Stocks analyzed during the week were:

- Oil Search - OSH

- Novus - NVS

- Woodside - WPL

- Hardman - HDR

- ANZ Bank - ANZ

- National Australia Bank - NAB

- Westpac - WBC

- Commonwealth - CBA

- Sons Of Gwalia - SGW

- Amp Limited - AMP

- Woolworths - WOW

- HPAL Limited - HPX

I have written to little purpose unless I have left the

impression

that the fundamental principle that lies at the base of all

speculation is this:

Act so as to keep the mind clear, its judgment

trustworthy.

~ S.A. Nelson: The ABC of Stock Speculation (1903).

|

Chart Forum: Email Notifications |

|

If you change your email address, please remember to amend your Chart Forum Profile. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.